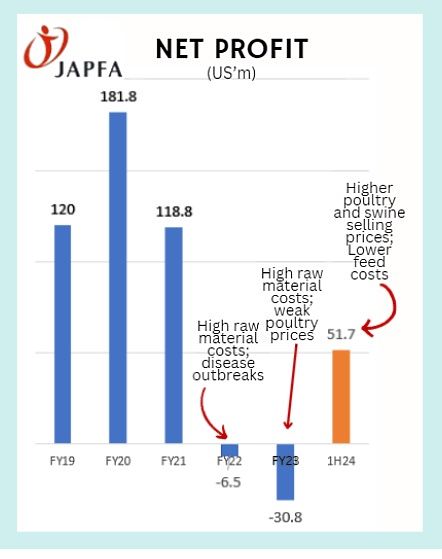

• So Japfa has indeed turned around in 1H2024, with a net profit of US$51.7 million. Earlier, DBS Vickers had held up its view that the turnaround would happen. See: JAPFA: Broker says this stock is "on cusp of a turnaround'  Headquartered in Singapore, Japfa is one of the largest poultry producers in Indonesia and in the region. (Japfa also has a smaller swine business, mainly in Vietnam). • Japfa controls the entire work flow: from producing the feed that feeds the chickens, to breeding and raising the chickens, and finally processing and selling the chicken meat and eggs. • Japfa's stock has surged 45% since the start of 2024, from 22 cents to 32 cents recently. A key trigger for the run was a Bloomberg report in early March on a possible privatisation of the company. See: Top Asia Poultry Firm Japfa Owners Said to Mull Go Private Deal. Japfa's response is here (which didn't outright say it wasn't in the works). • The privatisation possibility aside, after 2 years of losses, Japfa is giving investors reason to anticipate a profit recovery. Read CGS-CIMB'S take on the 2Q2024 results -- highlights include higher selling prices and lower feed ingredient costs. Naturally, it has a higher target price now .... |

Excerpts from CGS-CIMB report

Analyst: TAY Wee Kuang

Japfa Ltd: Likely sustained profitability in 2H24F

■ 1H24 core net profit of US$53.4m exceeded our FY24F forecast of US$25.4m as 2Q24 core net profit tripled qoq to US$40.0m.

■ Reiterate Add with a higher TP of S$0.43 (0.7x FY25F P/BV), with earnings upgrades due to better visibility on sustainable quarterly profits. |

||||

2Q24 earnings uplift from lower raw material prices

2Q24 revenue of US$1.1bn brought 1H24 revenue to S$2.3bn, in line at 50%/54% of our/Bloomberg consensus FY24F estimates.

However, core net profit exceeded expectations on lower raw material costs, with the qoq jump in PBT of US$45.9m contributed predominantly by gross profit increase of US$40.2m.

This was due to lower raw material prices for feed, such as corn and soybean meal (Fig 2).

We also observed that JAP’s inventory level increased by c.US$20.5m in 1H24 to US$774.7m, which we believe suggests JAP stocked up on raw material in view of lower prices.

This should translate to a stable cost structure for 2H24F, in our view.

ASP trends remain uncertain given underlying market demand Japfa is mainly into poultry breeding and farming in Indonesia. Photo: Company2Q24 showed positive ASP trends with Indonesian poultry and day-old chick (DOC) prices up 2.8% and 37.2% qoq (Figs 4 and 5), respectively, while Vietnam swine prices were up 16.3% qoq (Fig 6).

Japfa is mainly into poultry breeding and farming in Indonesia. Photo: Company2Q24 showed positive ASP trends with Indonesian poultry and day-old chick (DOC) prices up 2.8% and 37.2% qoq (Figs 4 and 5), respectively, while Vietnam swine prices were up 16.3% qoq (Fig 6).

However, management commented that buoyant prices were most likely driven by a reduction in supply rather than a recovery in demand.

In Indonesia, industrial players had conducted voluntary culling measures to mitigate persistent oversupply over the past two years while the ongoing African Swine Fever (ASF) outbreak in Vietnam has caused industry-wide reduction in swine fattening volumes, according to management.

However, we note that broiler prices have declined for three consecutive months since Mar 24, with high DOC prices suggesting that independent farmers could be entering the market to capitalise on the high broiler prices, which could result in an oversupply situation and further decline in broiler prices for 2H24F.

On the other hand, we expect swine prices to hold up for 2H24F given the six-month swine fattening period before additional supply enters the market.

Reiterate Add; better visibility on profitability for FY24F Tay Wee Kuang, analyst.We raise our FY24F/25F/26F EPS by 282.8%/104.9%/97.6% from a low base as we were previously cautious of JAP teetering between profit and losses across quarters given volatile ASPs. Tay Wee Kuang, analyst.We raise our FY24F/25F/26F EPS by 282.8%/104.9%/97.6% from a low base as we were previously cautious of JAP teetering between profit and losses across quarters given volatile ASPs. However, we think that the decline in raw material prices should support sustained profitability for FY24F. We retain our Add call. Our TP is lifted to S$0.43, still based on 0.7x FY25F P/BV, which is 0.5 s.d. above its 10-year mean as we think consecutive quarters of profitability will re-rate the stock. |

Re-rating catalysts: abating inflation across Vietnam and Indonesia that could spur higher consumption of protein.

Downside risks: industry oversupply of broilers resulting in a steep decline in broiler selling prices, outbreak of ASF in JAP’s facilities leading to one-off losses.

Full report here