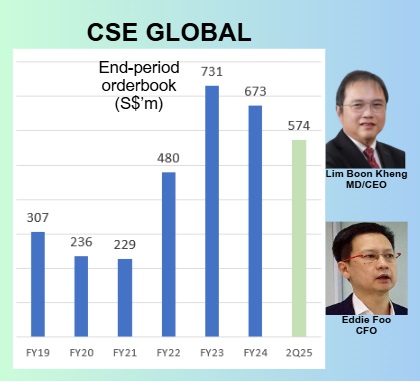

• Artificial Intelligence is said to be one of the defining inventions of our era. One way to gain exposure to this is by investing in companies that power the backbone of AI -- data centres (DC). The US is the world's largest and most advanced data center market.  Electrification solutions by CSE Global• Three years ago, Singapore-listed CSE Global began modestly to serve the data centre sector, reaping S$5 million in revenue. Since then, it has scaled its presence impressively. Electrification solutions by CSE Global• Three years ago, Singapore-listed CSE Global began modestly to serve the data centre sector, reaping S$5 million in revenue. Since then, it has scaled its presence impressively.• CSE, in which Temasek Holdings holds the No.1 stake (~23%), is a systems integrator specializing in electrification, communications, and automation, and is increasingly positioning itself as a key player in the data centre sector. CSE's order book may have declined (see chart) but CGS foresees a rebound through data centre-driven wins.  Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m). Electrification segment accounted for S$292 m of the 1HFY25 orderbook. The other segments: Automation (S$175 m), Communication (S$107 m).• Outpacing the other two business segments of CSE, the"electrification" segment has contributed nicely to the orderbook. See the chart and caption above. • Risks: CSE faces challenges like foreign currency ups and downs, and the ever-present risk of project cost-overruns. Read excerpts of CGS's report below .... |

Excerpts from CGS report

Analysts: Lim Siew Khee & Tan Jie Hui

■ We expect CSE to expand its electrification orders to more hyperscaler customers and/or larger in contract size with its planned capacity expansion. |

|||||

| CSE’s opportunity in the US hyperscale e-house/substation market |

The US is the world's largest and most mature data centre (DC) market, serving as home to the leading hyperscale providers such as Amazon (AWS), Microsoft, Google and Meta.

The demand for modular electrical houses (e-houses) and substations continues to accelerate, driven by the rapid expansion of hyperscale infrastructure.

CSE provides ehouses and substations to several undisclosed US hyperscalers, supporting mission-critical power infrastructure within these facilities.

"YTD, we estimate CSE has secured c.S$80m-90m in DC contracts, with electrification order wins contributing S$59m. We expect DC electrification order wins to grow to c.S$65m-75m by end-FY25F." -- CGS |

According to Grand View Research, an India & U.S. based market research and consulting company, the US e-house market is estimated at US$304m in 2024 and projected to grow at a CAGR of 4% to US$449m by 2033.

Meanwhile, the US DC substation market is valued at US$3bn in 2024, with an expected 9% CAGR from 2025 to 2030.

Assuming that 80% of CSE’s DC electrification products and services target the e-house segment and 20% address substations, we estimate that CSE’s total addressable market (TAM) for DC electrification in the US was c.US$930m in 2024.

| Plans to release land bottleneck for more electrification order wins |

In recent months, several US hyperscalers have announced major DC and AI infrastructure expansion plans.  MD Lim Boon KhengTo support the rising power infrastructure demand from CSE’s existing hyperscaler clients, we believe CSE will need to expand its real estate footprint, as it is currently facing land constraints for building additional e-houses and substations.

MD Lim Boon KhengTo support the rising power infrastructure demand from CSE’s existing hyperscaler clients, we believe CSE will need to expand its real estate footprint, as it is currently facing land constraints for building additional e-houses and substations.

CSE currently has c.450k sq ft of fully utilised land.

We believe CSE will scale its capacity by c.200k by end-FY25F, driven by a projected c.25% increase in contracted volume under the S$59m contract extension from an existing hyperscaler customer, along with the potential signing of new contracts.

Looking ahead, we anticipate CSE may add 200k-300k sq ft of land in early-2026F to accommodate continued growth in customers’ requirements.

Reiterate Add as we believe CSE is well-positioned to capitalise on the ongoing boom in US hyperscale power infrastructure, alongside a stronger order win momentum in 2H25F. |

See full report here. See full report here.

Also, see: CGS Refreshes Alpha Picks Portfolio as Singapore Stock Market Hits Highs |