Bocom: ‘Buy’ Maintained on Comtec Solar

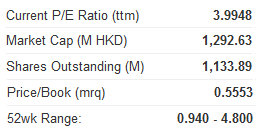

Bocom International is maintaining its ‘Buy’ recommendation on Comtec Solar Systems (HK: 712) after the brokerage discovered the Shanghai-based firm is unlikely to be negatively affected by recent anti-dumping measures in the US targeting Chinese government-subsidies for its solar energy sector.

“We learnt from Comtec that the company mainly exports mono-crystalline wafers to customers in mainland China and Taiwan, while the customers of its super mono wafers are also in the PRC.

“The anti-subsidy duties have no direct impact on the company,” Bocom said.

The brokerage currently has a target price of 2.05 hkd on Comtec.

US anti-subsidy/dumping duties on Chinese solar cell and panels were lower than expected, and are thus a modest upside surprise for China’s solar industry, Bocom said.

“On March 20, the US Department of Commerce imposed anti-subsidy duties of between 2.9% to 4.73% on Chinese solar cells and panels.

“These are smaller than expected The US DOC’s decision came in much lower than the 20-30% duties expected by the industry, and far below the 100% requested by the seven US solar companies,” Bocom said.

Chinese manufacturer Suntech, the world’s largest solar cell and panel maker, will be levied another 2.9% duty while Trina Solar will be charged 4.73% and others will be charged 3.61%.

“This is positive for the Chinese solar industry. Share prices of listed Chinese solar equipment makers increased in response to the news. Suntech, Yingli Solar and Trina Solar rose by 14.06%, 12.07% and 7.85%, respectively, on the news, but LDK Solar lost 1.51%.”

See also:

COMTEC ‘Outperform’ On Wafer Niche; FOCUS Helps Out Mercy Relief

COMTEC SOLAR: Economic Cloudcover Not Obscuring Wafer Demand

COMTEC SOLAR: ‘Buy' With 134% Upside, Says Yuanta; But 'Hold' Says UOB

COMTEC SOLAR: HK-Listco's 1H Profit Soars 48.1% On Vibrant Wafer Sales

Bocom: Three ‘Buys’ for Three Big Banks

Bocom International has ‘Buy’ recommendations on three major Hong Kong-listed PRC lenders.

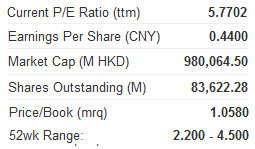

Bocom is reiterating its ‘LT-Buy’ recommendation on ICBC (HK: 1398) with a 5.3 hkd target price (7.5% upside potential).

Net profit for 2011 rose 26.1% to 208.3 billion yuan.

“This was in-line with our expectations. Overall asset quality was stable, with the NPL (non-performing loan) ratio edging up 3 basis points in 4Q11,” Bocom said.

Industries with higher NPL increases included transportation, storage and postal services, and steel.

“Loan mix continued to improve with an increased ratio of SME loans and individual loans.”

Among individual loans, non-mortgage loans saw a rapid growth.

Bocom is keeping its ‘Buy’ rating intact on Bank of China Ltd (HK: 3988) with a 3.90 hkd target price (26.6% upside potential).

“BOC had moderately positive fundamentals in 2012,” Bocom said.

The lender’s 2011 net profit rose 18.93% to 124.2 billion yuan.

Its loan-to-deposit ratio dropped to 68.77%, and on an adjusted basis, the ratio of structured deposits saw a large increase.

“The loan mix optimization and adjustment of its deposit strategy are expected to gradually produce effects in 2012, providing room for improvement as well as a moderate acceleration in intermediary business growth.

“We maintain ‘Buy’ on moderately positive fundamentals this year and an attractive valuation.”

Bocom is maintaining its ‘LT-Buy’ call on BOC Hong Kong Holdings (HK: 2388) with a 23.83 hkd target price (10.35 upside potential).

“NIM (net interest margin) expanded significantly in 2H and asset quality remained stable,” Bocom said.

BOCHK’s 2011 earnings came in 1.7% above Bocom’s forecast, mainly due to better-than-expected trading gains.

Excluding the effect of Lehman Brothers-related products, core 2011 profit was 18.15 billion hkd, up 11.5% y-o-y. The company’s market share in RMB deposits increased slightly in 2H11.

“NIM should remain stable in 2012, as the new loans granted in 2H11 were at higher rates and the expansion of RMB investment channels helps lift NIM. Asset quality was stable in 2011 and the company increased provisions,” the brokerage added.

See also:

China AMC's Top Manager Having Rough Year

Star China Fund Manager Upbeat On 2012

HONG KONG FUNDS: Eyes Should Be On China

CHINA’S LADY BUFFETT: Liu Ying Making Splash In Hong Kong