|

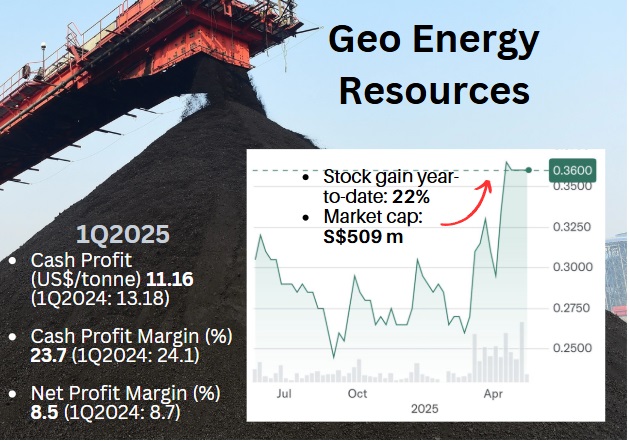

Geo Energy's stock price has risen 22% so far this year, aided by growing investor recognition of the potential fruits from its road-jetty project in Sumatra. |

| Production ramp, strip ratio, coal demand |

So, what's driving this uptick in production?

| Annual 30% dividend payout |

Geo Energy declared an interim dividend of 0.25 SG cents per share, a 25% increase from last year's interim dividend. While this translates to a 19% payout ratio for the quarter, management stressed their commitment is to a 30% dividend payout ratio on an annual basis. |

In an investor briefing, management explained it was mainly advance overburden removal in 2024.

By doing this heavy lifting last year, it was easier to get the coal out now.

Unit production cost came down with the blended strip ratio across Geo Energy's mines, said CFO Adam Tan.

At SDJ and the key TBR mine, where mining is nearing its end in 3-4 years' time, the strip ratio will decrease, which will help lower production costs.

However, at the relatively untouched TRA mine in South Sumatra, where production is being ramped up to mine its massive coal resources, the strip ratio will increase over the next couple of years.

| Potential cash cow |

A major project Geo Energy is pushing forward with is the MBJ road, a 92-kilometre haul road.

This is a huge undertaking – almost twice the length of Singapore East to West.

Progress is looking good and the related jetty project is also progressing positively and is on schedule.

• The team is "working vigorously" on the 92-km road, said Chief Operating Officer Philip Hendry. Work is happening "24 hours, three shifts, seven days a week", with completion targeted by June next year. • Land clearing is about 65% done, and cut-and-fill is 8-10%. • This is currently ahead of schedule. "Assuming we complete this by June next year it will be one of the fastest hauling road completion in the history of Indonesia," said Mr Hendry. |

Still, asked what challenges had presented themselves, Mr Hendry cited "numerous local issues", despite the company having all the necessary permits and licenses.

Managing these interactions with local communities is an ongoing task, which is similar to what Geo Energy experiences when operating its existing mines.

Geo Energy sees the MBJ road as a potential cash cow, having received a lot of interest from parties wanting to take a stake in, or use, the road.

Geo Energy has signed MOUs and term sheets but is not rushing into any deal.

The goal is to carefully select the "right party" as clients and partners, said Mr Hendry.

Applying a conservative multiple of 3× to the enterprise value/EBITDA implies a total infrastructure value of ~ US$1 billion. |

See also: GEO ENERGY: New, More Analyst Coverage as Profit Boom Seen Ahead