| KEY INVESTMENT RISKS |

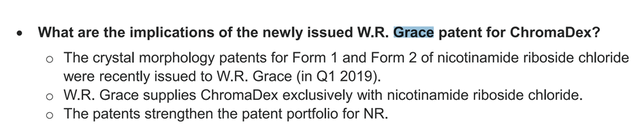

The risk adjusted returns are extraordinary. The main risks are shown below.

Source: Analyst

1. The Science Fails.

NR is expensive, and if it doesn’t provide any real benefits, there are more fun ways to make premium pee.

A failure of science could be devastating but the probability of this is low. As well as the vast amount of research on NAD, NR has a sizeable community of users. Individually these are n=1, but collectively it's fairly unbelievable that a large placebo effect is at work. (See FAQ: Is this all Placebo?)

Indeed such is the support for Tru Niagen that even in the unlikely event that the science is equivocal, it would probably still sell at healthy levels based on the ardent support with existing users. There are many products with no science that sell well, and Tru Niagen already has more science behind it than most.

2. Safety

There have been numerous studies, and no reports of notable side effects from NR. NR is water soluble, has a short half-life (~3-4 hours). After many years of fairly widespread use, there are no reports of serious side effects, nor unexpected outbreaks of disease conditions you’d expect if such side effects were happening.

Some investors may recall that mobile phones were disused as a brain cancer risk in their early years. At the time, the easiest reason to discount this was that there were no outbreaks of brain cancer cases, or a shift of these cancers to the right ear brain region, where the phone is commonly held.

In the event safety issues from long term use were found, this would not preclude it still being used as a drug – many drugs have known safety issues. As well as being registered as Generally Recognised as Safe with FDA, NR is considered so safe that it’s one of the few products approved for nursing mothers (in Europe).

3. The Patents Fail (Base case is 2036, not market consensus of 2026)

Chromadex patents are extensive, and at face value make NR as a therapeutic supplement their exclusive property until November 2026.

These patents have been challenged by Elysium Health, a former customer. A successful defence of these patents by Chromadex seems likely. There’s an excellent website by Shelly Albaum who is legally trained and following the Elysium lawsuit closely.

There are three ongoing lawsuits with Elysium, of which the most important lawsuit by far is Elysium’s patent challenge to invalidate Chromadex’s monopoly on NR. Elysium's case doesn’t look strong, but the legal system can always throw up surprises.

However, a new suit against Elysium from W.R. Grace (NYSE: GRA), Chromadex’s exclusive supplier of NR Chloride, stacks the board strongly against Elysium.

Chromadex has a patent on the use of NR as a dietary supplement, and W.R. Grace has patents on Form 1 and Form 2, the two known crystal forms of Nicotinamide Riboside Chloride. If this is confusing, a rough analogy is Chromadex owns a patent on the carbon molecule, and W.R. Grace has filed patents on graphite and diamond.

Drug compounds are usually produced as crystal forms, as crystallisation enhances purity, consistency and stability, which are desirable characteristics for storage and administration. Crystal forms are also unique, recurrent, and describable. The courts recognise crystal forms as patentable, for example in Glaxo Inc. v. Novopharm Ltd. There's a primer on patenting crystal forms here.

Different crystal forms can have markedly different pharmacokinetics, such as different solubility, absorption and metabolism, and one form may have quite different characteristics than another form. Indeed, the accidental change in crystal form of Ritonavir, an anti-retroviral medication, cost Abbott hundreds of millions of dollars in losses, as the new form turned out to be far less soluble than the prior form.

W.R Grace’s lawsuit means that even if Elysium succeeds in challenging Chromadex’s patents for NR, it now has to win its own patent infringement challenge from W.R. Grace, which alleges Elysium is using its patented crystal forms of NR Chloride in its products.

This is pretty easy to prove, as specific crystal types diffract electromagnetic waves in unique ways. Given there are only two known crystal forms for NR, and unless Elysium finds a novel argument, it should not be difficult to guess who will win this lawsuit.

W.R Grace is funding the litigation at its own cost. On his website, Shelly Albaum describes W.R. Grace’s legal counsel as “a murderer’s row of patent litigators”. They have retained Venables, whose patent litigation cup is overflowing after its victory against GSK.

As shown in the above table, the chances of Elysium winning its patent suit with both Chromadex and W.R. Grace is rated as low.

Grace filed patents on the crystal forms, Form I and Form II. The supply agreement permits them to own process improvements (see page 57 of this 10Q for the agreement).

Sections of the supply agreement have been redacted for commercial confidentiality, but its clear that as long as this exclusive supply agreement is in place, Chromadex effectively maintains its Tru Niagen monopoly until 2036, as W.R. Grace is blocked from supplying any other party.

The key risk is a termination of the exclusive supply agreement. On Page 25 of the 10Q linked earlier, it states that "In the event that certain conditions are met, then the Company will become a licensee of the Grace Patents for the crystal forms."

The exact text on this has been redacted but it presumably anticipates situations where Grace ceases to be a supplier. The supply agreement appears well drafted and already explicitly anticipates change of control, efforts to reduce production prices, and market exit of W.R. Grace. The fact this clause was redacted as commercially sensitive may also suggest that it may include a pricing formula, though this is speculative.

