|

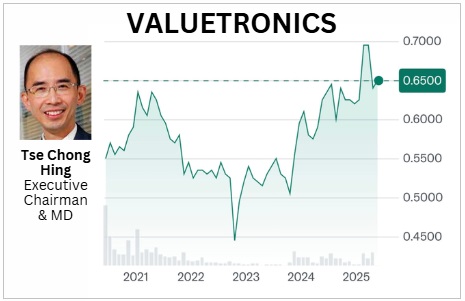

Valuetronics has flying under investors' radar for a long time but its stock's recent rise to a 5-year high likely signals a business turnaround. |

With a promising AI joint venture and a Vietnam plant ready to ramp up, things are looking up for Valuetronics, according to reports by Phillips Securities and UOB Kay Hian published in Nov 2024 after the release of the 1HFY25 (ended Sept 2025) results.

In addition, a transcript of the Q&A at the FY24 AGM was insightful.

| Positive Outlook and Recommendations |

Phillip Securities: Maintains a BUY recommendation with a raised target price of S$0.785 (previously S$0.76).

|

Valuetronics |

|

|

Share price: |

Target: |

Valuation is attractive as earnings are expected to recover and the company continues to accumulate cash.

UOB Kay Hian: Also maintains a BUY recommendation with an unchanged target price of S$0.78.

This is based on a FY25 PE of 10.8x, which is one standard deviation above Valuetronics' historical PE mean, anticipating strong demand from new customers and an AI joint venture (more below).

| Revenue Performance and Growth Drivers |

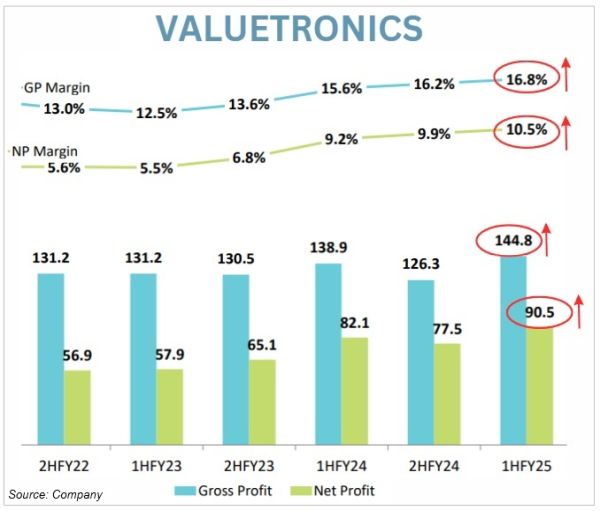

1H25 Performance: 3% year-on-year decline in revenue, which was within Phillip Securities' estimate.

| New vs Old Customers "Overall, the technology applications of the new customers are quite different from the Company’s existing customers. Existing long-time customers require more basic technology applications and are more consumer oriented, whereas the new group of customers require more of the latest technology applications. It takes time for a new group of customers to mature and make meaningful contributions to the Company’s revenue. "I believe the new customers would gradually make meaningful contributions to the Company’s revenue. Some of the existing customers are facing erosion of market share due to market competition, which in turn has affected their business with the Company. As such, despite securing new customers, there was a net-off effect arising from this situation which had led to the decrease in the Company’s revenue for the past 2 years." -- Tse Chong Hing, Chairman of Valuetronics, FY 2024 AGM |

As background, Valuetronics categorizes its business into two segments based on product applications:

• CE (Consumer Electronics): These are consumer products directly sold to end users, such as PCBA (Printed Circuit Board Assembly) and LED light bulbs.

Historically, CE products were its primary source of revenue.

• ICE (Industrial and Commercial Electronics): These products -- such as telecommunication equipment and automotive parts -- are meant for industrial applications or require additional processing by customers before reaching end consumers.

Recently, the ICE segment has gained more customers, leading to a significant reduction in the revenue contribution from the CE segment to just 22.4%.

Phillip Securities notes strong growth in networking products from a new customer replacing a major competitor.

Volume increases from three new customers (excluding networking) depend on improving macroeconomic conditions and capital expenditure decisions.

UOB Kay Hian identifies a Canada-based network access solutions provider as a key contributor to a 2% year-on-year increase in ICE revenue.

Phillip Securities notes an 18% drop in consumer electronics revenue in 1H25 due to legacy low-margin consumer lifestyle products.

And in 2H24, ICE revenue tumbled 23% year-on-year.

| Strategic Initiatives: AI Joint Venture & Viet plant |

Trio AI: This is a 55:45 joint venture with Sinnet Cloud, focused on providing GPU and AI-related cloud services in Hong Kong.

Valuetronics invested HK$222mn (S$38mn) to purchase MetaX GPUs (1000 units) for lease to the JV.

Revenue from GPU processing and AI services is anticipated to begin contributing in FY26, which starts from April 2025.

Phillip Securities estimates a potential annual revenue of US$11 million from GPU processing power as a service.

Vietnam plant: UOB Kay Hian highlights the plant as strategically positioned to meet changing customer needs, potentially due to de-risking from China amid US trade tariffs.

The Vietnam plant was operating at 40% utilisation at the end of 1HFY25, indicating room for production ramp-up.

| Financial Strength and Shareholder Returns |

UOB Kay Hian points out that Valuetronics was trading at only 2x FY24 ex-cash PE and offers an attractive FY25 dividend yield of 7%.

The near-term outlook for Valuetronics is considered positive, driven by new customer acquisitions, expanding profit margins, and the future potential of its AI venture and Vietnam plant. |