Excerpts from analysts' reports

DBS Vickers says investors will increasingly favour growth stocks over yield stocks

Singapore equities will be underpinned by the recovery momentum in the US, and the anticipated shift out of recession in the Eurozone.

In Asia, China’s GDP slowdown should also stabilise in 2014. However, optimism will be capped by the extent of QE tapering and the weak market sentiment for ASEAN.

STI is likely to range trade as sentiment gyrates between optimism in recovery in developed markets and uncertainties within ASEAN.

We peg a STI range of 2950 to 3350 in the coming months, which coincides quite closely with 12.33x (-1SD) to 13.9x (Ave) blended FY14/FY15 PE.

We expect the companies under our coverage to enjoy earnings growth acceleration in 2014. We see earnings (before EI) jumping 12.8% in 2014F compared with just 0.5% for 2013F.

DBS Vickers says investors will increasingly favour growth stocks over yield stocks

Singapore equities will be underpinned by the recovery momentum in the US, and the anticipated shift out of recession in the Eurozone.

In Asia, China’s GDP slowdown should also stabilise in 2014. However, optimism will be capped by the extent of QE tapering and the weak market sentiment for ASEAN.

STI is likely to range trade as sentiment gyrates between optimism in recovery in developed markets and uncertainties within ASEAN.

We peg a STI range of 2950 to 3350 in the coming months, which coincides quite closely with 12.33x (-1SD) to 13.9x (Ave) blended FY14/FY15 PE.

We expect the companies under our coverage to enjoy earnings growth acceleration in 2014. We see earnings (before EI) jumping 12.8% in 2014F compared with just 0.5% for 2013F.

Key themes for investment are centred around external recovery and global cyclicals, supported by earnings growth drivers in the industrial, oil and gas sectors.

As QE tapering progresses, expectations of a steepening yield curve reduces investors’ appetite for yield stocks.

The rotation from yield sensitive sectors to growth stocks will gain momentum.

As such, we Overweight Banks, Industrials, Oil and Gas, Consumer Services, Underweight Consumer Goods and REITS, and Neutral on Property and Telcos.

As QE tapering progresses, expectations of a steepening yield curve reduces investors’ appetite for yield stocks.

The rotation from yield sensitive sectors to growth stocks will gain momentum.

As such, we Overweight Banks, Industrials, Oil and Gas, Consumer Services, Underweight Consumer Goods and REITS, and Neutral on Property and Telcos.

Patrick Chew, CEO of Midas Holdings.

Patrick Chew, CEO of Midas Holdings. Photo: CompanyIn terms of stock pick, global proxies, China beneficiaries and oil and gas plays are key focus. Proxies to global recoveries are Hutchison Port, Goodpack and Venture.

With China’s outlook stabilising, beneficiaries of China’s reform efforts are Midas, Global Logistics and Osim.

Domestic recovery proxies are Genting Singapore, Courts and OCBC.

Rate of recovery in the OSV market will drive a re-rating for the sector, benefitting vessel owners like Pacific Radiance, while Ezion will continue to thrive on its niche product offerings.

Turnaround plays to watch out for in 2014 are Ezra and Vard; resolving their execution issues and a sustainable recovery could see both stocks re-rating.

Keppel Corp’s order wins have surpassed expectations with more potential orders in the offing, while margins are recovering.

The full DBS Vickers report is accessible here.

Recent story: Recovery stories for 2014: NOBLE GROUP, JAYA HOLDINGS

Keppel Corp’s order wins have surpassed expectations with more potential orders in the offing, while margins are recovering.

The full DBS Vickers report is accessible here.

Recent story: Recovery stories for 2014: NOBLE GROUP, JAYA HOLDINGS

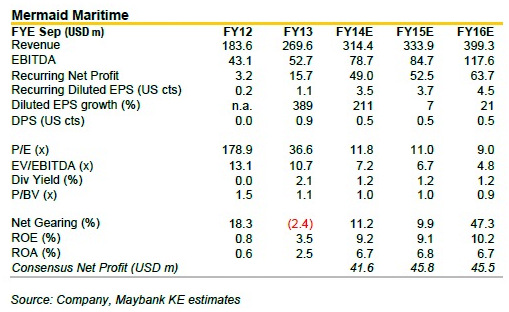

Maybank initiates coverage of Mermaid Maritime with 61-c target

Analyst: YEAK Chee Keong, CFA

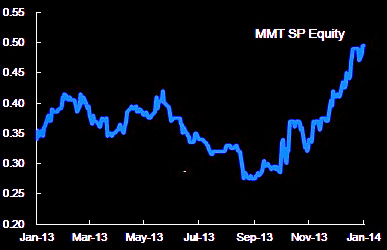

We initiate coverage of Mermaid Maritime with a BUY and TP of SGD0.61, implying a 20% upside.

We initiate coverage of Mermaid Maritime with a BUY and TP of SGD0.61, implying a 20% upside. Earnings should remain robust in FY9/14E, buoyed by a USD650m orderbook (including an unrecognised portion of a USD530m Saudi Aramco subsea contract), which practically guarantees a diluted EPS growth of 212%.

But the larger investment case is Mermaid’s potential evolvement into an integrated oilfield services player a la Malaysia’s SapuraKencana, which the market has yet to price in.

We see favourable industry dynamics, characterised by

(1) high oil prices keeping E&P activities and drilling demand elevated,

(2) 2013-2017 subsea sector spending likely to double vis-à-vis the preceding five years, and

(3) Thailand’s national oil company PTTEP’s higher capex budget of USD25b for 2013-2017 (vs ~USD9b for 2008-2012).

DBS Vickers' Strategy Outlook for 2014 (dated 3 Jan 14) highlighting the recovery of the oil & natural gas industry, among other sectors, provides an interesting read. Among its picks for the OSV operators are Pacific Radiance (TP $1.05), Jaya Holdings (TP $0.90), and Nam Cheong (TP $0.42).

Looks like the re-rating of Jaya Holdings has already begun. The stock has started to run, and is now at 0.83 (up from yesterday's closing of 0.73). Looks like target price of 0.90 is not too distant and not only achievable, but likely to be surpassed.