Giken Sakata's stock price decline mirrored the recent oil price decline even though recently acquired oil drilling contractor Cepu Sakti Energy's oil offtake price is fixed, meaning it is protected from the volatility in market prices. Bloomberg data

Giken Sakata's stock price decline mirrored the recent oil price decline even though recently acquired oil drilling contractor Cepu Sakti Energy's oil offtake price is fixed, meaning it is protected from the volatility in market prices. Bloomberg data

Twenty nine shareholders attended the AGM. Photo by Michael Lorenzo Manaog.

Twenty nine shareholders attended the AGM. Photo by Michael Lorenzo Manaog.

Date & Time: Thursday, 18 December 2014 (10am)

Venue: The Tanglin Club

WHEN GIKEN SAKATA announced its plans in April to acquire oil drilling contractor Cepu Sakti Energy, oil prices held steady above US$100 per barrel.

However, the recent collapse of oil prices by a good 40% in a short 3 months to about US$63 per barrel has hit Giken as investors sold down oil & gas plays in a knee-jerk reaction.

Over the same period, Giken’s stock stock price fell by over 20% to 26.5 cents on Thursday.

"I believe the Indonesian government will continue to award us with rights to drill more oil fields because of the good job we are doing," said Group CEO Sydney Yeung. NextInsight file photo

"I believe the Indonesian government will continue to award us with rights to drill more oil fields because of the good job we are doing," said Group CEO Sydney Yeung. NextInsight file photo

How really does the oil price movement affect Giken? We asked CEO Sydney Yeung on the sidelines of the AGM.

It turns out that Cepu Sakti Energy is protected to a large degree from oil price volatility as its offtake oil price is contractually fixed each year.

Thus, Giken’s 1QFY2015 earnings contribution from the drilling contractor has so far been unaffected by oil price volatility.

Indonesian national oil company Pertamina has been paying Cepu Sakti Energy IDR 4,160 per litre of oil.

This rate was based on a pre-determined exchange rate of IDR/USD 9,000, implying that the Indonesian government viewed US$73.50 per barrel to be acceptable as the average market price over the applicable contract period.

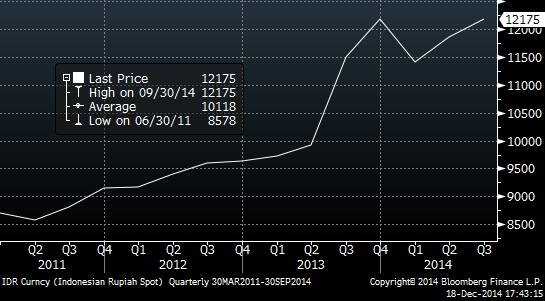

Cepu Sakti Energy receives payment for its oil offtake in rupiah, which has a current market value of about IDR/USD 12,000.

At current exchange rates, Pertamina is effectively paying an oil offtake price of only about US$53 per barrel, about 15% lower than current market rates.

It makes economic sense for Pertamina to continue to offtake oil from Cepu Sakti Energy as long as it is cheaper than the market.

L-R: Bernard Lui (Partner, Stamford Law), Sydney Yeung (CEO of Giken Sakata), Chin Siew Gim (Chairman of Giken Sakata). Standing: Ng Say Tiong (CFO and executive director, Giken Sakata).

L-R: Bernard Lui (Partner, Stamford Law), Sydney Yeung (CEO of Giken Sakata), Chin Siew Gim (Chairman of Giken Sakata). Standing: Ng Say Tiong (CFO and executive director, Giken Sakata).

Photo by Michael Lorenzo Manaog.Oil offtake price is regularly reset to reflect the international price and trend at the time of reset.

The IDR/USD reference foreign currency exchange rate will also be re-pegged to market value.

At the next rate reset in mid 2015, the quantum of adjustment on the IDR/USD reference rate may more than mitigate any downward revision of the reference oil offtake price in rupiah.

After all, the quantum of the adjustment should be sizable enough to reflect the sharp decline of the rupiah (as much as 25%) in the past 2 to 3 years.

"As long as the reference rate works out to more than US$70 per barrel, our business and revenue model remain unaffected," said Mr Yeung.

"We have a proven low-cost business model. We will continue to lower our cost with enhancements to our drilling program," he added.

The Indonesian rupiah has depreciated some 25% against the US dollar since the reference exchange rate was fixed for oil offtake more than 2 years ago. Bloomberg data

The Indonesian rupiah has depreciated some 25% against the US dollar since the reference exchange rate was fixed for oil offtake more than 2 years ago. Bloomberg data

|

Multi-bagger M&A Deal |

Recent story: GIKEN SAKATA: 51-C Target Price With More Upside If...