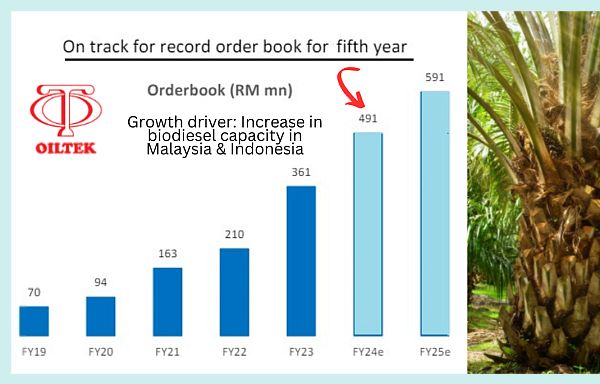

| • Here's an interesting small-cap growth stock that hasn't quite been highlighted by analysts and the financial media. Oiltek International's orderbook and profitability have done nicely in recent years and, finally, one broker -- Phillip Securities -- launched an initiation report of the stock this month (June).  Orderbook forecasts for FY24 and FY25 by Phillip Securities. Orderbook forecasts for FY24 and FY25 by Phillip Securities.• Oiltek is based in Malaysia but its 68% shareholder has Singapore roots: Koh Brothers Eco Engineering, a listco on the Singapore Exchange. Oiltek (current market cap: S$62 million) was listed on SGX in March 2022 at 23 cents /share. Its stock price languished. But following the release of its sterling FY23 results, it shot up 100% year-to-date, from 22 cents to 44 cents. • Oiltek's business is one-of-a-kind among listcos on the SGX: It provides turnkey solutions for refineries and processing plants in the vegetable oils industry. • While it has customers all over the world (including Wilmar, Sime Darby and Sinar Mas), Indonesia's players in the palm oil supply chain accounted for 78% of its FY23 revenue. For more, see excerpts of Phillip Securities report below... |

Excerpts from Phillip Securities' report

Analyst: Paul Chew

|

▪ The order book for Oiltek has been growing at a 50% CAGR over the past four years. FY24e is poised to be a fifth straight year of record orders. ▪ FY23 net profit jumped 51% to RM19.1mn on the back of strong order wins of RM322mn (FY22: RM196mn). We believe the company is riding multiple capex cycles. |

Highlights

| Oiltek | |

| Share price: 44 c | Target: 70 c |

• Riding multiple capex cycles. Oiltek is dependent on customers’ capex plans, especially in the palm oil sector.

Its growth drivers include:

| i) higher biodiesel blending in Malaysia from B10 (or 10% palm oil) to B20. This will increase the expected biodiesel tonnage to 1.8mn tonnes. The typical size of a biodiesel plant is 400k tonnes, implying additional four to five new plants; (ii) an increase in Indonesia biodiesel blend from B35 (since Aug23) to B40; iii) new biodiesel facilities nationwide in Indonesia and Malaysia for more comprehensive logistics coverage; iv) further downstream integration into higher value-added products, including specialty fast, animal feed, Rumen fats, cocoa butter equivalent and phytonutrients; v) Expansion of palm oil refining facilities and downstream diversification globally such as in Latin America. |

• The SAF bounty. There is a growing demand for SAF (sustainable aviation fuel).

|

Stock price |

44 c |

|

52-week range |

19 – 46.5 cts |

|

Market cap |

S$62 m |

|

PE (trailing) |

10.9 |

|

Dividend yield (trailing) |

3.7% |

|

1-year return |

98% |

|

Shares outstanding |

143 m |

|

Source: Yahoo! |

|

IATA projects SAF production will triple to 1.5mn tonnes in 2024. This would still be only 0.5% of aviation fuels in 2024.

Announced SAF projects could reach 51mn tonnes by 2030.

Many countries have mandated flights to use 3-10% of SAF by 2030.

Oiltek has the solutions to treat palm oil mill effluent (POME) and used cooking oil as feedstock for the production of HVO (hydrogenated vegetable oil). HVO is, in turn, the feedstock to produce SAF.

• Asset-light, strong ROE and cash flow. Oiltek’s key assets are its proprietary process technologies and a 45-year record of completing projects. Paul Chew, Head of ResearchIt outsources plant fabrication and installation work to third-party plants, which minimises minimizing capex needs. Paul Chew, Head of ResearchIt outsources plant fabrication and installation work to third-party plants, which minimises minimizing capex needs. Oiltek generates an ROE of 31% despite net cash of RM132mn. The dividend yield was 5% in FY23. We expect dividends to grow by 13% in FY24e. |