BYD is hoping electric vehicles like this taxi in Shenzhen will help recharge sales. Photo: Andrew Vanburen

Meanwhile, its A shares (SZA: 002594) rose 7.3% Tuesday to finish at their highest level since listing in Shenzhen on June 30.

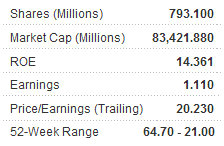

The automaker, which is 10% held by Warren Buffett and last year owned the best selling model in the PRC, has seen its valuation run all over the map these past few months.

Sinafinance has the latest in a Chinese-language piece on what is driving this innovative but struggling firm in so many different directions.

It seems that BYD, which stands for Build Your Dreams, is finally waking up from its months-long nightmare.

It seems that BYD (Build Your Dreams) is finally waking up from its months-long nightmare. Photo: BYD

This was partly due to the realization that dual-listing and being 10% held by the world’s most famous investor was one thing, but having weak financials and expectations of disappointing first half sales figures was another.

Therefore, the automaker shed a great deal of value over the past two trading days only to be revived once again by an American “white knight”... this time in the form of California-based Intel announcing a joint product development tie-up with the Shenzhen-based carmaker.

Whether or not this is enough to bring capital back onboard the company’s stock story depends on more than just high-profile cooperative agreements or injections from renowned investors.

Another factor driving the automaker’s shares of late was unrelated to the firm’s core fundamentals.

Carmakers across the board have recently been driven higher by a report in the official Xinhua News Agency over the weekend that the PRC’s State Council – the country’s cabinet – is contemplating new stimulus measures to support China’s sputtering auto sector, with sales in the industry falling in both of the past two months.

Glory Days: BYD recently boasted China's top selling sedan. Photo: BYD

However, one bit of positive news certainly did bring back investors, at least temporarily.

It was recently reported that BYD Chairman Wang Chuanfu – not long ago at the top of the country’s richest list – offered reassurances that the automaker’s most famous stakeholder, Berkshire Hathaway CEO Warren Buffett, had no plans to reduce or sell his stake in the carmaker.

BYD had said in its A-share IPO prospectus that it planned to use proceeds from its 79-mln share domestic listing to fund its lithium ion project, expand R&D, and diversify its product range – language that some investors saw as signs BYD was returning more to its roots as a dedicated rechargeable battery producer and may slowly lessen its exposure to the hyper-competitive PRC auto market.

BYD now: 26.95 hkd

Therefore, now that all eyes are off of Warren Buffett for the moment, existing and aspiring investors in BYD will have all eyes on the automaker’s upcoming first half earnings report.

But most analysts are saying the carmaker’s sales in the first six month are nothing to get overly revved up about.

See also:

XTEP, CHINA AUTOS: What Analysts Now Say...

BYD: No Sparkplug In Sight For Struggling EV Firm