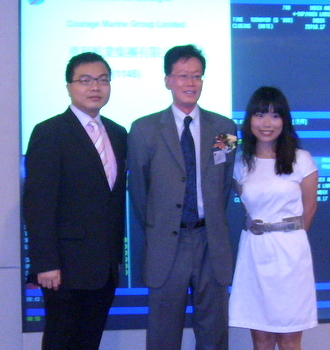

COURAGE MARINE dual-listed on the Hong Kong Stock Exchange this morning much to the delight of the company's Chairman, Mr Hsu Chih Chien.

“We thank the Hong Kong Stock Exchange as well as Singapore Stock Exchange and all the working parties for their hard work. The HK platform allows us to have exposure to more sophisticated investors across the globe,” he said.

More than 50 guests attended the listing ceremony, including industry peers, lawyers, accountants, consultants and investors.

Courage Marine (Stock Code 1145 HK) listed on the same day as the much anticipated PRADA spa (Stock Code 1913 HK).

Hence, there was much media attention on both companies with well over 100 journalists and photographers on site to interview the management.

Courage Marine shares opened slightly higher and traded range-bound throughout the day.

At the time of writing, more than half a million shares have been traded. The traded price of HKD 1.04 represented a slight premium over the 16 SGD cents traded in Singapore.

A spokeperson from Courage Marine confirmed that more than 60% of the Company shares were transferred over to the Hong Kong Stock Exchange prior to the dual listing.

Courage Marine, founded in June 2001, is one of Asia's younger dry bulk shipping companies.

It owns and operates 9 bulk carriers, deployed around Greater China, Japan, Russia, Vietnam, Indonesia, Bangladesh, and elsewhere in Asia. The vessels, totaling 576,991 deadweight tonnes, transport dry bulk commodities such as coal, sea sand, gravel, cement, clinker, iron ore, minerals, and wood chips.

On board to steer the group are five industry veterans with extensive hands-on experience in dry bulk shipping in Asia, particularly in Greater China.

The company brings over 150 years of combined experience, each excelling in the expertise to complement the others.

Profitable since inception, its substantial presence in the region can capitalize on China and Asia-Pacific’s continued economic growth. The company is well positioned to take advantage of growing demand for dry bulk marine transportation services, especially coal.

Recent story:COURAGE MARINE: A 51% jump in dividend as profit rises

No such luck for Courage Marine. Only 600k HKD worth traded. Haitong is a letdown.