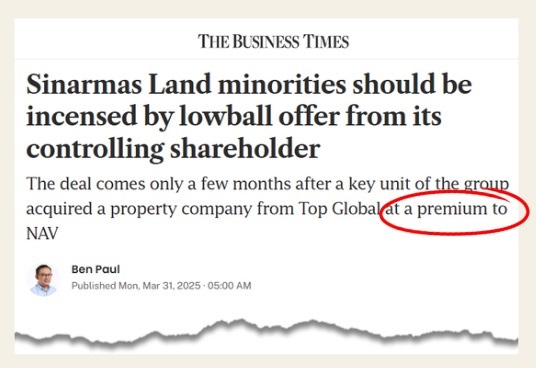

| Singapore-listed Sinarmas Land is a big player in Indonesia’s property world, building everything from townships and residential areas to shopping centers, hotels, and industrial estates. In March 2025, Sinarmas Land's controlling shareholder, the Widjaja family, offered to buy out minority shareholders at 31 cents/share. This is a steep 73.9% discount to Sinarmas Land’s net asset value (NAV) as at Jun 30, 2024, of S$1.19 per share. Business Times columnist Ben Paul didn’t hold back in his article published on 31 March (screenshot below).  Tracking things, he followed up with an article today, raising the possibility of a hike in the offeror's price.  "The way I see it, there is now a fairly high chance that the offeror will raise its offer price." "The way I see it, there is now a fairly high chance that the offeror will raise its offer price."The columnist reckons that a price hike is possible in order to meet delisting conditions. |

Sinarmas Land is actively involved in developing integrated townships, residential areas, commercial properties, retail spaces, hospitality, and industrial estates. BSD City, one of its flagship projects, is a massive development covering thousands of hectares in Tangerang, Indonesia, designed as a self-sustaining city with residential, commercial, and industrial zones.

The BT article in a nutshell:

- Current Situation

- Lyon Investments, linked to Indonesia’s Widjaja family, has increased its stake in Sinarmas Land to 92.3% after receiving valid acceptances for nearly 936.3 million shares, or 22% of total shares.

- With less than 10% of shares in public hands, Sinarmas Land is now in breach of the minimum free-float requirement.

- Lyon Investments, linked to Indonesia’s Widjaja family, has increased its stake in Sinarmas Land to 92.3% after receiving valid acceptances for nearly 936.3 million shares, or 22% of total shares.

- Offer Price and Market Reaction

- Sinarmas Land’s share price has consistently traded above the 31-cent offer price, indicating market anticipation of a possible price hike.

- The Independent Financial Adviser (IFA), W Capital Markets, described the offer as “not fair but reasonable.”

- Sinarmas Land’s share price has consistently traded above the 31-cent offer price, indicating market anticipation of a possible price hike.

- Delisting and Acceptance Thresholds

- For voluntary delisting, two conditions must be met:

- The IFA must deem the offer both fair and reasonable.

- The offeror must achieve at least a 75% acceptance rate (already nearly met).

- The IFA must deem the offer both fair and reasonable.

- To take the company private (compulsory acquisition), the offeror needs to exceed a 97% stake.

- For voluntary delisting, two conditions must be met:

- Valuation Concerns

- The IFA’s estimated fair value range is S$0.35–S$0.361, only about 13% above the current offer.

- Even at S$0.35, the offer would be just 0.41 times Sinarmas Land’s net asset value (NAV) of S$0.85 per share-well below precedent deals in Singapore, which ranged from 0.76 to 1.4 times NAV.

- The current offer is only 0.5% above the six-month volume-weighted averge price (VWAP), whereas previous deals offered 17.6%–77.5% premiums.

- The IFA’s estimated fair value range is S$0.35–S$0.361, only about 13% above the current offer.

- BT's criticism of Valuation Method

- The IFA’s sum-of-the-parts approach may undervalue Sinarmas Land, as it relies on public market discounts and precedent deals, ignoring potential higher private market values.

-- Ben Paul, Business Times |

If history repeats itself, the offer will be raised. (See: History Repeats? Widjaja Family's Low Offer for Sinarmas Land To Face Pushback)

The Widjajas have made two previous privatisation deals involving SGX-listed companies whose initial offers were upped subsequently:

| • Top Global: The cash offer was 33 cents per share in March 2017. A fresh offer was tabled in August 2021 at 39 cents per share, leading to the privatisation. • Golden Energy and Resources: Initially, in November 2022, the all-cash offer for this coal miner was set at 84.6 cents per share. This was revised in March 2023 to 97.3 cents per share. |

Again, whether a higher offer for Sinarmas Land will come is entirely speculative.