Excerpts from latest analysts reports...

UOB initiates CHP (HK: 591) ‘BUY’, Target 8.70 hkd on capacity expansion

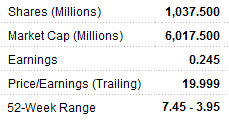

China High Precision Automation Group (CHP) (HK: 591) is one of the market leaders in the high precision industrial automation instrument and technology products industry in China. Targeting the middle- to high-end segments of the industrial automation instrument market, the company’s products can be used to detect, measure and analyse information (such as temperature, water pressure, or other variables) and are widely used in industrial production applications. CHP is also one of the dominators of the global low-end quartz watch movement market.

Import replacement taking place: China’s high-end instrument and meter market is dominated by foreign players. The government has indicated industrial automation instruments is a pillar industry crucial to the development of the overall economy as well as national defence infrastructure, and granted domestic players favourable policies. As a result, domestically-made products have been steadily gaining market share against imports over the past few years.

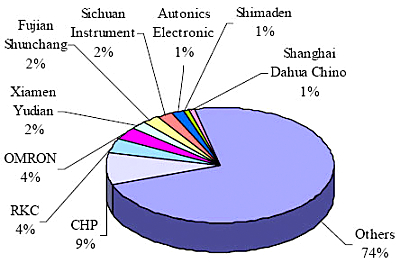

Leading market position: CHP ranks as the number one manufacturer of indicator and controller products and the third in transmitter products in the China market in terms of sales volume, making up about 9% market share for both products. For horological instruments, the company dominates the lowend segment with about 15% market share of the global quartz watch movement industry.

Capacity expansion to boost earnings growth: CHP is undertaking aggressive capacity expansion that will more than double its existing production while developing new products. The expansion will eliminate the company’s growth bottleneck and drive both the top- and bottom line at a three-year CAGR of over 40% for FY10-13F.

Initiate coverage with BUY and a target price of HK$8.70 based on 14x target FY11F P/E.

See also: TECHCOMP: Record Profit Of US$10.5 Mln In FY2010, Europe To Contribute To Bottom Line This Year

UOB says WWTT (HK: 1282, unrated) ‘key proxy to growing touchpad market’

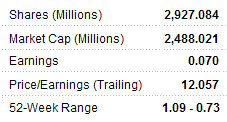

Unique touchpad manufacturer: World Wide Touch Technology (WWTT) (HK: 1282) is a leading provider of capacitive touchpads for notebook computers. It also produces fingerprint biometric devices, lighting source products and wireless charging devices. WWTT assembles and sells touchpads to touchpad vendors like Synaptics. WWTT achieved 18.5% yoy growth in revenue to HK$888.3m with 76.3% yoy growth in earnings in 2009.

Riding on strong demand growth: Leveraging on the popularity of mobile computing system and notebooks, the group sits at the frontier of the strong demand wave globally. According to iSuppli, worldwide sales of touchpad units are expected to grow at a CAGR of 28.1% in 2010-13, and accordingly, touchpad sales revenue is going to grow at CAGR of 18.3% in 2010-13. With strategic partner Synaptics holding 56.6% of market share in terms of worldwide touchpad sales, WWTT is a key proxy to the growing touchpad market. The group’s touch screen products are at an early stage of growth, and will contribute more top-line growth in the near future.

Technology pioneer in diversified industry: WWTT maintains close relationships with its main customers, like Synaptics, to develop capacitive touchpads for original design manufacturers (ODMs)/original equipment manufacturers (OEMs) of notebook computers. WWTT also makes efforts to develop technologies for fingerprint biometric devices, wireless charging devices, and plasma light projectors. With strong technology know-how, the group is well-positioned to gain strong orders for new products.

Strong R&D laid growth foundations: World Wide Touch Technology works closely with its technology partners, such as Synaptics and Powermat, and amalgamates underlying technology R&D licenced from customers. To date, WWTT has a team of 30 core technology developers and 334 R&D-related engineers.

World Wide Touch Technology owns large number of recognitions, patents and potential R&D projects waiting for commercialisation in the future.

See also: SERIAL SYSTEM Has Record $16.2 M Profit & Ups Dividend