QUALITY HEALTHCARE Asia Ltd (HK: 593), a Hong Kong-based comprehensive provider of a range of private outpatient healthcare and wellness services, has been around in one form or another dating back to the late Qing Dynasty, with experience in local medical services of over 130 years.

It has just got the equivalent of a clean bill of health in its biannual financial checkup.

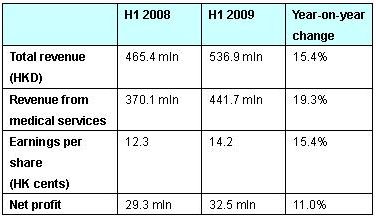

In an interim report that came out over the weekend, for the half ending June 30 the Hong Kong-listed firm’s top line grew 15.4% year-on-year to 536.9 mln hkd, producing a net profit increase of 11% to 32.5 mln.

“In the first half of 2009, Hong Kong was affected by the global financial crisis and the Influenza A virus. However, the group managed to deliver a good set of financial results. This is a strong validation of Quality Healthcare’s sound underlying business fundamentals and unique operating model,” said Dr. Lincoln Chee Wang Jin, its CEO who obtained his medical degree from the National University of Singapore.

The company provides both general and specialist care for its private and corporate members through a network of more than 560 Western and Chinese medical centres and 45 dental and physiotherapy centres.

Quality Healthcare also operates seven elderly care homes as well as Hong Kong’s longest-established international nursing agency.

And building on its brand and breadth, Quality HealthCare in 1998 became the first healthcare provider to be listed on the Hong Kong Stock Exchange.

But how has it achieved such remarkable success in such a crowded market, and how does it plan to keep shareholders smiling going forward?

“Everyone accepts that demand for healthcare will continue to rise. With the acquisition of the GHC network towards the end of FY2008 as well as the opening of new medical centres, the group’s core medical network has increased to 60 centres. Including other services such as dentistry, physiotherapy, counseling etc our core service presence number more than 90 through out HK.

“The group will continue to explore new locations to bring medical services closer to our patients and clients. Our recent announcement of an exclusive strategic relationship with Mannings, a leading pharmacy chain, is a step in this direction,” Dr. Chee said.

He said revenue should continue to grow and was protected from periodic sputters by the fact that few of the company’s clinics saw patients paying out of pocket.

“Around 80% of our patients’ bills are covered by their insurance providers,” he said.

He said the on-the-ground market situation provided justification for such a deal, and others like it.

“Having observed a continual demand for reliable and professional medical cosmetic services, the group has established another new Cosmetic Skin Centre within one of its medical centres in the Kowloon site in March 2009 and is studying the opportunities to expand in this market.”

The deal for GHC, a holding company with subsidiaries operating 18 GHC medical centres and a cosmetic specialist centre in Hong Kong, was signed in October of last year and will expand Quality HealthCare’s network presence into residential areas and enhances service depth.

He said the new pickup “will enable Quality Healthcare to increase its geographical presence and footprint throughout Hong Kong and to strengthen our community medicine and private patient offerings."

In addition to enjoying the benefits of the existing established network of GHC medical centres, Quality Healthcare will also add the existing clientele of GHC to its existing network base, enabling the new members to enjoy the comprehensive health and wellness services already available at Quality Healthcare.

"Going forward, Quality Healthcare is ideally positioned for the healthcare reform challenges that lie ahead. We will continue to ensure quality-assured healthcare services to the Hong Kong community, now made more convenient by our increased network presence, and to ensure affordability for our members through the knowledge, client base, and resource synergies made possible by the combination,” Dr. Chee said.

He said that as CEO, he was not comfortable sitting on profits too long but felt the need to invest in continued growth to ensure shareholder satisfaction down the road as well as continue to improve quality of care for patients.

“Investors will ask me why are we keeping so much cash around. Either invest it or give it to us as dividends. Of course, if we hear of a major private hospital project, or if the government announces a big project, we will find the funding. Our growth is purely project-driven,” Dr Chee said.

He said the company recently announced “a clear dividend policy.”

“The group has built up a healthy net cash position of 204.1 mln hkd, resulting from strong cash flow from the group’s operating activities. In accordance with the practice adopted last year, we have decided not to declare an interim dividend but will review the appropriate amount of any final dividend depending on its final results and the extent of any share repurchases achieved during the year.”

He said this policy was consistent with his growth philosophy as Chief Executive Officer.

“Dividend companies, such as utilities firms, usually have slower EPS (earnings per share) growth, versus growth companies which have faster earnings per share.”

However, Dr. Chee was not one to engage in compulsive shopping behavior.

“Yes, of course we are interested in making good acquisitions, but we hate paying premiums,” the 44 year-old ear, nose, and throat (ENT) surgeon said with a smile.

He said the company’s long-term plan was to work closely with its partners to establish a corporate wellness platform with a range of services for the corporations.

“Some of these new services could be launched in the second half of 2009 such as the Smoking Cessation Program and other new physical check up offerings. Improving on our IT infrastructure has also been a key progress made during the six months. Our key objectives are to increase productivity and reduce the cost of servicing through added efficiency and performance capability.”

Quality HealthCare catching China bug?

It is nearly impossible to discuss the growth strategy of any ambitious Hong Kong firm, sector notwithstanding, without mentioning the 1.3 bln-strong potential market to the north.

Although Quality HealthCare is still an exclusively Hong Kong play, this did not mean that it did not have eyes on the People’s Republic.

If Quality HealthCare were to make a go of it on the mainland, Dr. Chee said it would not be able to fully replicate its business model used in Hong Kong for a variety of reasons.

“Before entering the China market, we would likely try to reach a consensus to focus on services as well as utilize a hospital-centric model. We could also focus on the supply-side of the business, in terms of labs and equipment, etc. In fact, a lot of investors are looking to invest in the China medical market, and they prefer they have a Hong Kong arm,” he said.

He also said that while he had no problem with running a successful, aboveboard company, it also came at a certain price.

“Half of our business comes to our own doctors and clinics. But half ends up in other’s due to referrals, as it would be unethical to tell patient that we are the only ones who can perform this procedure and patients should always be empowered with choice” he said.

And perhaps unsurprising was the fact that the healthcare profession was not immune from pretenders and copycat competitors looking to get an edge on their peers.

“Forgive me if I am a bit vague for this interview, but alot of our competitors copy our business model and growth strategy, so therefore we sometimes remain somewhat vague in reports and interviews."

First half review

Revenue grew 15.4% from HK$465.4 million in HY 2008 to HK$536.9 million in HY2009. This was primarily due to the improvement in contribution from the medical services, which saw a 19.3% increase from HK$370.1 million in HY2008 to HK$441.7 million in HY2009.

This commendable result was achieved despite its corporate clients taking various measures to cut costs and reduce staff headcounts.

The group achieved a 30.8% increase in turnover for in-patient services and a 24.0% increase for third party administrative services when compared to the previous corresponding period. For out-patient services to cash and fee-for-service clients, the average revenue per visit grew by 4.3% while attendance grew by 15.5%.

Keeping to a lean and mean operation, the group managed to control its operating expenses in line with its increased revenue. This translates into an 11% increase in net profit attributable to equity holders, from HK$29.3 million in HY2008 to HK$32.5 million in HY2009. Earnings per share rose 15.4% to 14.2 cents in HY2009.