In this weekly series titled JUST ASK, we invite readers to send in questions on stock investing, and personal finance. We will ask an expert (or experts) to provide answers. Below is a question from a reader after reading our Q&A last week regarding cash-rich companies and whether they should be paying out special dividends. The answers are provided by ..... our readers! The answers are cobbled together from their postings in our forum, and supplemented by some fact-digging by us.

Reader: Last week’s Q&A discussed when it is good for cash-rich companies to pay generous dividends. What are some of the companies which have proposed big dividend payouts for FY09? What has been their business performance and what are their cash reserves?

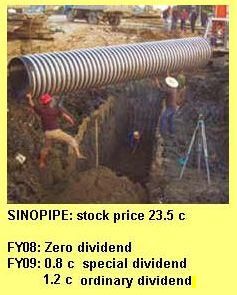

SINOPIPE HOLDINGS: Designs, manufactures, distributes and installs plastic pipes for water supply, electrical distribution, etc. in China.

Reader 'Wiki’ highlighted Sinopipe, saying it is paying a 2 cent dividend (made up of 0.8 cent special dividend and 1.2 cent ordinary dividend). At a stock price of 23 cents then, the dividend yield would be 8.7%.

’Wiki’ reckoned Sinopipe is safe stock to invest in as its net asset value at the end of FY2009 was 233.23 Rmb cents (equivalent to S$0.48).

’Harlequin’ pointed out that Sinopipe is not in a net cash position. It has Rmb 270 m in long-term and short-term borrowings while its cash in the bank is Rmb168 m.

Its CEO and COO’s investment holding company, Loyal Team Group, has bought about 5 million shares since early March after the FY09 results were announced. It now holds 40 million shares, which is 17.8% of the share capital.

Sinopipe stayed profitable in FY09, with net profit at Rmb 38.9 million, a 41.3% decrease from the previous year.

Revenue declined 4.2% to Rmb 795.1 million. The gross profit margin declined from 23.7% to 20.8%.

Sinopipe’s PE ratio is about 6.4X.

BRIGHT WORLD PRECISION MACHINERY: Manufactures stamping machines for sale mainly in China.

Reader ’Neontet’ highlighted that Bright World had proposed a RMB 15 cents (equivalent to 3 Singapore cents) dividend when the stock price was only 19.5 cents today.

Dividend yield at that time = 15%. “This S-chip is different from others in being generous to minority shareholders,” wrote Neontet.

The dividend payout itself would have surprised Bright World shareholders since the company didn’t pay any dividend for FY07 and FY08.

In those years, it was far more profitable at RMB145 m and RMB128 m, respectively, compared to RMB58.8 million in FY09.

Bright World’s annual report says the dividend is to reward shareholders for being patient for the past 2 years as it expanded its business and transformed itself into "a sizeable business with deep technological capabilities."

As at end 2009, the company had RMB56 million in cash versus RMB80 million in short-term bank borrowing.

Its operating cashflow was RMB107 m versus RMB108 million in capital expenditure – the latter will decrease sharply this year as its manufacturing facility is completed.

The stock’s PE ratio is about 8X (based on a recent stock price of 25 cents) and its NAV, 40 cents.

Incidentally, this company was the target of a takeover offer at 70 cents a share back in 2008.

However, in April 2009, the offeror withdrew its offer as Bright World had reported a 11.3% fall in its FY08 net profit. This breached a pre-condition of the offer that Bright World's FY08 profit should not decrease 10% or more.

MEIBAN GROUP: Is in the business of design, tooling, plastic injection molding and contract manufacturing.

Highlighted by reader ‘fun$’, this company is paying 2 cents in dividend, unchanged from FY08.

It is cash-rich with net cash of $39m (11.7 cents a share) and minimal borrowings after it repaid $7.8 million in debt in FY09.

Cashflow from operations has been consistently positive, with the figure for FY2009 being $34.95 m.

NAV= 43.6c.

At a recent price of $0.34, it's trading at 7.4x PE and a dividend yield = 5.9%.

It been paying out dividends without fail every year since at least 1995, according to 'fun$'.

For FY09, Meiban's net profit was $15.7 million, down by 29% from the previous year.

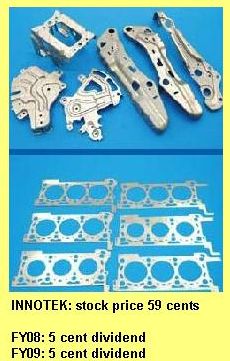

InnoTek: Is in the busines of precision components stamping, tool & die design & fabrication, product sub-assemblies, etc.

The company, which has been the subject of a lot of discussion in our forum, reported $7.6 m in net profit for FY09, a turnaround from a $7.0 m loss in FY08.

The stock price has soared from 40+ cents to 59 cents following the company's announcement of a 5-cent final dividend payout. Loaded with about $79 million in net cash, InnoTek has also been aggressively buying back its shares.

Adding to the bullishness around the stock (current dividend yield = 8.5%), InnoTek has guided for a strong 1Q and FY10 business performance.

Reader 'Harlequin' figured: "At some point all the bought back shares will be released back into the market via a placement. So it's a form of insider buying: They know business performance will be good enough for the market to re-rate the stock to 70 ct, whatever, and so they are confident of buying low and selling high.

"If that's the game plan, then you understand why InnoTek is aggressively buying bk its shares. InnoTek is going to have the last laugh (vis-a-vis its sceptics who are scrutinising its sales/earnings/expenses, etc)."

Last week's story: JUST ASK: 'Should cash-rich companies pay special dividends?'

Email your questions to