This article was recently published on www.sharesinv.com, and is reproduced with permisison

HANKORE ENVIRONMENT Technology Group has shed off its old shell, Bio-Treat Technology, and is raring to soar. Not only was its name changed to HanKore in May 2011, a new management has taken over, led by the present executive chairman, David Chen.

Chen first became involved in the company in December 2009 when his investment vehicle, Giant Delight, pumped in about $70.6 million to restructure the company. More than 60 percent of the money was used to pay off the outstanding debt from the Bio-Treat’s convertible bonds legacy, and the remainder used as working capital and capital expenditure.

NextInsight file photo.

Chen brought a wealth of industry experience to the company, having founded and headed Beijing Revolution Science and Technology, a leading environmental protection and wastewater treatment solutions provider with over 30 types of water treatment technologies.

Besides a new management, Hankore attracted new investors, including SGX-listed Boustead, Suzhou Venture Group (invested through Huayuan), Dezhou Capital (invested through Firstree), and Ancient Jade Capital.

Suzhou Venture Group is a sovereign angel investor with access to resources and brand influence in the PRC. Dezhou Capital is a major shareholder for nine companies listed in China, of which two are water treatment companies (Xinrong and Hongcheng Water).

Ancient Jade’s founder, Lin Zhe Ying, was a deputy director at the PRC Ministry of Commerce and a key official representing China in its negotiations over World Trade Organisation’s rules in commercialising the water treatment sector.

Chen said, “Dezhou Capital made the decision to invest in us soon after it inspected our plants and business.” Chen believes that the company’s assets of water treatment projects and plants and its high standards in managing water treatment plants attracted these shareholders.

These new anchor shareholders will provide a strong network and the necessary expertise for the company to expand in China. The funds brought in by these shareholders helped the company complete its capital restructuring last year and clearing the debt of the US$206 million convertible bond of its predecessor, Bio-Treat. As a result, its balance sheet has improved greatly.

Chen said: “Water is a resource that will become scarcer while water treatment is an industry with high barriers of entry. With a strong internal management, we are now able to match the state of development of this industry in PRC.”

Golden era for PRC water sector

The company sees a golden era of growth in China’s water sector in the next five to ten years. On this firm belief, HanKore aims to triple its water treatment capacity in three years, and to further increase its capacity by five-fold in five years.

HanKore’s new management has already started to pave the way to achieve these bold targets, having progressed into the next phases of several of their projects.

In January 2012, it went into a second collaboration with Sanmenxia Industrial Park on a Build-Own-Operate contract, which involves a water supply project with a capacity of 150,000 tons per day.

In February 2012, it commenced a Build-Own-Transfer project in Liquan County with a total wastewater treatment capacity of 60,000 tons per day as well as the second phase project of the wastewater treatment plant in Xianyang, doubling the treatment capacity to 200,000 tons per day.

With the phenomenal progress it made in such a short time, HanKore was duly awarded the “No. 2” ranking in the PRC’s 2011 Water Industry in the Top Ten New Achiever Enterprise Award category, presented by ChinaWaterNet (www.h20-china.com), the most influential and the most authoritative cyber media in the water industry in China.

Interestingly, HanKore was ranked above a PRC subsidiary of Sembcorp, which stood at tenth position in the same award category.

The company has also made a turnaround in its financial results. Revenue for its first half of its financial year ending 30 June 2012 surged 40 percent year on year while net profit improved 26 percent!

Not surprisingly, the investment community has started to take a closer look at the company.

However, beyond the historical baggage from Bio-Treat, there are still some concerns.

The recent company results showed certain impairments, write-offs and other exceptional items. Investors are concerned about the scale of such items, and wonder if they will still be present in subsequent quarters.

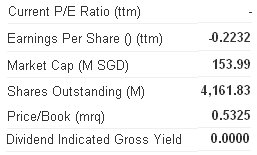

The company’s cash seems to be depleting and net cash from operating activities has not shown significant improvement, suggesting that the company seems in need of further funds to address its debts.

Being more wary of S-chips generally, Singapore investors would look forward to HanKore displaying a higher corporate disclosure standard and degree of transparency so that they can better understand the specifics of those impairments along with the facts and circumstances surrounding them.

Ultimately, to regain the confidence of investors who suffered losses investing in Bio-Treat, HanKore has more to do in terms of providing honest assessments of the direction and risks the company faces so as to convince investors it has a viable roadmap to reach the bold targets it has set, and to be the rising phoenix it aspires.

Recent story: HANKORE, TEHO: Robust 1H2012 earnings growth of 26%, 48%, respectively