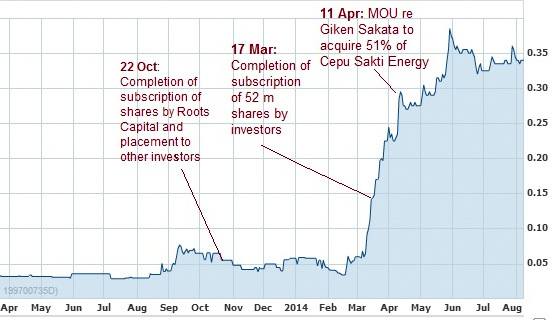

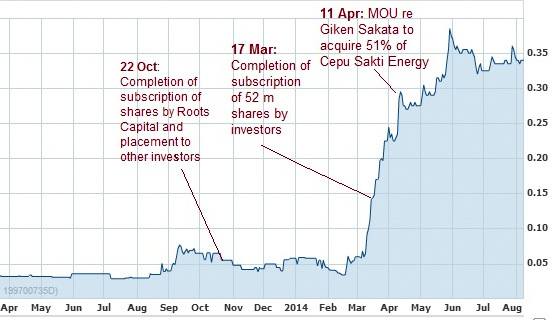

Giken Sakata (35.5 cents) has a trailing PE of 127 based on its legacy business, and a market cap of S$112 million. Chart: Yahoo Finance.

Giken Sakata (35.5 cents) has a trailing PE of 127 based on its legacy business, and a market cap of S$112 million. Chart: Yahoo Finance.

Little known although it has been listed on the Singapore Exchange since 1993, Giken Sakata has weathered tough times in the precision machining and engineering industry.

However, its stock has sprung to life -- shooting up 512%, no less, this year -- as the company disclosed periodically updates on its impending entry into the oil and gas sector in Indonesia.

A prime beneficiary of the stock gain is private equity firm Roots Capital Asia, which had subscribed for 76.275 million new shares, or a 29% stake, in Aug 2013.

That catapulted Roots Capital to the No.1 position among shareholders of Giken Sakata.

Sydney Yeung, MD and founder of Roots Capital Asia, a private equity firm. |

Sydney Yeung, MD and founder of Roots Capital Asia, a private equity firm. |

Photo by Leong Chan TeikIts purchase price of S$1.83 million, or 2.4 cents a share, has resulted in a 1,379% paper gain as the stock has reached 35.5 cents.

Roots Capital Asia's MD, Sydney Yeung, told NextInsight that he is not a short-term investor in this venture.

Instead, he is weighing an offer to move from being a non-executive director of Giken Sakata to a senior management role in the company to run its oil & gas venture while it retains its legacy business.

And for good reason: By his reckoning, there is big upside in drilling for oil in onshore oil fields whose production was abruptly stopped during World War II.

There is virtually no exploration risk since reservoirs of oil are known to be untapped based on seismic data collated in the 1970s and 1980s by Pertamina, Indonesia's state-owned oil & gas company.

The oilfields are not sizeable enough to attract the foreign giants, says Sydney, so Giken Sakata is stepping in to seize the opportunity under the so-called Old Wells Programme.

Giken Sakata is seeking shareholder approval (on Aug 22) to acquire an approximately 53.7% stake in Cepu Sakti Energy Pte Ltd, which holds a 95% interest in PT Cepu Sakti Energy. The latter, in turn, holds an 80% right to extract oil from two oil fields (Dandangilo-Wonocolo and Tungkul) in Central Java.

The oilfields have a total of 148 oil wells. There are at least another 91 wells in the Kawengan field that PT Cepu Sakti Energy has more recently been awarded the right to, as announced on July 16.

The consideration for the stake in Cepu Sakti Energy is S$48 million, which will be satisfied via cash (S$25.2 m) part of which is to be raised from a placement of new shares, and the balance via new Giken Sakata shares at 30 cents apiece.

The vendor is Java Petral Energy whose shareholders include Otto Marine's former CEO, Lee Kok Wah (now chairman of Java Petral Energy), and Otto Marine's chairman, Yaw Chee Siew.

PT Cepu Sakti Energy has drilled 13 wells and has more than 200 more to go.

PT Cepu Sakti Energy has drilled 13 wells and has more than 200 more to go.

Photo: PT Cepu Sakti EnergyFollowing the acquisition, Giken Sakata will loan S$6.25 million at 5% annual interest for three years to PT Cepu Sakti Energy.

Java Petral Energy will own a 16.08% stake in Giken Sakata as its No.2 shareholder, just a whisker behind Roots Capital Asia's diluted stake of 16.14%.

Giving an update of the action on the ground, Sydney said that PT Cepu Sakti Energy has already drilled 13 wells adjacent to the old ones and found oil in all cases. In June, the two oilfields delivered about 670 barrels a day for sale to Pertamina.

The capex is just US$120,000-160,000 a well and the payback period is just less than six months each, he added.

The favourable economics ensures that PT Cepu Sakti Energy will have lots of miles to go. "The potential to scale up is very strong as we have another 200-plus wells to drill," said Sydney.

Beyond that, there is still scope, as Indonesia has more than 10,000 old wells and Pertamina is incentivised to find contractors to produce oil and help reduce, or even reverse, the country's unenviable position in recent years of being a net importer of oil.

Giken Sakata (35.5 cents) has a trailing PE of 127 based on its legacy business, and a market cap of S$112 million. Chart: Yahoo Finance.

Giken Sakata (35.5 cents) has a trailing PE of 127 based on its legacy business, and a market cap of S$112 million. Chart: Yahoo Finance. Sydney Yeung, MD and founder of Roots Capital Asia, a private equity firm. |

Sydney Yeung, MD and founder of Roots Capital Asia, a private equity firm. | PT Cepu Sakti Energy has drilled 13 wells and has more than 200 more to go.

PT Cepu Sakti Energy has drilled 13 wells and has more than 200 more to go.  NextInsight

a hub for serious investors

NextInsight

a hub for serious investors