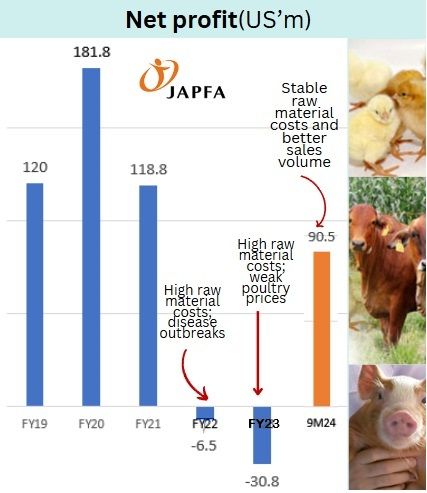

• 2 months ago, in Aug, when Japfa made an equal access offer at 35.5 cents/share, CGS International recommended that shareholders decline the offer as it was below its 43-cent target price. Shareholders would also have been dissuaded if they had heeded DBS saying, in July 2024, that Japfa is "on cusp of a turnaround". • As it turned out, Japfa managed to purchase 76.3% of the maximum number of shares under the equal access offer. And it now has unveiled a sterling set of 3Q results which signals a business turnaround indeed after dismal 2022 and 2023 (see chart).  Headquartered in Singapore, Japfa is one of the largest poultry producers in Indonesia and in the region. (Japfa also has a smaller swine business, mainly in Vietnam). • Japfa controls the entire work flow: from producing the feed for its chickens, to breeding and raising them, and finally processing and selling chicken meat and eggs. • Read CGS's take on the 3Q2024 results below. Naturally, the analyst has a higher target price now (53 cents), and the stock trades at 4.9X its forecast earnings. Surely there would be ex-shareholders who wished they had ignored the equal access offer .... |

Excerpts from CGS-CIMB report

Analyst: TAY Wee Kuang

Japfa Ltd: Heading into a consumption upcycle

■ 9M24 core net profit of US$90.5m beat expectations, coming in at 93.0%/101.5% of our/Bloomberg consensus’s FY24F estimates.

■ 3Q24 profitability for its APO segment was led by higher swine fattening volumes in Vietnam amidst tighter supply industry-wide. ■ Reiterate Add with a higher TP of S$0.53 after upgrading our FY24F-26F EPS and rolling forward our valuation to 0.7x (unchanged) FY26F P/BV. |

||||

Feed was lynchpin of Indonesia’s resilient profitability in 3Q24

JAP’s core net profit grew 14.8% yoy to US$37.2m in 3Q24, with the 7.0% qoq decline seasonal in nature due to lower demand post Lebaran festivities in Indonesia, in our opinion.

Its 55.4% subsidiary, PT Japfa Tbk (JPFA IJ, Add, TP: Rp1,900, CP: Rp1,830), recorded a resilient core net profit of US$23.5m for 3Q24, falling only 12.3% qoq despite 11.5% and 22.9% declines in ASPs for broiler and day-old chicks (DOCs), respectively (Figs 2 and 3).

Management shared during its analyst briefing held on 29 Oct that stable raw material prices for feed (i.e. soybean meal and corn) (Figs 4 and 5) as well as growth in sales volume supported margins for JPFA during the quarter.

Lower feed cost translated to 3Q24 EBIT margins of 7.9% for JPFA’s animal feed segment (-0.6% pt qoq) and 20.4% (-0.1% pt qoq) for its poultry breeding segment despite the lower DOC prices, according to JPFA’s 3Q24 disclosures.

APO continues to benefit from buoyant swine prices in Vietnam Japfa is mainly into poultry breeding and farming in Indonesia. Photo: CompanyAfrican Swine Fever (ASF) continues to negatively impact the supply of pork in Vietnam, keeping ASPs buoyant.

Japfa is mainly into poultry breeding and farming in Indonesia. Photo: CompanyAfrican Swine Fever (ASF) continues to negatively impact the supply of pork in Vietnam, keeping ASPs buoyant.

However, JAP’s animal protein others (APO) segment was able to grow its swine fattening volumes in 3Q24 (Fig 6) thanks to its established swine breeding pyramid and farms’ biosecurity measures, ensuring a steady supply of swine fattening stock.

Given the lead time for swine fattening stock of 6 months, we think the segment will continue to record stable profitability ahead, especially since some operational initiatives implemented over the past few years have successfully lowered its cost of production, according to management.

Poised for sustained profitability; reiterate Add Tay Wee Kuang, analyst.We are more positive on JAP’s FY25F outlook given the potential consumption stimulus measures from the newly elected Indonesian government that has just been sworn in as well as given improving demand dynamics for swine in Vietnam. Tay Wee Kuang, analyst.We are more positive on JAP’s FY25F outlook given the potential consumption stimulus measures from the newly elected Indonesian government that has just been sworn in as well as given improving demand dynamics for swine in Vietnam. We raise our FY24F-26F EPS by 25.6-37.5% and roll forward our valuation to FY26F while adjusting JAP’s shares outstanding for the completion of its equal access offer in Sep 24. Our TP is lifted to S$0.53, pegged at 0.7x FY26F P/BV, 0.5 s.d. above its 10-year mean as we think the stock will continue to re-rate as the industry heads into a demand upcycle. Downside risks: an economic downturn reducing protein consumption and outbreak of ASF in JAP’s facilities leading to one-off losses. |

Full report here