SINGAPORE MAY BOAST the globe’s highest percentage of US dollar millionaires at 11.4% of the populace, but while the number in the PRC is still less than 1%, the total rose by the fastest rate worldwide last year.

UOB Kay Hian says this is very good news for Hong Kong-listed luxury players, with the PRC and Hong Kong high-end timepiece markets shining very brightly in March.

In a broker call updating the status of listed watch, jewelry and luxury goods retailers, UOB said international luxury groups have reported better-than-expected results and operating performances so far in 2011.

“Their results show strong demand for luxury goods, particularly in Asia. Some luxury brands have room for more price hikes.”

The Singapore-based brokerage said that the despite the extremely unfavourable base effect in March 2010, total Swiss watch exports went up in March 2011, up 11.1% year-on-year. Growth was led by Hong Kong, the largest Swiss watch market, up 21.6% y-o-y, while Mainland China registered a stunning 63.5% y-o-y growth in the import of Swiss watches in March 2011.

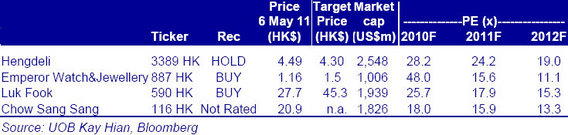

“We expect Emperor Watch & Jewellery (HK: 887; BUY) and Hengdeli (HK: 3389; BUY) to have recorded strong sales and earnings growth so far this year,” UOB added.

Mainland China and Hong Kong jewellery markets continue to boom

Mainland China’s retail sales of gold, silver and jewellery soared 51.7% y-o-y in March 2011 to 14.5 bln yuan, while Hong Kong’s retail sales of jewellery, watches and clocks, and valuable gifts surged 54.1% y-o-y to 6.6 bln hkd in March 2011.

Windfall gain in gold prices propels earnings momentum for Luk Fook

The recent sharp rise in gold prices has given a headstart to Luk Fook (HK: 590; BUY) in FY2012.

“We forecast Luk Fook’s pure gold jewellery gross margin in FY2011 at 14% (based on the assumption of average three-month increase in gold price of 4%).

"As the average three-month increase in gold price was 5.8% in FY2011, our pure gold jewellery gross margin forecast may turn out to be slightly conservative,” UOB said.

It added that in addition, the average three-month increase in the gold price has been 9.7% so far in FY2012.

“But we forecast LF’s pure gold jewellery gross margin in FY12 to be 10% (assuming average three-month increase in gold price of 0% in FY12). Hence, there could be upside risk to our FY12 earnings forecast as well.”

Survey on Chinese millionaires

According to the 2010 Hurun Wealth Report released by the Hurun Research Institute, Beijing, Shanghai and Guangdong account for almost half of all millionaires (>Rmb10m each) in China. Some 70% of the millionaires are male. The US and France are their top international travel destinations, and millionaires in Tier 1 cities prefer to collect cars and watches.

See also:

HENGDELI: A Hong Kong-Listed Firm To Watch

MING FUNG Jewelry Sees Hengdeli Tieup As Golden Opportunity

HK JEWELERS CHOW SANG SANG, LUK FOOK: What Analysts Now Say...