HONG KONG’S fund managers are getting familiar with a new kid on the block from Singapore - Aries Consulting, an investor relations outfit helmed by Financial PR’s deputy managing director Mark Lee.

In the first investor conference jointly organized by Aries and Taifook Securities, some 50 fund managers and analysts trooped into Renaissance Harbour View Hotel Mon this week to meet the management behind stocks deemed as potential winners.

”The 14 featured firms were chosen from among hundreds of other Hong Kong and Singapore-listed firms for their promising prospects during and post-downturn,” said Taifook Research’s MD, Mr Marco Mak.

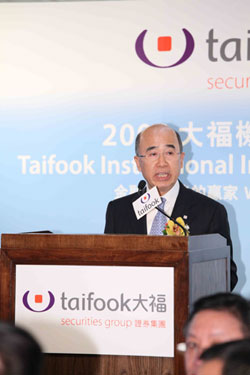

Mr. Peter Wong, Taifook’s group MD and CEO, said the gathering “offers a unique opportunity both listed companies and investors to become better acquainted, exchange innovative ideas and share winning strategies that we believe will lead to wonderful partnerships and excellent investment opportunities.”

Besides getting to know the management of HKSE-listed companies, the SGX listcos who participated in the conference also got to hobnob with government officials from Hong Kong’s securities industry who graced the event as guest speakers.

These include executive director and deputy CEO of Hong Kong’s Securities and Futures Commission, Mrs Alexa Lam as well as Mr. Charles Ng, associate director-general of Investment Promotion of Invest Hong Kong.

The luncheon’s keynote speaker, Mrs. Alexa Lam, stressed that enhanced ties between regulatory authorities in both the SAR and its massive neighbor across the border would help facilitate investments in China and Asia as a whole.

As stimulating as the luncheon speeches were, the real stories were happening behind closed doors on the 28th floor, which had been fully rented-out for the conference.

China Gas

Taifook’s 14 selected “winners” |

Agile Property Holdings (3383.HK) |

China Gas (0384.HK) |

China Kangda Food (0834.HK) |

China Travel International (0308.HK) |

China Water Affairs (0855.HK) |

Embry Holdings (1388.HK) |

Golden Meditech (8180.HK) |

GZI Real Estate Investment Trust (0405.HK) |

Hi-P International (HIP.SP) |

Hopewell Highway Infrastructure (0737.HK) |

Kingdee International (0268.HK) |

Want Want China (0151.HK) |

Xtep International Holdings (1368.HK) |

Yangzijiang Shipbuilding (YZJ.SP) |

One such story was that of Hong Kong-listed China Gas Holdings Ltd, on whose end-March valuation Taifook has assigned a 69% upside – tops among the 14 featured firms.

In the closed door meeting with fund managers, the LNG and LPG supplier said its growth was only limited by its supply.

“If our supplies were sufficient, our sales would triple,” said Mr. Liu Ming Hui, managing director of China Gas, adding that the firm – in which Sinopec owns a 9.9% stake – planned to boost its city gas projects to 80 by end-year from 72 now.

He added the company would continue to focus more on gas supply over pipeline construction going forward “because (supply) provides recurring income.”

China Kangda

And this is expected to stand at 3.2 and 2.5 this year and next, respectively, which was why this Shandong-based food producer was chosen by Taifook as an outperformer.

Kangda CFO Mr. Stanley Leung said that the EU continues to be a robust customer for its line of chilled and frozen rabbit meats, while Japan is its top buyer of processed foods including soups, curry products and meatballs.

“China is traditionally not a major consumer of rabbit meat, but we are working to change that. Meanwhile, our chicken sales here are strong, with KFC and McDonald’s both major clients,” Mr. Leung said.

He added that over 90% of its domestic chicken sales are contract orders from restaurants, which offers more reliability in both orders and payment.

Embry

Hong Kong-listed Embry Holdings Limited is seen benefiting from the recent RMB 4.5 trillion economic stimulus package from China, meant to help loosen credit and put cash in consumers’ billfolds.

The vertically integrated lingerie retailer has a leading market share in China, and expects its sales to skyrocket on relatively low ownership base levels in the country.

“In China, average brassiere purchases per annum are just 2-3, while in the west they are between 6-12, so there is plenty of room for expansion,” said Mr. Clement Chan, Embry Form’s CFO.

Hopewell Highway Infrastructure

Toll road construction firm Hopewell Highway Infrastructure is also eyeing the massive stimulus package with great anticipation, as much of the money is targeted by authorities for roads and bridges.

“The stimulus package will directly benefit the economy, and therefore benefit us, especially the Guangzhou-Shenzhen Superhighway.

It’s definitely a positive factor,” said the Hong Kong-listed firm’s executive director Mr. Barry Mok.

Mr. Mok added that the company should pay a 100% dividend this year “unless major new projects are pursued.”

He said Hopewell was not too worried about competition from train travel in Guangdong Province.

“We don’t expect direct competition from railways as they are fixed-line, fixed-schedule.

"Our major concern is that China maintains healthy economic growth, with more investment in new roads.”

And although China’s economy “only” grew at 6.1% in the first quarter, already banks like RBS are raising their full-year targets to numbers much closer to the government’s stated objective of 8%, making it seem all the more realistic after all.

Recent story: WINNERS after the crisis ...