|

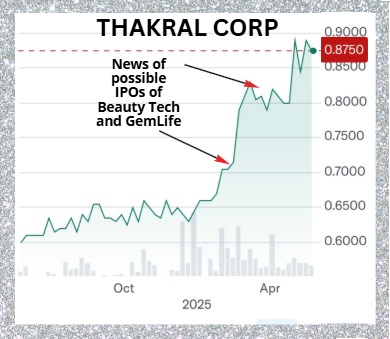

In the last 3 months or so, Thakral Corporation's stock has gained traction, putting on 32% year-to-date.

This was especially evident after word got out that one of its investments is possibly seeking a London IPO (see: THAKRAL: Buzz around potential IPO of investee sends this stock up 10.5%). |

At an online briefing this week. (clockwise from top left): Torsten Stocker, Chief Operating Officer, Lifestyle Division | Anil Daryanani, CFO, | Darren Chan, Analyst, Phillip Securities | Inderbethal Singh, CEO

At an online briefing this week. (clockwise from top left): Torsten Stocker, Chief Operating Officer, Lifestyle Division | Anil Daryanani, CFO, | Darren Chan, Analyst, Phillip Securities | Inderbethal Singh, CEO

Strategic Partnerships: L'Oréal, DJI and Nespresso

Thakral divides its business reporting into "investment" and "lifestyle" segments.

The lifestyle business sees it partnering with global brands L'Oréal, DJI and Nespresso.

Thakral serves as the exclusive distributor for several of L'Oréal's high-end fragrance brands in Greater China.

This distribution encompasses offline retail channels, such as managing mono-brand boutiques in shopping malls and department stores, placing products in multi-brand retailers like Sephora, and overseeing distinct e-commerce channels for these specific brands.

Question: Given China's economic slowdown, how is the market for Thakral's premium fragrances in China?

Turns out, they have been outgrowing the overall cosmetic market.

Torsten Stocker, Chief Operating Officer, Thakral Lifestyle Division, noted, "To some extent, our category is outgrowing or continues to outgrow the market. And we're obviously benefiting from this".

In South Asia, Thakral operates as the exclusive distributor for DJI across seven markets, including India, Pakistan, Bangladesh, and Sri Lanka.

DJI is the global leader in the drone space, holding over 70% market share.

Beyond drones, Thakral distributes DJI's leading photographic equipment and accessory brands, such as the Osmo Action Pro camera.

Faced with import restrictions on drones from China into India, Thakral supplies components to local Indian manufacturers via Bharat Sky and has invested in the broader drone ecosystem through Skylark Drones, a software specialist.

Question: How is the distributorship renewed and what's the risk of it being lost?

CEO Bethal Singh said Thakral's relationship with DJI is long-standing, and renewal is performance-based annually, with Thakral consistently outperforming goals.

He added that DJI had over 10 distributors before Thakral became exclusive. Photo: Nestle Nespresso SA

Photo: Nestle Nespresso SA

In 2024, Thakral was appointed the official distributor for Nespresso in India, a testament to Thakral’s expertise in brand-building and retail operations..

Thakral aims to supply the brand to hotels and corporate clients. The Indian market, with its rapidly growing middle class, presents a substantial opportunity.

Nurturing Growth Segments: GemLife and Beauty Tech

Alongside established brand partnerships, Thakral has invested in high-growth business segments.

GemLife, in which Thakral holds a 31.7% stake, is Thakral's "star performer," said CEO Bethal.

GemLife develops lifestyle resorts in Australia specifically for people over 50.

GemLife boasts a substantial pipeline of approximately 6,500 homes across potentially over 20 resorts planned over the next decade.

The business has two main revenue streams: profits from the sale of houses and recurring weekly "site fees" paid by residents.

The recurring site fee revenue was around AUD 19.4 million this year and is projected to reach AUD 67 million (or AUD 80 million+ including annual increments) when all 6,500 homes are established

GemLife is poised for an IPO which, as in the case of Beauty Tech Group, would have an impact on Thakral's re-rating upside.

|

1Q2025 Metric |

1Q 2025 (S$’000) |

1Q 2024 (S$’000) |

YoY Change |

|

Revenue |

75,962 |

59,998 |

26.6% |

|

Gross profit |

12,908 |

11,119 |

16.1% |

|

Gross margin |

17.0% |

18.5% |

(1.5 ppts) |

|

Operating profit |

3,298 |

3,357 |

(1.8%) |

|

Operating margin |

4.3% |

5.6% |

(1.3 ppts) |

|

Share of profit of associates |

3,247 |

1,797 |

80.7% |

|

Profit before interest and tax |

6,341 |

4,970 |

27.6% |

|

Profit attributable to equity holders |

3,365 |

3,538 |

(4.9%) |

|

So, Thakral is a stock to watch given the possible two IPOs mentioned above.

|

The 1QFY25 presentation deck is here.

See also: THAKRAL: How its Aussie property biz works, why it is biggest contributor