A reader contributed this article

|

Stamford Land Corporation, a Singapore-listed hospitality and property investment firm, presents a compelling case for value-oriented investors. Stamford Land stands out with a net cash position of S$508 million, or roughly S$0.34 per share, which constitutes about 81% of its market capitalization based on a stock price of S$0.42. It’s built from savvy divestitures -- selling hotels in Sydney and Auckland at record prices in the last two, three years -- and a rights issue that has bolstered their liquidity. |

| What makes up its value |

As of March 31, 2025, total assets stood at S$1.096 billion.

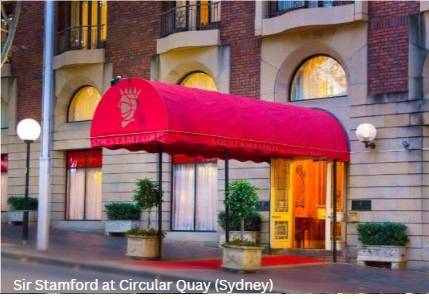

• In 2023, Stamford Land sold this Sydney luxury hotel for A$210 million. Stamford bought it for A$36 million in 2000. • Hotels are initially recorded at purchase price plus directly attributable costs (e.g., renovations, site preparation). Over time, they're depreciated using the straight-line method over useful lives. Their market values are likely much higher than their accounting values. |

Investment properties were worth S$334.4 million (including a 60% stake in 8 Finsbury Circus, a prime Grade A office building in London's City financial district)

Under property, plant, and equipment are five hotels in Australia worth S$174.9 million, all carried at historical costs that undervalue their true worth.

These assets form the backbone of the "Hotel Owning and Management" segment, which drives the majority of Group revenue (S$148.4 million for FY2025).

Stamford Land has no debt.

This is the kind of financial conservatism and discipline that allows a company to weather storms and seize opportunities.

| A Turnaround Worth Noting |

For FY25 ended March, revenue dipped 5.5% to S$148.4 million, but profit attributable to owners soared to S$32.8 million from S$5.9 million in FY2024, thanks to a dramatic drop in fair value losses on investment properties from S$81.5 million to S$0.9 million.

Interest income of S$16.4 million further bolstered earnings, while finance costs fell 22.3% to S$6.2 million.

The net margin improved to 22.1% from 3.8%, and return on equity rose to 3.8% from 0.7%.

The current ratio of 14.0x signals liquidity that few can match.

| Leadership I Can Trust |

What excites me is the leadership of Executive Chairman Ow Chio Kiat, who has a knack for reading market cycles.

He built up the group’s current hotel portfolio in Australia back in the early 1990s when the market was distressed with the exit of Japanese owners, scooping up hotels in prime locations across gateway cities at bargain basement prices.

On the shipping front, he also exited the container shipping market at the peak in 2007 via another company, Singapore Shipping Corporation, distributing bumper dividends in the process.

Today, Stamford Land’s remaining portfolio comprises of five hotels, one in Sydney, one in Brisbane, one in Melbourne and two in Adelaide.

The group has not updated valuation exercises for its hotels but substantial surplus likely resides in these assets as these hotels were carried at historical costs.

Case in point is the divestment of Stamford Circular Quay in Sydney, bought for A$36m and sold for A$210.5 million.

Similarly, the Stamford Auckland was sold for NZ$170m, or about twice the purchase price 27 years earlier.

Stamford Land also owns a 60% stake in a prime London office property 8 Finsbury Circus, which it bought in 2019.

As interest rates moved up from 2021, the group was saddled with valuation losses as office cap rates -- ie the "yield" you'd get if you bought the property outright with cash -- expanded from 3.8% to 5.5%.

However, now as the interest rate cycle swings down with the Fed preparing to cut rates, there is potential for writebacks to this property, boosting its book value.

Another area to watch is, Stamford is currently in the midst of extensive discussions with the Queensland Government on the potential redevelopment of its Brisbane hotel.

While the process could be lengthy, any breakthrough on this front will be highly accretive to the valuation of this asset.

| Risks |

That S$508 million cash pile enables the group to stand pretty, earning a stream of interest income while awaiting the right opportunity to deploy into accretive deals.

However, risks are real too—hospitality revenue is tied to tourism cycles, staff costs rose 20.7% to S$52.2 million in FY2025, and currency fluctuations cost S$9.0 million.

The dividend yield is low at S$0.005 per share, and shareholders frequently express disappointment at it.

Stamford Land isn’t a speculative bet—it’s a business with intrinsic value, a strong moat of cash, and leadership that acts like owners.

Chairman Ow signals his optimism on Stamford Land, with regular open market purchases of the stock. His family also significantly raised their combined stakes in the company from 40+% to over 65% currently, via the earlier rights issue. At current prices, the stock offers a margin of safety. I’d buy and hold, letting Mr Ow’s acumen and the company’s assets work over time. As Warren Buffett said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Stamford Land, to me, is the former. |

|||||||||||||||||

For a hotel/property play with different dynamics see: BANYAN GROUP's Share Surge: Why Phuket Property Focus will Add More Fuel Ahead For a hotel/property play with different dynamics see: BANYAN GROUP's Share Surge: Why Phuket Property Focus will Add More Fuel Ahead |