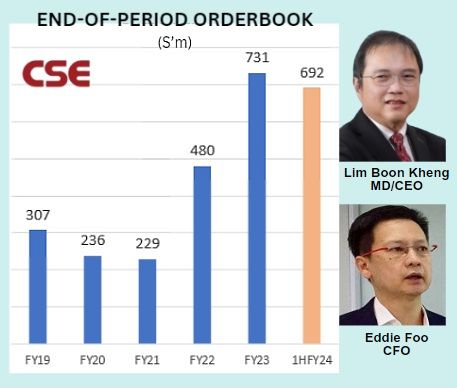

• For sometime now, analysts have been noting that a growth driver for CSE Global is its "electrification" business which supports the growth of data centers and EVs, and renewable energy projects. For CSE (market cap: S$286 m), that business has grown rapidly and is concentrated in the US, which contributed about two thirds of 1H2024 group revenue by region. • Finally, now investors can get a first-hand account of the on-the-ground operations via an 8-page report by Maybank Kim Eng's analyst, Jarick Seet. • As background, CSE is engaged in projects that enhance electrical infrastructure, which includes working on substations, switchgear, switchboards, and transformers. These projects are crucial for upgrading power systems to meet increasing demand. • CSE's "electrification" segment has contributed to a strong orderbook for the group. See the chart below.  Electrification segment accounted for S$395 m of the 1HFY24 outstanding orderbook. The other segments: Automation (S$191 m), Communication (S$106 m). Electrification segment accounted for S$395 m of the 1HFY24 outstanding orderbook. The other segments: Automation (S$191 m), Communication (S$106 m).• CSE counts Temasek Holdings as its No.1 shareholder (~23% stake) and the Singapore Government as one of its clients. Read excerpts of Maybank's site visit report below .... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Electrifying our conviction

We believe that its electrification business is in the midst of a rapid expansion phase, driven by strong demand from data centres, LNG terminals as well as infrastructure projects, and this will likely persist for the next few years.  |

The prospects for the data centre segment are massive with an existing 40,000 sqf facility that will rise to 75,000 sqf in 2025.

This will satisfy demand from just one customer and will still need to be expanded to meet its demand pipeline in 2026.

As a result, we are even more convicted and expect more contracts in the near term.

Maintain BUY with an unchanged TP of SGD0.64.

| Rapid expansion phase driven by strong demand |

The electrification business has seen rapid growth in the past few years driven by grid growth and upgrades due to population growth as well as population shuffle between different states and cities.

|

CSE |

|

|

Share price: |

Target: |

In addition, demand from data-centres, LNG terminals, power distribution centres, and substations for EV-charging have also fuelled demand for CSE’s products and services.

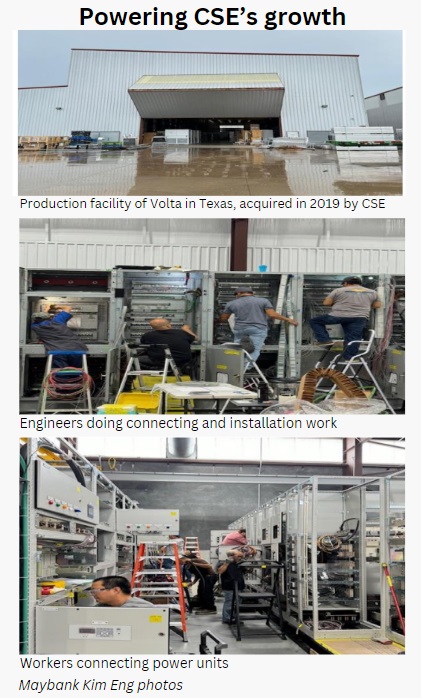

CSE has also expanded its office & facility space from about 100,000+ sqf to about 374,500 sqf currently across 5 locations.

With the pipeline of orders still growing at a 15-25% pa rate YoY, we expect further expansion to potentially 600,000 sqf by 2026.

| Data centres an exciting growth area |

Currently, CSE is serving a major US cloud provider in the data centre space for power management systems and solutions with an extension worth SGD49.2m to be executed from 1Q24 to 4Q25. Jarick Seet, analystWe understand that its 40,000 sqf facility in Tetris Hockley will likely expand to about 75,000 sqf in 2025.

Jarick Seet, analystWe understand that its 40,000 sqf facility in Tetris Hockley will likely expand to about 75,000 sqf in 2025.

Judging from the number of new data centres to be built globally, we expect orders for 2026 to double, suggesting further expansion may likely be needed in 2026.

CSE is also in the midst of qualification with other cloud providers which could further boost its growth.

| Adding more conviction to our conviction |

CSE offers a unique opportunity to ride the upcycle in attractive growth areas.

CSE is a key proxy to ride the multi-year upcycle in electrification in the US and globally, accompanied by an attractive 5.9% dividend yield.

See full report here.