SERIAL SYSTEM’S chairman and CEO, Derek Goh, has been busy transferring cash from his pocket into the company coffers.

In the past two weeks, he exercised 6.844 million warrants of Serial, coughing up 9 cents per share for a total of about $616,000.

The warrants are in the money as the stock price recently traded at 12.5 cents.

As though the warrant conversion wasn’t enough, Derek bought 300,000 shares from the open market last week for 12.5 cents apiece.

That brought his shareholding in Serial to 267 million shares, or a 35% stake in the company.

In a meeting with analysts and investors after the release of the 1H results, Derek expressed confidence in the prospects for the company even after 1H net profit surged 448% year on year to $6.5 million.

Annualising 1H sales, one arrives at S$742 million, which would be a record for the company.

The party appears to be far from ending: Derek said the internal target for next year is S$1 billion in sales, with meaningful contribution as a result of Serial’s product lines expanding from local to regional bases.

Examples of such product lines are those from Tyco Electronics, Avago and On Semiconductor.

In addition, new product lines from the likes of Osram, AMS and Walsin Group, will add to revenue in 2010 and beyond.

Recent stories:

CHINA NEW TOWN, MAN WAH, SERIAL SYSTEM: What analysts now say.....

SERIAL SYSTEM: 448% surge in 1H profit to $6.5 m

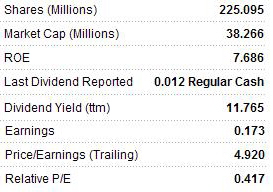

SINOPIPE HOLDINGS is a S-chip that has no analyst coverage, so it is relatively unheard of and being a small-cap of only S$38 million, it is far beyond the investment interest of most funds.

It is engaged in the design, manufacture, distribution and installation of a variety of plastic pipes and pipe fittings.

It recently reported flattish profit growth for 2Q but for 1H, net profit jumped 70.5% to RMB 24.6 million.

A new substantial shareholder with a stake of 5.5% emerged last week – Triumpus Capital – but little is known about its background.

In fact, we would have not paid more attention if not for a particular name that was linked to it: Dr Pu Weidong.

Dr Pu was an investment analyst with UOB Kay Hian in Singapore, subsequent to which in 2006, he joined Sinomem as Vice President for Corporate Planning, Strategic Investment and Investor Relation.

A year later, he became its Chief Financial Officer while concurrently holding a directorship in Triumpus Assets Management Pte. Ltd and Triumpus Capital Ltd.

Dr Pu, 40, resigned from Sinomem at the end of 2009.

Given his expertise in investments, his choice of Sinopipe as a major investment could lead to investors taking a closer look at the company, which many would previously have considered to be in a non-sexy business.

Its gross margin was none too exciting at 19.1% in HY2010.

Valuation-wise, though, it appears more sexy, recently trading at 17 cents, or a hefty 63% discount to its net asset value as at end-June of 234.45 RMB cents (S$0.47).

On a PE basis, it is not expensive. Annualising its 1H earnings per share you will get 4.4 Singapore cents, which translates into a PE of 3.8X based on the recent stock price of 17 cents.

Best of all, its trailing dividend yield stands at an eye-opening 11.7%.

It is not just Dr Pu who has been taking a liking for Sinopipe shares. The company’s insiders have been consistently buying stock too in the past one year. Check www.sgx.com

Past stories on Sinopipe's excellent dividend payout and our China correspondent's interview with the CEO:

JUST ASK: 'What companies are giving good dividends?'

SINOPIPE eyeing piping-hot growth on infrastructure campaign