- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Techcomp

- neontet

- New Member

-

Less

More

16 years 5 months ago #1718

by neontet

Replied by neontet on topic Re:Techcomp

came across Nov 2007 article on Techcomp.

www.nextinsight.net/content/view/141/60/

Interesting that target prices of 80 cts - $1.00 were bandied then. the 2008 storm has passed and Techcomp is on the way to record earnings. Looks like the current 31 cents share price has room for growth.

Please Log in to join the conversation.

- neontet

- New Member

-

Less

More

- Thank you received: 0

16 years 5 months ago #1753

by neontet

Replied by neontet on topic Re:Techcomp

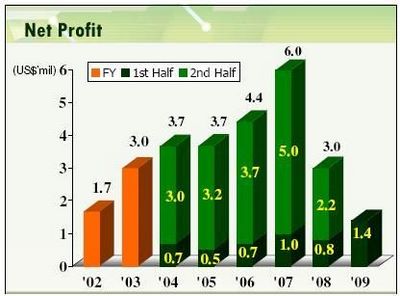

very telling track record. expect 09 to be a bumper harvest (unless something corks up.... )

www.nextinsight.net/content/view/1424/60/

Please Log in to join the conversation.

16 years 5 months ago - 16 years 5 months ago #1756

by erelation

Replied by erelation on topic Re:Techcomp

I guess it is a game of patience for such undervalued counters.... Similar to Sinwa.. i brought at $0.23 but sold off all my holding at $0.32.... suddenly it shoot up to S$0.45 now. Loaded several lot of Techcomp and prepare to hold until it reaches $0.50

Last edit: 16 years 5 months ago by erelation.

Please Log in to join the conversation.

16 years 4 months ago - 15 years 1 month ago #1789

by Mel

Replied by Mel on topic Re:Techcomp

From The Edge newsweekly June 15, 2009:

Richard Lo has an excellent way of gauging the severity of epidemics and health scares. The president and founder of Techcomp (Holdings), a manufacturer and distributor of analytical instruments, life science equipment and laboratory instruments, is usually busiest when disaster strikes.

Take, for instance, the 2007 Chinese export recalls, which saw Dora the Explorer dolls and boxes of Spearmint toothpaste being pulled from supermarket shelves worldwide because they contained harmful chemicals. Sales of Techcomp\'s products - some of which are used to test the presence of chemicals or other pollutants - soared. So, too, did its stock, which touched an all-time high of 68.5 cents that year. But that interest has been short-lived.

Last Thursday, Techcomp closed at 25.5 cents, down 1.9% for the year, and 36.3 % below its IPO price of 40 cents a share. In fact, outside of small surges when health and safety issues make the headlines, interest in Techcomp has been muted since the company was listed in 2004.

"It\'s disappointing," says Lo, who owns 47.9% of Techcomp. He says since the company\'s listing, it has almost doubled its revenue from US$41.9 million in FY2004 to US$81 million in FY2008. That works out to a compound annual growth rate of 17.9%, which Lo believes is commendable, given that the market for Techcomp's products has grown at an average of 12% a year. Lo, 50, is confident that things will change eventually.

"I believe that in the long run, the market will value us correctly based on our fundamentals, as long as we keep on delivering," he says. But he also understands that it won't be easy attracting investor interest.

"We are the only company [in this industry] within the Asia ex-Japan region that is listed. So, I think the market does not have sufficient understanding [of our business].\"

Richard Lo has an excellent way of gauging the severity of epidemics and health scares. The president and founder of Techcomp (Holdings), a manufacturer and distributor of analytical instruments, life science equipment and laboratory instruments, is usually busiest when disaster strikes.

Take, for instance, the 2007 Chinese export recalls, which saw Dora the Explorer dolls and boxes of Spearmint toothpaste being pulled from supermarket shelves worldwide because they contained harmful chemicals. Sales of Techcomp\'s products - some of which are used to test the presence of chemicals or other pollutants - soared. So, too, did its stock, which touched an all-time high of 68.5 cents that year. But that interest has been short-lived.

Last Thursday, Techcomp closed at 25.5 cents, down 1.9% for the year, and 36.3 % below its IPO price of 40 cents a share. In fact, outside of small surges when health and safety issues make the headlines, interest in Techcomp has been muted since the company was listed in 2004.

"It\'s disappointing," says Lo, who owns 47.9% of Techcomp. He says since the company\'s listing, it has almost doubled its revenue from US$41.9 million in FY2004 to US$81 million in FY2008. That works out to a compound annual growth rate of 17.9%, which Lo believes is commendable, given that the market for Techcomp's products has grown at an average of 12% a year. Lo, 50, is confident that things will change eventually.

"I believe that in the long run, the market will value us correctly based on our fundamentals, as long as we keep on delivering," he says. But he also understands that it won't be easy attracting investor interest.

"We are the only company [in this industry] within the Asia ex-Japan region that is listed. So, I think the market does not have sufficient understanding [of our business].\"

Last edit: 15 years 1 month ago by niadmin. Reason: Formatting text

Please Log in to join the conversation.

16 years 2 months ago #1866

by Morpheus

Replied by Morpheus on topic Re:Techcomp

In view of the storm that is coming next week, I will choose to park my excessive money into Techcomp. This is a defensive stock, who will benefit from the H1N1 crisis as more testing equipment is required to test the swine flu virus. I estimated profit to be around USD 7-8.5m. If it is USD 7m, we will be looking at a PE of around 5x based on 30.5 cents and a dividend yield of around 5.6% based on its previous dividend payout ratio. If it is USD 8.5m, then we are looking at probably one of the cheapest growth stocks on SGX. Management is better off delisting the Company and listing in NASDAQ or Hong Kong. The Company can reach 15x to 20x PE over there.

Please Log in to join the conversation.

Time to create page: 0.237 seconds