Excerpts from latest analyst reports.... Credit Suisse says Yangzijiang has 'undervalued growth and improved capabilities' ■ Maintain OUTPERFORM: We hosted a roadshow with Yangzijiang where management reiterated its strategy to become an integrated marine services provider and confidence in delivering continued earnings growth. We increase our target price from S$1.90 to S$2.20, and maintain our OUTPERFORM rating, as we believe the market is underestimating Yangzijiang’s growth potential.

Analysts: Gerald Wong, Bhuvnesh Singh, Christopher Chang

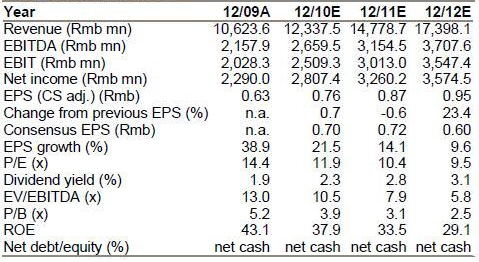

■ Growing through market share gains: We forecast a 16% CAGR in net profit between 2009 and 2012 through an increase in vessels delivered and resilient margins. Despite a decline in shipbuilding orders globally, management believes it will be able to gain market share from distressed yards. Yangzijiang has acquired land to develop a new yard with a potential capacity of 1,000,000 DWT, increasing its total capacity by more than 40%.

■ We expect margins to stay strong: Yangzijiang continues to benefit from high-value contracts signed in 2007-08, which make up close to 75% of its current order book. We estimate that net margins will stay above 20% in 2012 despite lower margins for new contracts, and our 2011 forecasts are 20% above consensus.

■ Moving up the value chain: Management reiterated its strategy to focus on the high-end containership market, where Yangzijiang has a competitive edge over other Chinese shipyards. When the new yard is ready in 2012, it will be used mainly to construct 8,000 TEU containerships, allowing it to move up the value chain and compete more effectively with Korean yards.

■ Undervalued growth: We reiterate our OUTPERFORM rating, and increase our target price from S$1.90 to S$2.20, based on 2011 P/E of 13x, in line with the sector average. Yangzijiang is one of the cheapest shipbuilding stocks globally with a 2011E P/E of 10.4x, and we believe the stock will be rerated as containership orders accelerate and strong margins are maintained through the company’s strong execution capabilities.

CIMB maintains 'hold' on Technics Oil & Gas but highlights TDR and other catalysts

Analyst: Yeo Zhi Bin

• Upstream, an oil and gas journal, reported that Technics has teamed up with Vietsovpetro to bid for EPC of six wellhead platforms for India’s national oil company, ONGC. Total value of the contract is estimated to be about US$300-400m.

• However, we are mindful of the competition. Indian engineering giant Larsen & Toubro (L&T), Punk Lloyd, Singapore-based Swiber, Abu-Dhabi based-NPCC and McDermott are reported to have submitted bids. Although chances of securing this contract are slim, in our view, we think that this tender exercise is evident of Technics growth and capabilities.

• Buoyant Vietnam market. Management sees opportunities from the US$4.3bn Chervron-led Vietnam Gas project, which aims to develop the gas fields along Vietnam’s southern-west coast.

• The upstream element includes a FPSO, a large central processing platform with 20,000 tonnes topsides and steel structure, wellhead satellite platforms and infield pipelines. EPC works for the project is expected to be tendered for in Mar 11. Awards are expected in 2H11.

• Given Technics’ strong exposure to the Vietnam oil & gas sector, chances of securing EPC for the central processing platform and wellhead satellite platforms are higher, in our view. An order win from this project would catapult Technics into the big league.

• With the outstanding 71.5m warrants (1-for-1 conversion at strike price of S$0.40, issued at S$0.10) deeply in the money, we expect them to be exercised at strike date, 26 Nov 10. The group can expect a cash inflow of S$29m and increase in share capital within FY11.

• With Technics expected to be in a net cash position for FY11 and no major M&As in the pipeline, we believe that the group could exercise effective capital management and re-distribute surplus cash to shareholders.

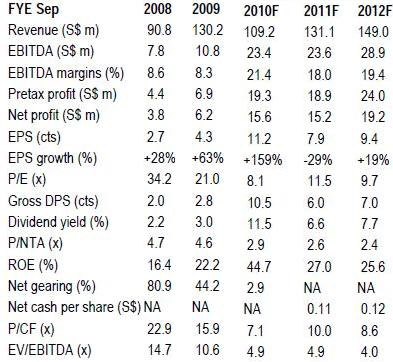

• We raise our DPS forecast to 6 Scts and 7 Scts from 4.5 Scts and 5.5 Scts for FY11-12. This implies a 75% payout and yields of 7-8%.

Near term catalysts but valuations are rich

• Technics’ share price has sky rocketed some 70% since our initiation. We believe that its 1) stellar results (9M10 earnings of S$12.3m vs. 9M09 earnings of S$4.5m); 2) YTD strong cash generation of S$36.5m and surprise bumper dividend of 10.5 Scts has supported the uptrend.

• YTD, management has also bought back about 9.5m of shares, signalling that it feels that the company is undervalued.

• Further near term catalysts? Should Technics be able to price their TDRs at a premium to their last traded price, there could be a further spurt in share price in the near term.

• On the other hand, long-term value investors should exercise caution. At 11x CY11 P/E, Technics is trading above its bigger and more established downstream engineering peers. Hiap Seng Engineering, PEC Ltd and Rotary Engineering are trading at 7x CY 11 P/E. We believe that much of the positives have been priced in and chances of disappointment are high if execution issues or lower-than-expected order-wins occur. Maintain HOLD.

Recent story: TECHNICS OIL & GAS shares at three-year high - nearly