| • Singapore-listed Trendlines Group invents, incubates, and invests in medtech and agrifood technology companies in Israel and Singapore. • In Nov 2022, Trendlines announced it would shift gears for 2023 (see: "TRENDLINES GROUP: Strategic shift in 2023 to prime its mature start-ups for exit"). This week, in an online session, Trendlines management took questions from investors on a range of topics including impending exits by portfolio companies. • The 1-hour online session also saw management presentations into the ground-breaking work of several portfolio companies and a review of FY2022 performance of the group. Catch all that at: |

Below are excerpts of the Q&A, which have been edited for brevity:

| Q: What's the game plan for this year, how many exits are we targeting? |

Todd Dollinger, Co-Chairman & Co-CEO, Trendlines GroupTodd: We have a large portfolio of 56 companies today. We have a larger percentage of more mature, more experienced companies today than we have ever seen and we feel that to be most productive these companies require more of our effort in helping them mature and bring them to revenues and bring them before investors and the strategic partners that will acquire these companies this year and in the years ahead.

Todd Dollinger, Co-Chairman & Co-CEO, Trendlines GroupTodd: We have a large portfolio of 56 companies today. We have a larger percentage of more mature, more experienced companies today than we have ever seen and we feel that to be most productive these companies require more of our effort in helping them mature and bring them to revenues and bring them before investors and the strategic partners that will acquire these companies this year and in the years ahead.

Steve: We have many companies that are in revenue today. Todd talked about Arcuro’s sales in the first quarter of this year are probably greater than their sales for all of last year.

Steve Rhodes, Co-Chairman & Co-CEO, Trendlines Group.Similarly on the agritech side, we have companies that are expecting to do sales of two and three times more than they did last year. Just one example: Sol Chip which in 2021 had US$65,000 of sales, in 2022 had $500,000 and in 2023 expects sales of US$1.5-2.5 million.

Steve Rhodes, Co-Chairman & Co-CEO, Trendlines Group.Similarly on the agritech side, we have companies that are expecting to do sales of two and three times more than they did last year. Just one example: Sol Chip which in 2021 had US$65,000 of sales, in 2022 had $500,000 and in 2023 expects sales of US$1.5-2.5 million.

Companies growing like that brings us closer and closer to exits. We can't of course predict when those exits will occur as they're up to the market, they're up to the buyers.

But I can say with confidence that we are in talks all the time with the market. Todd was in the States recently speaking with major multinational companies and exposing them to selected portfolio companies.

We're pushing very hard for exits and I think that we're going to see significant exit activity in the next couple of years which will then enable us to distribute dividends as we've promised.

Todd: We put a tremendous amount of effort into properly positioning companies for sale and for sale at what we believe to be appropriate value producing prices. That's why we attend conferences, we visit with our strategic partners around the world.

In fact, I'm off again tomorrow on a trip that'll take me to Canada and Singapore, and we'll be meeting with some of the biggest medical device companies in the world during the course of these visits.

| Q: How does Trendlines see the current startup funding winter going? How will the company position itself in the near to medium term? |

Steve: The truth is that up until now we have not seen a significant decline in investment activity in our portfolio companies. Our company Viaqua closed an investment around just two weeks ago. Another one of our medical device companies is closing a round this week.

We've encouraged all of our portfolio companies to both look at their expense structure to make sure that they can extend their runway on the one hand and on the other to begin their fundraising activities earlier because we believe it could take longer to raise capital.

Todd: It's a really interesting question and there are two key factors that address the inquirer’s thought -- one is the ability to raise and the second is valuations.

Trendlines fits in a very interesting niche in the investment world. As you know we don't raise money for companies at multi-billion dollar valuations, we are startup specialists and we work on growing those companies. We've actually never raised money at valuations even in the hundreds of millions of dollars much less billions of dollars.

When you're talking about raises and valuations of 10 million, 20 million, 30 million dollars there is, in difficult times, less downward pressure on the valuations. As well, we see continuing availability of capital.

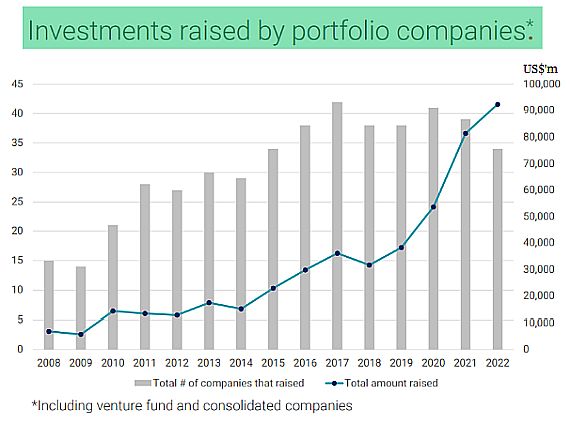

Take a look at what we've achieved during down years (see chart below) and first of all you see we continue to raise more money each year than the year before. This has been a constant threat for a number of years now and the valuations are increasing.

|

Stock price |

9.4 c |

|

52-week |

8.1 – 11 cts |

|

PE (ttm) |

-- |

|

Market cap |

S$84 m |

|

Shares outstanding |

895 m |

|

Dividend |

-- |

|

1-year return |

-13% |

|

Source: Yahoo! |

|

So who gets battered during these tough times? The companies that go out and raise a billion dollar, multi-billion dollar valuations. They wind up losing 80, 90% of their value in some cases.

We, on the other hand, see on average valuations increasing and the total amount of funding increasing. I realize that's a bit counter-intuitive but that’s what our numbers are.

We anticipate a good year this year even in these confusing market times and confusing political times internationally and domestically.

Trendlines' presentation deck is here.