The following content was recently published on Drizzt's blog, www.investmentmoats.com, and is reproduced with permission.

WANT TO OWN a Toto business? Your chance may be here! But is it worth it?

Malaysia’s Berjaya Sports Toto would like to spin off subsidiary Sports Toto Malaysia SDN BHD into a business trust to be constituted and registered in Singapore to be known as Sports TOTO Malaysia Trust (STM-TRUST).

STM is principally engaged in the business of operating Toto pool betting under Section 5 of the Pool Betting Act, 1967.

STM is licensed to operate its Number Forecast Operation (“NFO”) nationwide.

It currently offers seven games which are drawn three days a week, namely Toto 4D, Toto 4D Jackpot, Toto 5D, Toto 6D, Mega Toto 6/52, Power Toto 6/55 and Supreme Toto 6/58.

STM also offers the most number of games in Malaysia and has the largest domestic network of 680 outlets in Malaysia.

This sounds great.

Reasons for IPO

This IPO serves as a way for initial investors into this venture to exit the investment by way of special dividends.

I believe that this move will effectively dilute the new shareholders, since money is removed from the trust to pay a special group of investors.

It should be seen that the majority shareholders would want to maintain control of the company that they list it as a business trust to continue to earn management fees

Valuation: PE of 17 times and EV/EBITDA of 12 times

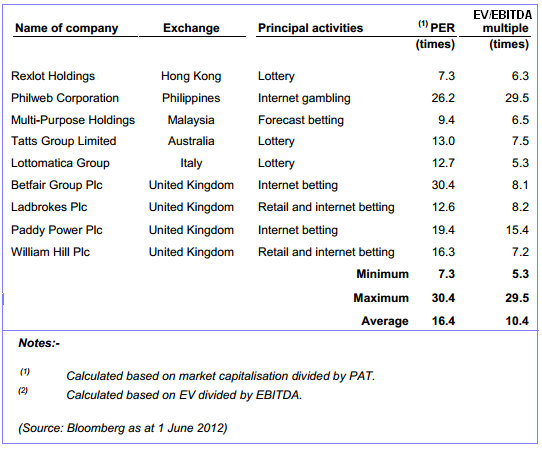

STM-Trust did a competitive analysis on listed gambling businesses and came to the conclusion to list it at a PE of 17 times and EV/EBITDA of 12 times.

Compare them against the other REITs and Business Trust listed on my Dividend Stock Tracker.

Then against the other listed gambling establishments in the world.

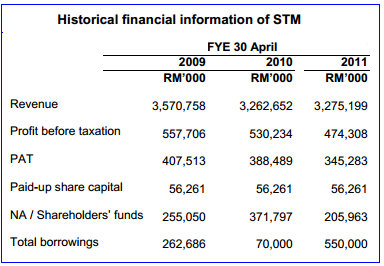

The revenue and profit are very consistent although they have shown signs of tapering down. However, we do not know what are the non-cash items within the profit.

It would be best to see the EBITDA before making any judgment.

Debt Levels

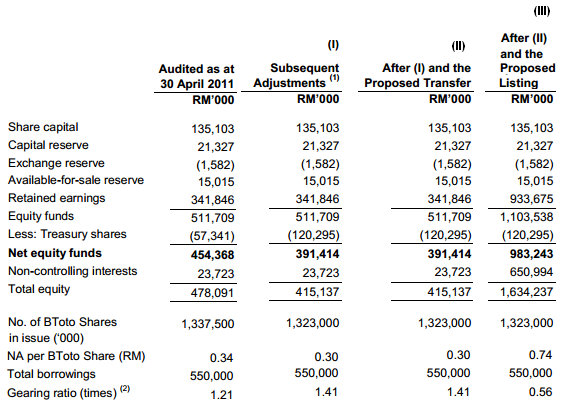

Unlisted, the current debt to asset is 56%. After listing, the debt to asset will fall to 25%. That looks conservative. Certainly not as bad as MIIF.

The debt looks large but compared against the most recent profit after tax of 345 mil it looks very safe. Like Singtel, Starhub safe.

Earnings and Potential Dividend Yield

A PE of 17 times translate to a 5.88% earnings yield. STM-Trust intends to pay out 100% surplus operating cash flow as dividends annually. As I said, we do not have the operating cash flow figures, so we are not sure how conservative this is.

As this should be listed at 1 time Price-to-Book, the 5.88% yield looks average compare to the REITs. Remember, most of the REITs listed on SGX are either geared 30% to 40% on average and trading below book value.

The closest comparable are CapitaRetailChina, CapitaMall Trust, Frasers Centerpoint, Cache Log Trust, Ascendas REIT, Sabana REIT.

All these are trading almost at 1.0 times book value and having a 25% to 30% gearing.

Except for Cache and Sabana, this trust may not yield as much as them, unless their free cash flow is much higher than that.

EV/EBITDA is very low compared to this selected group which may indicate undervaluation (or that these REITs as a whole are overvalued)

Typically, I would buy an investment with a EV/EBITDA close to 10 times and PE of 12 times. This looks a tad expensive, but not as expensive then this selected group of REITs.

Business Risk: Tangible assets versus the lack of it

Now the difference between this business trust and the REITs is that REITs have tangible assets.

What does STM Trust have? Not really much in tangible assets. I believe the major asset to amortize is the limited right to operate a lottery in the country.

• How long is this right? Is it limited?

• How much will STM Trust need to pay to renew it?

• About the dividend payout, do they pay out after amortizing the rights over the duration? Amortizing it is a more sustainable model (Think of this as industrial REITs have 30 or 60 year land lease that you need to renew)

A Good Buy?

Honestly I do not have enough information to make a decision.

My original thoughts were:

• If this lottery is a damn good business, why the heck would they want to spin it off?

• Is it due to the falling profitability?

• If it is so cash generative, why take on those debts?

• IPOs are never cheap

• My last business trust IPO (HPH Trust) really stung me

As I invest in more of these assets, I begin to look at the clues off the balance sheet:

• 17 times PE puts future earnings close to that of Ascendas REIT, Capitamall Trust and Frasers Centerpoint trust. These trusts have a certain premium to their price, either due to strong sponsors, good track record and lower propensity to collapse. What does STM Trust have that matches close to it?

• The section on business risk is a main consideration. It tells us the sustainability of the business trust itself. Valuing a perpetual or potentially perpetual asset versus one that has a limited lifespan is different.

• It would be good to see the performance of this in 2007-2008 period. Hell if they have data from 2001 to 2003 it would be great as well.