- Posts: 194

- Thank you received: 15

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Straco -- gem?

7 years 7 months ago - 7 years 7 months ago #24395

by Big Fish

Replied by Big Fish on topic Straco -- gem?

Straco announced that its insurance claim for SG Flyer stoppage is facing resistance from insurer due to exclusion clauses (Haha...insurers!). From investor pt of view, not a big issue as it is a one-off event.

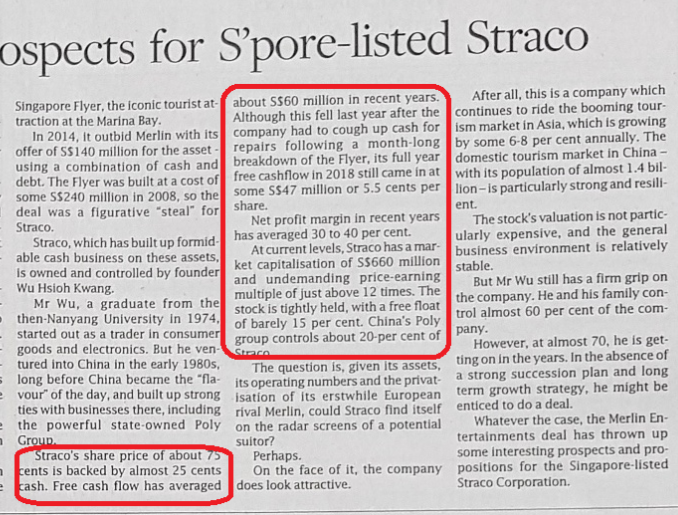

Straco had $193 million cash (net cash:$146 m) as at end 1Q2018. With SG Flyer up and running, by end-2Q, cash should go past $200 million. The market cap is $650 million, valuing the operating assets at only $500 m when they generate about $50 m profit annually.

Straco had $193 million cash (net cash:$146 m) as at end 1Q2018. With SG Flyer up and running, by end-2Q, cash should go past $200 million. The market cap is $650 million, valuing the operating assets at only $500 m when they generate about $50 m profit annually.

Last edit: 7 years 7 months ago by Big Fish.

Please Log in to join the conversation.

6 years 10 months ago #24706

by BNN

Replied by BNN on topic Straco -- gem?

Please Log in to join the conversation.

6 years 5 months ago - 6 years 5 months ago #25004

by BNN

Replied by BNN on topic Straco -- gem?

Singapore hotels see best month in years amid Hong Kong turmoil: Reuters

Read more at www.todayonline.com/world/singapore-hote...id-hong-kong-turmoil

Surely will have positive impact on Singapore Flyer too!

Read more at www.todayonline.com/world/singapore-hote...id-hong-kong-turmoil

Surely will have positive impact on Singapore Flyer too!

Last edit: 6 years 5 months ago by BNN.

Please Log in to join the conversation.

5 years 11 months ago #25286

by Big Fish

Replied by Big Fish on topic Straco -- gem?

Pursuant to the announcement on 25 January 2020, the Board of Straco Corporation

Limited (the “Company”) would like to announce that the temporary closure of the

Company’s attraction, Shanghai Ocean Aquarium, in response to the situation relating to measures to prevent and contain the spread of Coronavirus in the People’s Republic

of China, will end on 17 March 2020. The aquarium will resume normal operation from

18 March 2020.

In accordance with relevant regulations, and to ensure a safe and healthy experience

for all visitors, the aquarium will put in place measures such as temperature screening

procedures, social distancing, and provide face masks and hand sanitisers. In addition,

the aquarium will control the volume of visitors at the level within 50% of its daily

capacity as a precautionary measure.

Limited (the “Company”) would like to announce that the temporary closure of the

Company’s attraction, Shanghai Ocean Aquarium, in response to the situation relating to measures to prevent and contain the spread of Coronavirus in the People’s Republic

of China, will end on 17 March 2020. The aquarium will resume normal operation from

18 March 2020.

In accordance with relevant regulations, and to ensure a safe and healthy experience

for all visitors, the aquarium will put in place measures such as temperature screening

procedures, social distancing, and provide face masks and hand sanitisers. In addition,

the aquarium will control the volume of visitors at the level within 50% of its daily

capacity as a precautionary measure.

Please Log in to join the conversation.

5 years 8 months ago #25347

by Big Fish

Replied by Big Fish on topic Straco -- gem?

"the Group has implemented various cost cutting measures, which include trimming of wage cost, with head office senior management taking the biggest pay cut of 30% to 50% with effect from 1 April 2020."

That's a very sharp cut. In fact, 50% is the highest % cut I have heard of during this Covid period.

Who's taking the hit? My guess is the chairman, since we can't expect anyone else below to do so. So,the Chairman drew $1.5 m in total remuneration for FY2019, according to the AR. His annual fixed salary was ard $1m in 2019.

That's a very sharp cut. In fact, 50% is the highest % cut I have heard of during this Covid period.

Who's taking the hit? My guess is the chairman, since we can't expect anyone else below to do so. So,the Chairman drew $1.5 m in total remuneration for FY2019, according to the AR. His annual fixed salary was ard $1m in 2019.

Please Log in to join the conversation.

Time to create page: 0.279 seconds