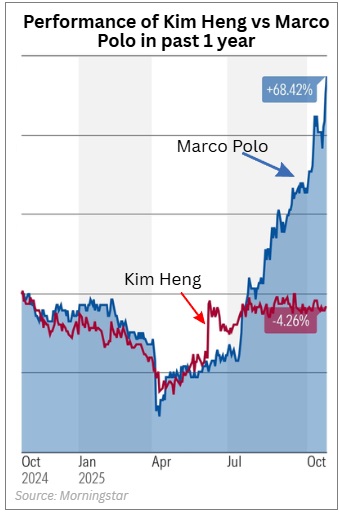

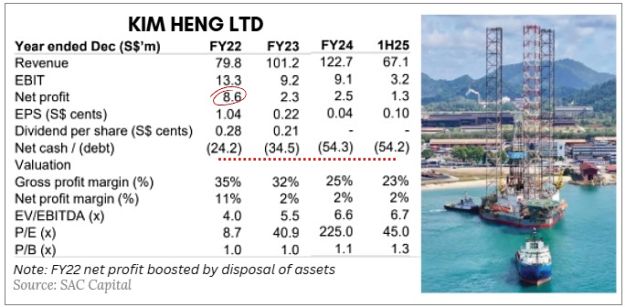

• A well-covered stock, Marco Polo Marine was upgraded by RHB and Maybank Kim Eng recently, with the new target prices being 10 cents and 11 cents, respectively. • At the same time, Kim Heng Ltd, a peer of Marco Polo, received some attention for the first time in a long while through a non-rated report by SAC Capital.  • Both Marco Polo and Kim Heng have repositioned their key business focus from Oil & Gas support services to offshore wind energy logistics to capture growth in Asia’s rapidly expanding clean energy sector. • Each is a one-stop service provider combining vessel operations, maintenance, and shipyard support, thus achieving vertical integration across the offshore value chain.  While Marco Polo's stock has soared 68% in the past year to 9.6 cents, Kim Heng has struggled. At 9 cents recently, it's down 4%. While Marco Polo's stock has soared 68% in the past year to 9.6 cents, Kim Heng has struggled. At 9 cents recently, it's down 4%.• The profitability trajectory of Kim Heng has just not matched Marco Polo's. But is Kim Heng poised for a turnaround? • In brief, offshore wind and subsea construction projects are expanding rapidly across Asia-Pacific. This is driving more demand for support services like vessel deployment, barge operations, foundation installation and subsea cable work. Kim Heng is well-positioned to capture this demand given its experience and assets in these areas. • In addition, a shortage of offshore support vessels is supporting higher utilisation rates and stronger day rates for Kim Heng's chartering fleet. • Read excerpts of SAC Capital's report ... |

Excerpts from SAC Capital report

Analyst: Daniel Ng

| Kim Heng Ltd is a Singapore based offshore and marine services that has progressively evolved from its oil and gas origins into the fast-growing offshore wind and subsea infrastructure markets. The Group operates across multiple segments, including marine support services, vessel chartering and towage, heavy equipment rental, and shipbuilding and repair, supporting projects ranging from rig maintenance to wind farm construction.  |

| Investment Thesis |

Kim Heng represents an inflection point story within Singapore’s small-cap offshore and marine universe.

The company has transitioned from a traditional oil and gas support player into a diversified marine contractor with exposure to offshore wind, subsea cable, and vessel fabrication work. Three structural drivers shape the investment case for Kim Heng:

| Stock price | 9 cents |

| 52-week range | 6.4-9.8 cents |

| Market cap | S$63.4 m |

| PE (ttm) | 37 |

| P/B | 1.3 |

| Dividend yield | - |

| Source: Yahoo! | |

1. Expanding Renewables Platform

Kim Heng is increasingly participating in offshore wind projects across Taiwan, South Korea, and Southeast Asia, supported by contracts in HDD cable landings, subsea works, and foundation fabrication.

New ventures such as Soiltech Adira Korea provide visibility into multi-year geotechnical and installation scopes, offering a pathway to recurring revenues beyond vessel charter work.

2. Recovery in Conventional Offshore Services

Legacy segments such as chartering, ship repair, and marine fabrication are benefiting from the rebound in regional offshore

activity.

Rising utilisation and collaborative partnerships, such as with Dyna-Mac, enhance the Group’s ability to capture higher specification opportunities including FPSO modules and fabrication packages as oil and gas capex cycles normalise.

3. Asset-Backed Re-Rating Potential

With two Singapore waterfront yards and an owned fleet of vessels, Kim Heng trades at approximately 1.3× P/B, a level that broadly reflects its asset heavy model, while still offering optionality for capital recycling or monetisation.

1. Offshore Wind Contract Execution and Regional Expansion Kim Heng is actively executing offshore wind projects in Taiwan through HDD cable landings, marine logistics and foundation fabrication.  Thomas Tan, executive chairman & CEO of Kim Heng. File photoThe Group is now extending this capability into South Korea under the Soiltech Adira platform, where initial mobilisation and geotechnical engagement have commenced. Thomas Tan, executive chairman & CEO of Kim Heng. File photoThe Group is now extending this capability into South Korea under the Soiltech Adira platform, where initial mobilisation and geotechnical engagement have commenced. As regional offshore wind tendering accelerates, these frameworks offer potential for backlog expansion and multi-year revenue visibility. 2. Fleet Redeployment Following Dry-Docking Chartering income declined in 1H2025 due to the temporary dry-docking of vessels for special class surveys, rather than a reduction in market demand. With vessels scheduled to return to operation, utilisation recovery and redeployment to offshore infrastructure and wind-related projects could support margin improvement in subsequent periods. 3. Capital Recycling Through Vessel Sales The Group continues to deploy a capital recycling strategy by acquiring, refurbishing and divesting vessels, supplementing operating income through opportunistic asset sales. Trading of vessels increased 128% year-on-year to S$37.9 million in FY2024 (30.9% of revenue), followed by a further 32% increase to S$20.7 million in 1H2025 (40.9% of revenue). Continued disposals at favourable prices may unlock disposal gains and strengthen liquidity through capital recycling. 4. Gradual Re-Rating via Renewables Integration Although renewables are not disclosed as a separate segment, offshore wind work is now embedded across marine support, fabrication and subsea services. As Adira-branded entities secure larger scopes in Taiwan and South Korea, market perception may evolve from viewing Kim Heng as a purely cyclical marine contractor to a hybrid offshore energy services provider, offering scope for valuation re-rating. |

See the full SAC Capital here.

See the full SAC Capital here.

See how 2 other peers have re-rated: PACIFIC RADIANCE & NAM CHEONG: Positive Momentum Attracts Analyst Bullishness