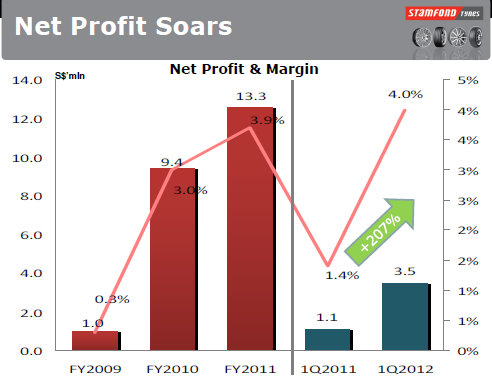

STAMFORD TYRES has just had a strong 1Q (ending July 2011) with its net profit surging 207.7% to S$3.5 million, a result that could have been better if not for a ‘supply issue’ at its South African operations.

That issue has been resolved, said its management, and the strong growth expected of its South African operations will resume.

In 1Q (ended July 31), South Africa contributed S$8.8 million in revenue, up just 2.3% year-on-year. (The potential for South Africa is reflected in the 24.9% sales growth rate for the full FY2011 versus FY2010.)

In 1Q, revenue from the key market – Southeast Asia – grew 8.1% to S$66.2 million.

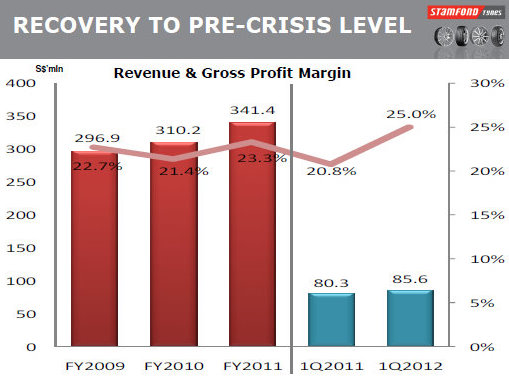

In all, in 1Q, Stamford Tyres’ revenue grew 6.6% to $85.6 million.

The outlook for Stamford Tyres in the next three quarters of its current FY12 (ending April 2012) is positive, with the year’s results likely to outperform FY11’s.

Its 3Q and 4Q typically enjoy higher sales than the 1H.

The fact that net profit growth outpaced revenue growth reflects the management’s strategy of not chasing revenue growth for its own sake.

Gross profit and gross margin are of greater importance, said Stamford Tyres president Wee Kok Wah at a briefing for analysts and fund managers on Monday.

The gross margin for 1Q was 25%, which is within the 23-25% range that can be considered normal for Stamford Tyres, said its CFO, Conson Sia.

This is much better than the 15-18% range for wholesale distribution businesses in general, said Mr Wee.

Stamford Tyres’ gross margin in 1Q was aided by a better sales mix of high-performance tyres and earthmover tyres.

Looking ahead, the company expects the prices of natural rubber and synthetic rubber to stay firm.

Consequently, it has built up its tyre inventory, which rose from $95.1 million as at end April this year to $112.7 million as at July.

Stamford Tyres, in a nutshell, is a stable business with strong growth potential in South Africa and a more measured growth pace from its established market of Southeast Asia.

The stock traded recently at 30 cents (after going x-dividend of 1.5 cents), virtually unchanged since the start of this calendar year and from six months ago.

In other words, it has been spared the severe beating that the overall market has taken in recent months.

Still, Stamford Tyres is trading at a deep discount to its Net Asset Value of 46.75 cents a share and at a historical PE of just 5.25, which help explain why Mr Wee has been a regular buyer of the stock (see story link below).

Recent stories:

Buying during market panic: DMX, WEE HUR, LMA, STAMFORD TYRES

YANGZIJIANG, STAMFORD TYRES, SARIN: What analysts now say....