Excerpts from latest analyst reports....

NRA Capital initiates coverage of SUNMART (20.5 c) with 29-c target price

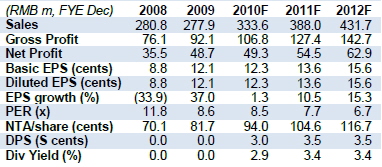

This could be the catalyst for the share price given the fact that Korean listing allows shares to be freely interchangeable. The counter currently trades at 8.5x 2010F and 7.7x 2011F EPS before the dilution from dual listing (11.3x 2010F and 10.3x 2011F EPS after dual listing).

As the company’s operations are domiciled in China, relative valuation benchmarking against local peers would be appropriate and reasonable as they share the similar risk factors. By applying a 30% discount (to account for its smaller size) to the sector average for packaging industry of FY11 PER of 15.6x, we derive a target price of $S0.29.

Analyst: Mark Chow

At the last traded price of S$0.21, Sunmart is trading at a FY10F PE of 8.2x and FY11F PE of 7.4x. Based on the industry prospects and company fundamentals, we initiate with a BUY recommendation with a target price of S$0.33.

The Korean listing should act as a significant catalyst and is likely to give further upward pressure to the current price as valuations in Korea tend to be richer and has the added advantage of being fungible.

Recent story: SUNMART: Dual-listing in Korea is just around the corner

OCBC Investment Research picks VALUETRONICS and VENTURE as buys in semiconductor space

Analyst: Kevin Tan

Maintain NEUTRAL on broader technology sector. With all the challenges faced by technology companies and moderate outlook going into 2011, it is no surprise that that the sector has been underperforming in the recent months, as illustrated by a mere 1.2% returns YTD in the FTSE ST Tech Index vs. 10.4% YTD in ST Index.

And with outlook of the overall technology sector still likely to remain mixed in 2011, we are thus maintaining our NEUTRAL weighting. Nevertheless, we believe there is still a lot of growth potential in specific segments, as the global economy and consumer/business confidence continue to improve.

For this reason, we maintain our BUY ratings on Avi-Tech, Karin Technology and Micro-Mechanics as they are likely beneficiaries of the market upswing. We choose Valuetronics [BUY, S$0.44 FV] and Venture Corporation [BUY, S$12.10 FV] as our preferred picks as both companies present good growth opportunities, boast healthy financial position and excellent management, and provide attractive dividend yields.

Recent story: VALUETRONICS has a new growth engine