| • Singapore-listed Riverstone Holdings has long been tracked by CGS-CIMB. Given its familiarity with the company, the broker has deep insights into Riverstone's prospects. • That shows in the latest report, which makes a bold forecast that Riverstone will pay a special dividend when it announces its 4Q2023 results soon. In addition, CGS-CIMB says that Riverstone will return to y-o-y profit growth in 2024. • Aside from its track record of high payout ratios for dividends, and unlike its peers, Riverstone has a resilient business producing high-margin gloves for use in cleanrooms of electronics companies as well as -- more recently -- customised gloves for the healthcare sector.  For CGS-CIMB's report, read on .... |

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Excerpts from CGS-CIMB report

Analyst: Ong Khang Chuen, CFA

■ We think 4Q23F marks a fundamental inflection point for RSTON, with its net profit returning to yoy growth (+5% qoq, +48% yoy) on demand recovery.

■ We expect cleanroom demand to further improve in FY24F, while RSTON’s focus on customised gloves helps expand its healthcare segment margins. |

|||||

| 4Q23F preview: improving profitability, special dividend likely |

We project Riverstone (RSTON) to record a net profit of RM62m for 4Q23F (+5% qoq, +48% yoy), helped by a recovery in glove demand at end-2023F.

We estimate RSTON’s cleanroom segment volume grew 5% qoq in 4Q23F, while its healthcare segment GPM improved to 19% in 4Q23F (3Q23: 16%) as RSTON’s strategy to focus on customised gloves paid off.

Overall, we project RSTON’s FY23F net profit at RM215m, 65% above its pre-pandemic (FY19) level.

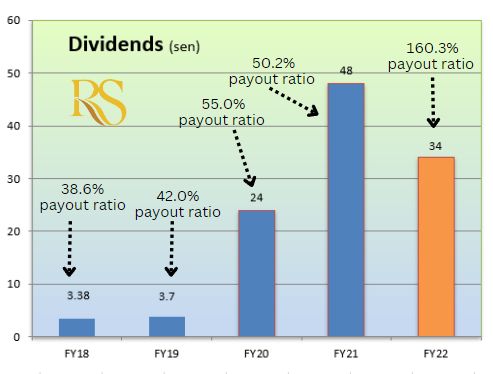

We also see likelihood of a special dividend being declared as RSTON seeks to return excess cash to shareholders (end-Sep: net cash of RM950m).

Our current FY23F DPS of 15sen assumes a 100% payout ratio (FY22: 160%).

| Cleanroom glove volumes to recover |

RSTON sees further volume recovery in FY24F, riding on the modest recovery of the electronics manufacturing sector.

RSTON is currently in talks with customers on a possible slight price reduction in return for price-locking. However, it is confident segment margins can be kept at c.50% as selling prices are still at a c.30% premium to pre-Covid levels.

| Strategy to focus on customised gloves pays off |

We expect RSTON to see stronger healthcare segment ASP and GPM in FY24F via its emphasis on growing its customised glove offerings.

Catered to laboratory use or corrosion-resistant applications, such products can command GPM of up to c.30% (compared to <5% for generic gloves).

RSTON said there is currently limited competition in this niche market, and it has been able to capture this opportunity as its dipping lines were designed to cater to more flexible manufacturing originally intended for cleanroom glove production.

RSTON is currently reconfiguring one of its plants (previously decommissioned) to cater to the production of customised gloves and expects the new capacity to come onstream from 2Q24F onwards

Reiterate Add as we believe 4Q23F marks a fundamental inflection point with RSTON’s net profit returning to yoy growth. |

Full report here.