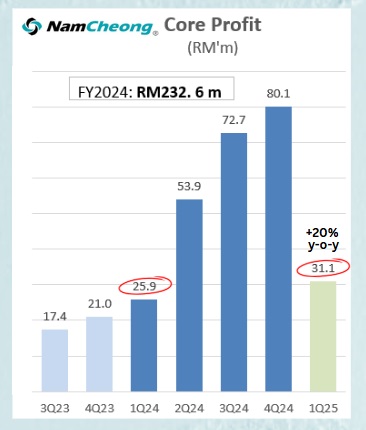

Nam Cheong Limited reported a 20% gain year-on-year in core profit for 1Q2025, thanks to favourable charter rates and a bigger fleet of offshore support vessels (OSVs) in Malaysia.

That's when offshore oil & gas activities dip, and vessel operators take the opportunity to send some vessels for maintenance. Nam Cheong, which is Singapore-listed, owns the largest fleet of OSVs in Malaysia at 37 vessels. The scale helps it not only to stay profitable in 1Q but command a rock-solid gross margin of 48%. Some peers, with smaller fleets, reported losses or earnings drops in 1Q.  Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates. Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates. |

While 1Q is typically the slowest quarter of the year, 2Q and 3Q -- with the monsoon season being over -- will see oil & gas production and exploration activities normalise.

There's an ongoing shortage of OSVs and strong demand, so charter rates are expected to stay strong.

Because of a lack of newbuilds for many years, the collective fleet of OSVs is aging.

It has been tough to get bank financing to build new vessels, largely due to ESG reasons, as well as rising costs of construction.

Nam Cheong's vessels average 8 years of age, and are far from the 20-year maximum (extended from 15 years in 2022) stipulated in Petronas' tender requirements.

Nam Cheong's vessels average 8 years of age, and are far from the 20-year maximum (extended from 15 years in 2022) stipulated in Petronas' tender requirements.

Watch out for Petronas tenders

"Major upcoming opportunities" -- noted Bursa-listed OSV operator Perdana Petroliam's 1Q presentation deck.

Malaysian oil major Petronas is about to call a tender for vessel charters under Phase 2 of its so-called Safina programme, which works this way:

- Petronas tenders out long‐term charter contracts.

- Successful bidders (ie, vessel operators) engage Malaysian shipyards to build the OSVs.

- When built, the vessels are chartered to Petronas under the agreed contracts.

Nam Cheong is expected to tender for those contracts -- and, if successful, assign its shipyard in Sarawak to construct the vessels.

Being vertically integrated will likely result in better margins for Nam Cheong compared to a vessel operator which has to share some margin with a third-party builder.

What about financing?

A new OSV, depending on the type and size, will cost RM70 million to RM100 million.

Petronas' "Safina" programme is expected to attract banks willing to back large-ticket assets with long-term charters as Petronas is seen as a rock-solid counterparty.

Key FY2024 financial metrics revisited

- Nam Cheong achieved a gross profit margin of 53% for the full year 2024.

Core profit from vessel chartering came in at RM232.6 million (S$70.2 million). This excludes other income and other expenses (mainly from the debt restructuring) and contributions from joint ventures/associates.

This translates to a historical PE of 3X (based on a market cap of S$208 million at 53 cents stock price).

Unlike PE ratios, EV/EBITDA accounts for debt, and Nam Cheong's EV/EBITDA is about 3X.

These EV/EBITDA and PE figures are relatively low, indicating an undervaluation as its peers on Bursa Malaysia trade at much higher multiples.

|

Look out for more long-term charter contracts

|

See also: The Clock’s Ticking on Aging Fleets of Offshore Support Vessels