Compiled by NextInsight

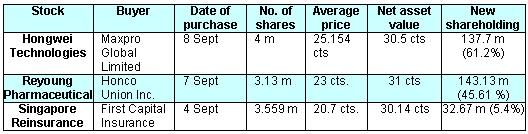

THE ABOVE three stocks came under significant accumulation by their substantial shareholders in the last couple of days.

Photo montage: Hongwei annual report

* Hongwei Technologies is a S-chip that is principally engaged in the manufacture and sale of synthetic cotton which can be used as a cost-competitive substitute of natural cotton, and polyester differential fibres.

It trades at a historical PE of 4.2X and a small market cap of $57 million. For the first half of this year, its revenue dropped 23% and its net profit fell 11% to RMB27.3 million.

Its largest shareholder, Maxpro Global, owns Hongwei shares in the nominee account of UOB Kay Hian. Maxpro is 100% owned by Zhuang Xinxin, a non-executive director and the wife of Lin Jimiao, the Executive Chairman and CEO of Hongwei.

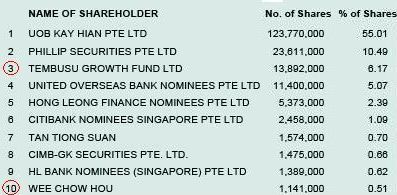

Two interesting Singapore shareholders are named in the top 20 shareholder list in the annual report of 2008:

Source: Hongwei Technologies annual report 2008

*** Tembusu Growth Fund, which is managed by Tembusu Partners whose chairman is Andy Lim, hubby of Lim Hwee Hua, Second Minister for Finance and Second Minister for Transport.

A member of the investment committee is Yeo Cheow Tong, the former Minister of Transport.

*** Wee Chow Hou is Professor and Head of the Strategy, Management and Organization Division at the Nanyang Business School.

*****

* Singapore Reinsurance suffered a loss last year (due to an underwriting loss, losses in investments and lower profits from the sale of investments) and so does not have a PE.

Its market cap is $173 million.

For the half year ended 30 June 2009, the Group's revenue was relatively flat at S$42.6 million. So was net profit at $4.7 million.

First Capital Insurance, its substantial shareholder which has recently made a stock purchase, has been writing non-life insurance for more than 55 years.

*****

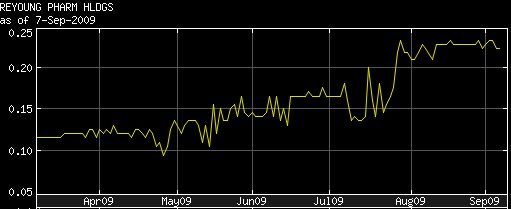

Reyoung stock's 52-week range: 4 cents - 27 cents

* Reyoung is also a S-chip, and it manufactures pharmaceutical products and personal hygiene products. It trades at a historical PE of 10X and a market cap of $78 million.

For the first half of this year, its revenue rose rose 7.9% but its net profit fell 12.4% to RMB23.1 million.

The 3.13-million share purchase was made by Honco Union, which is an investment vehicle of Reyoung's chairman (Zhao Yushan), an executive director and a former executive director.