| While 2021 was a most unusual period for all businesses, primarily due to the pandemic, the period can only be described in superlative terms for Geo Energy Resources. There has never been a better time in the past 9 years for the Indonesian coal miner since it listed on the Singapore Exchange in October 2012. And the rewards have flowed through to shareholders in the form of 9 cents/share of dividends, inclusive of a proposed 5-cent final dividend for FY2021. This table shows the 11X jump in dividends y-o-y:

The 9-cent dividend -- totalling US$93.5 million -- is 52% of the earnings for 2021, leaving Geo Energy with ample firepower for organic and inorganic growth. |

In 2021, the Geo Energy group achieved a string of record-busting heights:

| • Record revenue of US$641.9 million (+109% y-o-y). • Record yearly coal sales of 11.4 million tonnes (+7% y-o-y). • Record EBITDA of US$270.9 million (+375% y-o-y). • Record US$179.1 million in net profit (+88% y-o-y). • Record total dividends paid/proposed of S$0.09 per share (+1,025% y-o-y). |

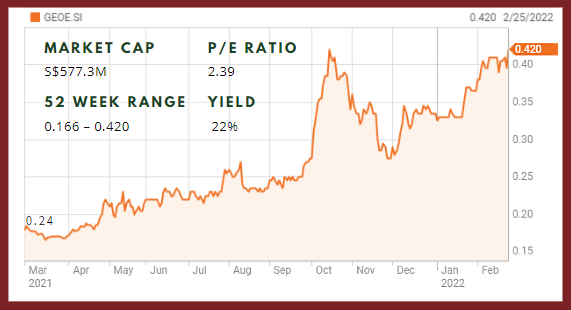

Accordingly, Geo Energy's share price has re-rated strongly.

Including the dividend on the S$0.09 paid and proposed for 2021, the total shareholders' return from 1 January 2021 to 23 Feb 2022 was 163%. Note: 22% yield based on 2021 proposed final dividend of S$0.05 per share and total interim dividends of S$0.04 per share.

Note: 22% yield based on 2021 proposed final dividend of S$0.05 per share and total interim dividends of S$0.04 per share.

Chart: Reuters

Still, the stock is "greatly undervalued," reckons the company>

Its enterprise value, excluding net cash and treasury shares, as of 23 February 2022 of US$242 million.

Its market capitalisation, excluding treasury shares, as of 23 February 2022 was over US$429 million.

"Our shares are undervalued given the VALMIN JORC valuation of the Group’s coal reserves of US$726 million as at 31 August 2021, our net profit from operations of US$179.1 million in the year and US$191 million cash as at 31 December 2021."

Geo Energy is a highly leveraged play on coal price.

Every US$1 increase in the annual selling price per tonne translates into a whopping US$12 million extra revenue (Geo Energy's approved full-year production quota of 12 million tonnes) with a very high profit margin.

The crucial question, as always, is what is the outlook for coal? Has its existential decline begun and renewable energy is taking over?

Not quite. It's getting clearer that under-investment and under-funding in supply and exploration owing to climate-change factors are leading to sustained high coal prices for quite a few years to come.

This might even be the decade for coal, as some investors figure.

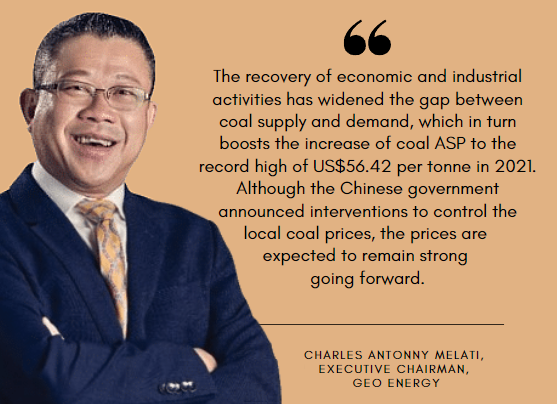

| "The coal market is expected to remain strong in 2022, with demand led by recovering economies at an all-time high. The Group has received approval of an increased RKAB production quota of 12 million tonnes for 2022, as we target to ramp up production if conditions permit. The Group targets another great performance in 2022 if coal prices remain buoyant." -- Geo Energy |

Industry Outlook

Coal Analysis and Forecast to 2024 (excerpts from Geo Energy's presentation deck):

• China and India account for two-thirds of the coal consumption in the world, which will greatly influence the global trend in next few years. In 2021, the coal consumption increased 4% in China, 13% in India, and 17% in the United States. • Coal demand expected to reach an all-time high in 2022 and continue until 2024, with emerging and developing economies being the driving force. The expected global economy recovery, higher power demand due to cold winter and hot summer, and adverse weather conditions might curtail coal supply. • The continued uncertainty around Australian coal ban by China, Indonesian miners continue to enjoy the high import demand from China. |

For more info, see Geo Energy's presentation deck here.