CHOW SANG SANG Holdings International Ltd (HK: 116) saw its first half net profit rise 23% year-on-year to nearly 300 mln hkd on a 44% rise in retail jewelry sales.

The company’s management met with investors in Hong Kong Wednesday as part the Company of the Month series organized by Aries Consulting.

In a conference room overlooking scenic Victoria Harbor, Chow Sang Sang Director & Deputy General Manager Mr. Winston Chow said that although Hong Kong was both the location of its corporate headquarters and the exchange on which its shares were traded, it was neighboring mainland China that would be the key growth driver going forward.

“Our strategy in China is to increase the efficiency of each shop and help build brand awareness in every city in which we operate. Expansion in the PRC is not only a goal for revenue growth’s sake, but it is also an excellent way to improve inventory management as it’s much harder to control with just one shop in a metro area, particularly when dealing with bigger ticket items,” Mr. Chow said.

He said that if customers had their heart set on a particular piece of jewelry, and the nearest Chow Sang Sang outlet was out of stock, in many cities with more than one outlet the item in question was just a phone call and a short cross-town delivery away.

Rapid Growth In PRC

The company said its expansion plan into Mainland China in the first half “continued on track.”

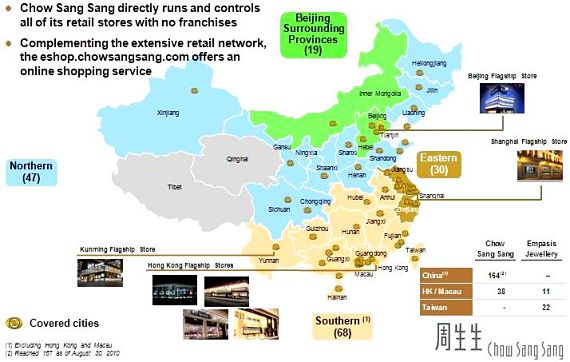

“Chow Sang Sang Jewelry Co Ltd operates 39 Chow Sang Sang shops and eight Emphasis shops in Hong Kong. In Taiwan and Macau it operates 22 and three Emphasis shops, respectively. There are 174 Chow Sang Sang shops across the PRC with many more to come. In fact, it is now in over 60 Mainland Chinese cities and has a presence in every province except Qinghai and Tibet. China is our major growth area,” Mr. Chow said.

He said the company planned 50 new outlets per year in the PRC over the next three years.

And one unique aspect to Chow Sang Sang’s business model is its outlet ownership structure.

“Unlike many of our competitors, none of our outlets are franchised out. All are operated by us. This allows us to fully control our brand image and quality. For this reason we have always resisted the franchise model,” he said.

And Chow Sang Sang was very interested in brand development, given its historical evolution into a major player in the jewelry retail sector.

“In 1983, 80% of our sales were in gold, but twenty years later that number had shrunk to around 20%, with the rest primarily retail jewelry sales. So we have transformed from a goldsmith to a jeweler. We want to continue to position ourselves more as a jewelry retailer than a gold retailer.”

He said that was a key strategic transformation as Chow Sang Sang’s average gold sector margins were around 8-12% while its jewelry retail business enjoyed much higher margins of 35-40%.

Chow Sang Sang has been one of the most recognizable names in the business in its home market of Hong Kong for many years, but Mr. Chow said its early success in the gold sector has meant it had to work a bit harder to promote itself as more than a goldsmith.

“We have been somewhat of a victim of our own success, and are always promoting ourselves in Hong Kong as a leading jewelry retailer as well. Hong Kong is a relatively small market and people here often think of us first and foremost as a gold retailer.”

However, the company’s rapid expansion into Mainland China was presenting a clean slate of opportunities for Chow Sang Sang to rebrand itself.

“China allows us to position ourselves primarily as a jewelry retailer. This allows us more product diversification, higher margin operations and avoids an overexposure to the limited margins in the ultracompetitive gold retail market,” Mr. Chow said.

The numbers say it all, as first half jewelry retail sales were the shining gem of the group’s performers.

Jewelry retail operations generated a turnover of 3.71 bln hkd, increasing 44% a year earlier.

That revenue amount constituted 71% of the group’s total, helping operating profit increase 47% to 377 mln hkd.

Oftentimes Chow Sang Sang didn’t have to go to the coveted Mainland Chinese customers to earn their business, but the PRC shoppers instead came directly to them.

“First half contribution from Hong Kong and Macau accounted for 64% of the total turnover of jewelry retail, with visiting mainlanders contributing 42% of this,” the company said.

In the first half of the year, Mainland China went from being the third biggest economy in the world to No.2 now, surpassing Japan in the process.

And Chow Sang Sang is definitely seeing a commensurate rise in the spending power of the mighty PRC consumer.

“Contribution to the turnover of jewelry retail from the Mainland Chinese shops in the first half of this year amounted to 35% of the total. Sales of items priced 50,000 yuan and above rose by over 50% compared with last year,” the company added.

And with no slowdown in sight for the Chinese economic juggernaut, Chow Sang Sang is well positioned to strike gold... but would prefer to focus more on jewelry retailing in the world’s most populous country.

“With our retail outlets in China growing along with the sustained economic growth there, we feel this is now our Group’s main growth strategy and we are confident that it is the most suitable way forward for us,” Mr. Chow said.

See Aries Consulting's previous Company of the Month story:

COURAGE MARINE: Diverse Fleet Helping Boost Bulk Biz