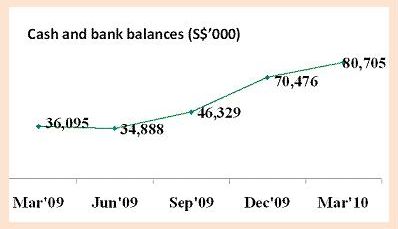

From left: Kim Eng analyst Pauline Lee, Super's business development manager Darren Teo and financial controller Koh Chun Yuan. Photo by Sim KihRECORD NET CASH balances of S$77 million as at March, plus upcoming divestment proceeds could inspire Super to pay a special dividend at year end, reckons Kim Eng analyst Pauline Lee.

From left: Kim Eng analyst Pauline Lee, Super's business development manager Darren Teo and financial controller Koh Chun Yuan. Photo by Sim KihRECORD NET CASH balances of S$77 million as at March, plus upcoming divestment proceeds could inspire Super to pay a special dividend at year end, reckons Kim Eng analyst Pauline Lee.

She and her counterpart at DMG & Partners Securities maintained their ‘Buy’ calls on Super on Monday after the leading Southeast Asian 3-in-1 instant coffeemix player more than doubled (up 152% year on year) its net profit to S$15 million for 1Q2010.

The analyst consensus target price was S$1.22, some 35% above the stock's last close price of 90.5 cents.

”We see great potential in our core instant coffee business and are divesting our vinegar factory and China property,” said its financial controller Koh Chun Yuan at an analyst briefing on Wed.

Super completed divesting its entire 49% stake in Jiangsu Hengshun Seasonings and Foods for S$34.3 million in Apr, and expects to divest its entire 37.5% stake in Care Property Holdings for S$20.3 million by Jun.

1Q2010 revenues were up 27% at S$81.6 million.

Consumer goods sales were up 22% at S$73.7 million, thanks to higher sales into the Southeast Asia markets.

|

Including both non-dairy creamer as well as soluble coffee powder, Super’s 1Q2010 ingredient sales had soared 111% year-on-year to S$8 million, fuelled by robust demand in China, Taiwan and Singapore.

Super has been known for its instant F&B brands, but demand for its third party ingredients is so good, it is increasing its non-dairy creamer capacity by 50% to cater to external clients.

It is adding one production line to increase production capacity for non-dairy creamer to 75,000 tons a year by 3Q2010.

”We have been supplying mainly to food manufacturers but we’re now expanding into the market for hotels, restaurants and cafes,” said its business development manager Darren Teo.

Formerly known as Super Coffeemix Manufacturing, the leading Southeast Asian 3-in-1 instant coffee player’s name was changed to “Super Group Ltd.” with effect from 9 May 2010.

Below is a summary of questions raised at the briefing and the management’s answers:

Q: Margins expanded due to depressed raw material prices in 2009. (Gross profit margin increased by 8.3 percentage points year-on-year to 39.5%). Are these margins sustainable?

An increase in raw material prices affects manufacturers globally, not just us. For markets where we are no.1, we take the lead in raising retail prices. We have been passing price increases to consumers.

Q: Is there seasonality in your sales?

China, Myanmar and Thailand are colder during the second half of the year. That’s when demand for hot beverages increase.

Q: What’s your foreign currency exposure?

It is not significant as we have a natural hedge. As our raw materials are commodities, they are denominated in the USD. We also sell to many countries using USD.

Q: What assets on your balance sheets show your non-core businesses?

The investments in subsidiaries, associated companies and joint venture companies.

Q: How will utilization look like for FY2010 with the new capacity?

Utilization for non-dairy creamer production lines was 71% in FY09. Besides producing for internal use, we were producing for large China food manufacturers and had to turn away orders last year due to insufficient capacity. The new production line is meant to cater to external orders.

Q: When you supply to large manufacturers in China, do they impose a non-competitive clause that precludes you from selling your instant coffeemix?

That is unlikely as Super is a brand that has been around for a long time. Furthermore, most customers are not competitors. For example, they may be buying non-dairy creamer for soups.

Q: Do you plan to integrate your numerous brands?

Having many brands allow us entry into different market segments of varying price points. For example, Coffee King’s ingredients are inferior to Super, and we sell it at a lower price. We used it obtain the market share of the smaller brands.

Related story: SUPER COFFEEMIX: Insights into branding leading instant coffee