Source: Smart Investor magazine

THE AFFORDABILITY of private homes has been reduced considerably after the huge run-up in prices during the boom period of 2006 and 2007.

Even if the economy begins to see some stability around 2010 – which is what economists predict – some property watchers doubt if demand for housing would have a quick recovery.

“It’s unlikely there would be a fast recovery in the physical market, definitely not price recoveries which we saw in 2006 and 2007. You have to remember that the massive price movements in 2006 and 2007 started from a very low base as the market had pretty much been moving sideways from 2000 to 2004,” says CIMB property analyst Donald Chua.

Demand for homes is also closely related to job availability. Singapore is highly dependant on foreign labour and thus, the residential property market is highly sensitive to employment levels as well as to the growth of the foreign population.

In the last two years, an influx of foreigners has been largely attributed to the number of jobs created in the city state. Not surprisingly, rental and property prices rose in tandem.

But a higher unemployment rate forecasted this year – expected at around five per cent from the current 2.8 per cent – would lead to more foreign labour departing the country, thus further impacting demand in the property market. Recent figures from the Urban Redevelopment Authority (URA) showed only 4,287 homes were sold last year, a stark contrast to the record high of 14,811 new homes transacted in 2007.

“This is the lowest number of new homes sold since the early 1990s,” commented Li Hiaw Ho, executive director for research at property consultant CB Richard Ellis.

PRICING PRESSURES IN THE MARKET

As at end-2008, the URA residential price index reflected a 4.3 per cent year-on-year average decline in home prices – following a 31.2 per cent increase in 2007. But considering the turbulence of the past year where stock markets plunged to new depths and demand for residential property dwindled, the drop in property prices could have been much worse.

“Developers are holding back the sale of units. This is limiting excessive supply in the market and also some of the downside in prices,” says Alfred Low, property analyst at Phillips Securities.

Evidently, most developers have kept their launch activities to a minimum with roughly 700 new homes unveiled in the last quarter of 2008, compared to an average of 1,800 units during the preceding three quarters.

“Developers were hesitant to launch new projects because of the expected lukewarm response from homebuyers and the difficulty of pricing their projects in a down market. As the Singapore economy slid into a technical recession from the third quarter, potential buyers stood on sidelines all the more, in anticipation of further price cuts,” notes property consultancy firm CB Richard Ellis.

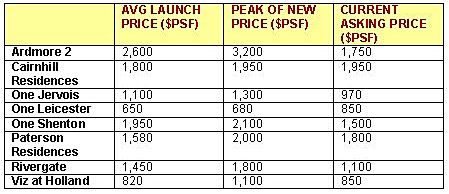

Source: Agents, URA, CIMB-GK.

So, can we expect more developers to start slashing prices soon in a bid to clear existing stock and ease the potential strain on their balance sheets?

OCBC Investment Research property analyst Foo Sze Ming suspects that smaller developers could well buckle due to cash flow pressures.

“Holding back launches do come with a price to pay. Developers will need to continue to incur interest payments for the loans taken out for land acquisitions. While most of the bigger developers do have strong buffer of cash to cover their interest payments, smaller developers may be financially stretched if they hold on to their land. As such, we think that it is possible that smaller developers will continue to launch new projects at the expense of profitability in order to clear their inventories,” she notes.

In fact, a number of boutique developers have been cutting prices in recent months. Some of the most aggressive price cuts were recorded in December, with prices of several new units reduced by up to 40 per cent from launch prices in 2007. These include Ritz-Carlton Residences in Cairnhill Road, where eight units were sold at a discount of 39 per cent, while Lucida located at Suffolk Road had three units sold at 35 per cent lower.

However, CIMB’s Mr Chua says it is more likely that prices would come down progressively. “I don’t think we would see widespread slashing of prices because that would not give the developer a good reputation in the market and if that were the case, consumers would probably sit on the sideline in anticipation of even bigger price cuts.”

Strong HDB prices in the past year have supported mass market home prices.

DROP IN HOME VALUES TO CONTINUE

Property analysts differ on the level of decline in the cost of private homes expected this year, though estimates range from 15 to 35 per cent. The middle and mass market properties will continue to see price corrections, though the drop is expected to be less for mass market homes as prices have not risen as sharply compared to homes an the higher end.

Mass market properties have also had support from strong HDB prices, with the HDB resale price index gaining 13 per cent in the first nine months of 2008.

Besides housing demand from newly-formed households, the increased demand from foreigners has driven HDB prices upwards. “With private housing rental driven sky-high by the property boom in 2007, more foreigners have turned to the more affordable option of renting HDB flats, which in turn drives HDB rental rates higher and this has encouraged more permanent residents (PRs) to buy HDB flats instead of renting,” says OCBC’s Ms Foo.

As in 2008, luxury homes are expected to bear the brunt of depreciating home values. Goldman Sachs Paul Lian points out that the weak rental market, which has been negatively impacted by the outflow of foreigners amidst leaner times, would continue to be a drag on prime property prices.

“As a general rule of thumb, 60 per cent of prime residential properties are purchased for investment or rentals, while only 30 per cent of mass market residential properties are likely bought for rentals. Given the buyer profile, rental yields are an important consideration for prime property buyers,” he says.

And in the current asset deflation cycle where capital appreciation is not on the horizon, rentals yields will take on greater significance when buyers evaluate the investment merits of purchasing a prime property, Mr Lian added.

On a separate note, tighter mortgage conditions could exacerbate price declines in the property market. Reports suggest that banks have tightened their credit standards in assessing home loan applications. Local banks are still lending up to 80 per cent to “credit-worthy” borrowers, but in cases where borrowers are stretched, only 60 to 70 per cent loan-to-value mortgages have been offered.

With the bulk of property launches in 2007 due for TOP (Temporary Occupation Permit) in 2009 to 2010, buyers who purchased property using the defunct secure mortgages now, will be facing far stricter lending terms.

The URA estimates that 45 per cent of the 10,000 units expected to be completed this year were sold on the Deferred Payment Scheme.

BETTER VALUE EMERGING IN THE SECONDARY MARKET

Ultimately, property owners not able to secure loans will probably turn to the secondary or re-sale market to exit the property. “Until banks relax mortgage conditions, we expect heightened selling pressure at projects upon completion,” wrote UBS analyst Regina Lim in a research report last month.

With more distressed properties flowing into the secondary market, pressure for more competitive pricing continues to mount. Feedback from property agents indicate substantially reduced selling prices for both completed and uncompleted homes compared to what was being offered when the properties were first launched.

Asking prices for projects such as One Shenton and Rivergate are 25 to 30 per cent lower than the transaction one to two years ago. Anecdotal evidence points to offer prices from genuine buyers could also be five to 10 per cent lower than what agents initially quote.

However, prices could still correct further should the mismatch in supply and demand continue. “Transaction volume has been thin and if demand is not strong, then prices would have to come down even more I believe,” says CIMB’s Mr Chua.

While it seemed obvious that the residential property market was going to face a challenging year ahead, the latest indicators seem to suggest an adjustment period much longer than what most would have initially hoped for.

This article was recently published in Smart Investor magazine and is reproduced here as part of a special collaboration between the magazine and NextInsight.