Excerpts from CGS-CIMB report

Analysts: Lim Siew Khee & Cezzane See

1) Private equity and funds are cashed up after going through the Covid-19 scare; and preparing for recovery. Among the bigger corporates, investment or expansion plans have been put on hold due to the uncertainty. We think the vaccine rollout and expected gradual recovery are key drivers for M&A pipelines before valuations spike. 2) Low valuations for cyclical business. As global demand turns down and industrial activity slows, commodity stocks have been suffering from overcapacity and concerns over insufficient demand. Such a scenario could change on the back of rising commodities prices. 3) Expansion of value chain, especially among the tech companies to take advantage of common customers’ platforms to increase product offerings and market share. |

| Look out for small caps in O&M space and beyond |

We think corporate actions might go on, especially among small-caps.

We believe that globally, corporates have been preserving cash since Covid-19 broke out and they have the means to make an offer by taking the longer-term perspective, hunting for companies that have the potential for rebound if oil prices recover.

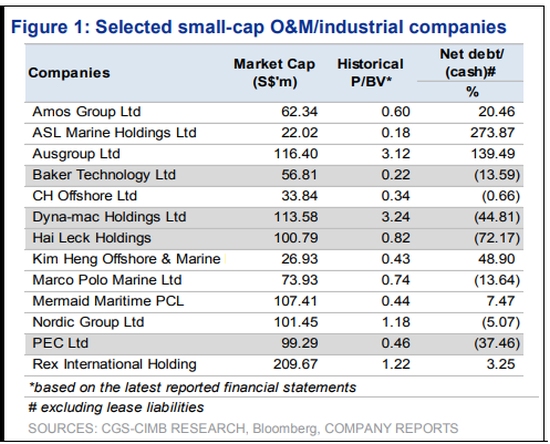

Figure 1 shows small-caps Singapore listed O&M companies with some trading below book value and in net cash position. Beyond the O&M sector, companies with significant controlling shareholders across sectors are shown in Fig 3-7.

| Net cash small-cap O&M/industrial companies |

|

Baker Technology |

|

|

Share price |

28 cents |

|

P/B |

0.22 |

|

Net cash |

13.6% |

|

Market cap |

$56.8 m |

|

Source: CGS-CIMB |

|

1) Baker Technology (Not Rated). Trading at 0.22x historical P/BV, major shareholder Mr Benety Chang and spouse hold 52.69% of the company.

Its key revenue derived from the 54.98% stake in offshore vessels company, CH Offshore (Not Rated), which is also trading below book of 0.34x historical P/BV.

Baker Tech is one of a few small-cap Singapore listed companies remaining that have the capabilities to build liftboats/rigs.

2) Dyna-mac Holdings (Not Rated). Dyna-mac trades at historical P/BV of 3.2x with a rising order book of S$227m in Nov 20 (vs. c.S$96m in Nov 19). In Dec 20, Dyna-mac also announced its foray into clean/renewable energy sectors.

The company announced that it is repositioning its business to pursue opportunities in the global green hydrogen market, which is adjacent to its core capabilities. In conjunction with this, it is currently evaluating the need to expand its yard facilities to fulfill potential demand by increasing its production capacity, maximising operational synergies and to undertake new green hydrogen projects.

3) Hai Leck Holdings (Not Rated). Largely controlled by the Cheng family, the company trades at 0.8x historical P/BV with net cash of c.S$72m. Hai Leck is one of the key players in the project and maintenance services to the oil and gas and petrochemical industries in Singapore.

To diversify away from the mechanical engineering business, Hai Leck acquired contact centre services, Tele-centre, in 2011. Contact centre contributed c.51% of its revenue in FY20.

4) PEC Ltd (Not Rated). It is a key onshore EPCC/plant maintenance service provider with an orderbook of S$191m as at FY20. The company has net cash of S$37m and trades at 0.46x historical P/BV.

Full report here.