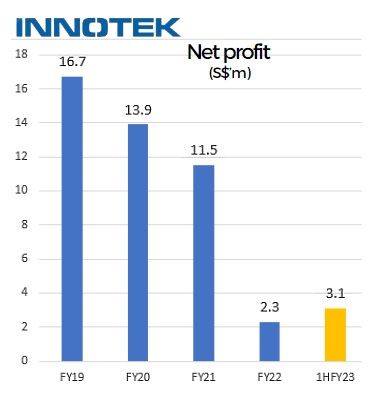

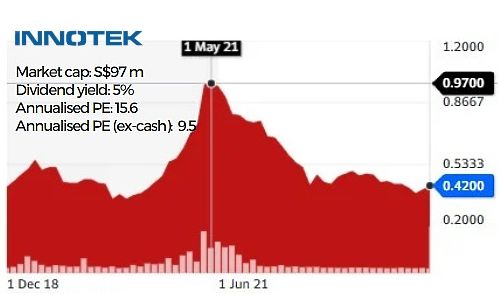

• Innotek is a SGX Mainboard-listed precision metal components manufacturer, serving the consumer electronics, office automation and automotive industries. • Reflecting its established quality of work, it has won “Supplier of the Year” awards from Tier-1 automotive companies Continental and Vitesco Technologies, as well as from Ricoh, a Japanese multinational imaging and electronics company. • Reflecting its established quality of work, it has won “Supplier of the Year” awards from Tier-1 automotive companies Continental and Vitesco Technologies, as well as from Ricoh, a Japanese multinational imaging and electronics company.• Also worth noting: Lou Yiliang, the Group’s CEO, was named Best CEO in the small-cap category for SGX-listed companies with a market capitalisation of less than S$300 million at the Singapore Corporate Awards (SCA) 2022. • The Covid pandemic impacted Innotek's profitability (see chart) by disrupting operations and supply chains, and jacking up raw material prices. But things are looking up now with its 1H2023 profit coming in at S$3.1 million (1H2022: loss of S$1.7 million). After a recent briefing by management, Lim & Tan Securities reported on some Q&A highlights (see below). Innotek on 29 Nov put out its fuller transcript of the Q&A session on the SGX website. |

By Lim & Tan Securities

We highlight the key Q&A from an analyst briefing with Innotek’s ($0.40, up 0.01) management team:

Q: What is the estimated running losses for your Thailand facility on an annualized basis and when are you expecting to breakeven and/or turnaround your Thai facility and which are the customers driving your Thai facility?

A: InnoTek’s Thailand facility, Mansfield Thailand, has recorded higher order flows from existing customers, and also secured new Office Automation (OA) products.

This marks a recovery from earlier impacts due to the pandemic and global economic downturn. Mansfield Thailand is expected to see a turnaround in 2024. Chart: Yahoo!

Chart: Yahoo!

Q: What’s the utilization rate that your China and Thailand plants are running at for 1H’23 and 2H’23 and how much additional production capacities are you planning for both countries for 2024?

A: All of the Group’s facilities recorded higher utilisation rates this year compared to FY2022, albeit to varying degrees, with our higher-performing facilities in China exceeding 70%. Looking ahead, the Group will continue to accelerate business momentum and invest in increasing production capacity to meet growing demand.

Q: In previous meetings, management has shared that new customers in the AI, Gaming, battery storage, semiconductor, EV charging and medical areas will be new growth drivers for InnoTek starting in 2H’23 and accelerating in growth and contributions in 2024.

| • How are these new customers doing so far in 2H’23? Is management deciding to add new geographical locations to service these new customers? • Can management share the outlook and expected contributions from these new customers for FY23 and FY24 in percentage terms and also their expected growth rates? |

A: Our new field business has been steadily growing, particularly in the gaming machine and servers market, and we expect the trend to continue going into the second half of the year.

Q: Management shared previously that because their new AI customer is serving the top global AI MNC player and that InnoTek is the sole source supplier, this segment can contribute more than 10% of sales for FY23 and become a new growth driver for the company going into 2024.

| • Is management’s target still on track and can we expect more capex to be spent on this new AI customer? • Currently how many AI customers are you serving and is there a possibility of increasing the number of customers in this arena given that they are the sole source for the GPU components, which are critical parts? |

CEO Lou Yiliang: Architect of Innotek's turnaround since 2015.A: We have been working closely with our customers in the server industry, one of whom is the main supplier to global leaders in the Artificial Intelligence (“AI”) sector, to increase our production capacity to meet growing demand, and we expect this to positively contribute to our financial performance in the coming months.

CEO Lou Yiliang: Architect of Innotek's turnaround since 2015.A: We have been working closely with our customers in the server industry, one of whom is the main supplier to global leaders in the Artificial Intelligence (“AI”) sector, to increase our production capacity to meet growing demand, and we expect this to positively contribute to our financial performance in the coming months.

Q: The company’s net cash position fell from near $100mln to $60+mln for 1H’23. Why did the cash fall so much and what’s the outlook for the cash position in 2H’23 and 2024? How is InnoTek capitalizing on the rapidly rising interest rate environment to earn more interest?

A: InnoTek’s net cash position stood at S$38.1 million as of 30 June 2023, compared to S$59.0 million as of 31 December 2022, mainly due to higher working capital requirements, higher CAPEX as we acquired a 70%-stake in our Vietnam JV and increased investments in fixed asset.

The Group will take a conservative approach to utilising its cash position, to ensure it remains nimble and ready to adapt to changes in the operating environment. Meanwhile, the Group will continue to implement cost control and maintain a healthy sales volume to improve our margins and bottom line.

Q: Last year despite making a small profit only, management was generous in maintaining dividends at 2 cents per share. This year with better prospects on profitability as well as brighter outlook thanks to strong orders from new customers and new products, would there be better final dividend when full-year results are announced in Feb’24?

A: The Board and management’s main priority is delivering a robust and sustainable financial performance and will consider reviewing the dividend payout once it can show sustainable financial growth. We want to remain prudent with our balance sheet in order to maintain a consistent dividend payout, which in turn benefits shareholders in the long term.

Q: What's the impact of raw material prices on profit margins in 2H’23 and what are the raw material price trends for 2024?

A: While raw materials prices in China have generally stabilised, they have continued to remain elevated. Looking ahead, prices are expected to gradually increase, driven by capacity restriction of steel mills due to the implementation of carbon-neutrality policies, even as demand rises on the back of a recovering Chinese economy.

Q: How is the new acquisition doing in Vietnam and has it broken even or started to turnaround to make a profit for 2H’23. What’s the outlook like for 2024?

A: Since its establishment in March 2023, our Vietnam JV has made significant progress and commenced mass production of products in May 2023. Despite volatile demand from Europe and America, the Company has already commenced mass production of sheet metal processing parts for financial equipment and EV charging station orders, as well as stamping parts for OA orders.

As customers establish their manufacturing operations in Vietnam, we are optimistic performance at our JV will improve in FY2024.

| "We believe that the successful execution of its new strategy of serving new customers in the fast growing AI, Gaming, EV, Semiconductor and Battery Storage business segments could likely catalyst a re-rating of the stock in FY2024." -- Lim & Tan Securities |