Though it cannot be said with certainty due to the redaction, a fair guess would be that one of the ways that should W.R. Grace wish to exit the market for producing NR Chloride, then Chromadex would be able to license W.R. Grace's patents exclusively.

In any event, while we don't know what the exact conditions to license the Grace patents, the text on p25 makes it indisputable that there is way for Chromadex to license the Grace patents to 2036.

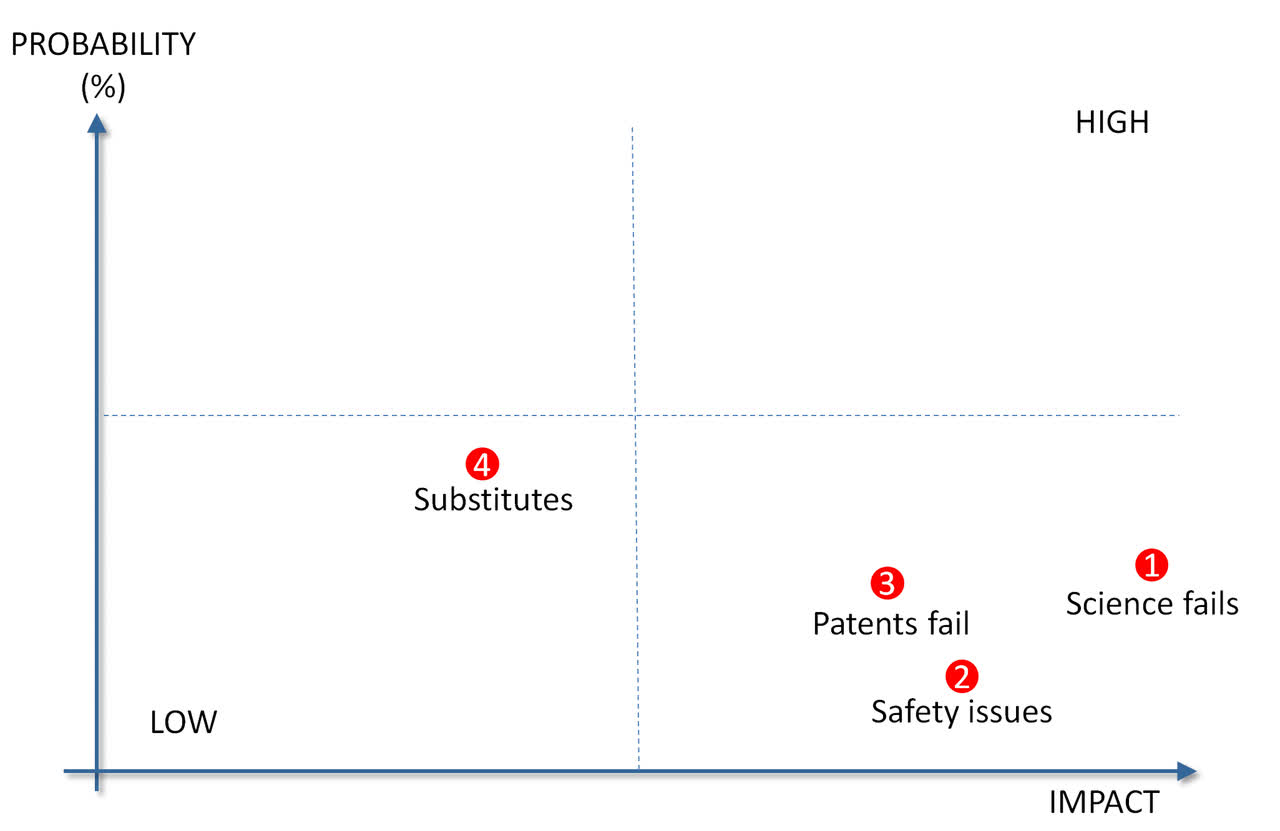

Management's comment on the W.R. Grace patents from the Chromadex Investor presentation is below (page 8):

This is why the base case is for the patents to run to 2036. This is ~3x what is commonly believed. Please see the Section: Patents for more on this.

4. Substitute Products

There are five well studied NAD precursors (nicotinamide, niacin, NR, NMN and tryptophan), all with their own effects on NAD, safety profiles and downstream (i.e. non-NAD mediated) effects.

NR appears to be the best of the five. It’s uniquely and orally bioavailable, does not have the uncomfortable flushing side effect of niacin, and not subject to feedback inhibition of nicotinamide. It's also more energetically efficient at producing NAD than these two precursors, and far more metabolically efficient than tryptophan. NMN also appears to be a precursor to NR (rather than NAD), making its a poorer choice. (See Section: Battle of B3s)

Chromadex also has patents over NRH, another NAD boosting molecule. This is a reduced form of NR and may be even more effective at boosting NAD than NR. This ability by itself may not be that important, as NR is dose dependent and can boost NAD levels many fold. The most exciting would be should NRH has greater affinity to specific tissues body than NR.

David Sinclair, who is introduced later in this document (FAQ: Cast), is also developing alternative NAD precursors with a biotech called Metrobiogen, which reportedly combines NMN with Hydrogen Sulphide for absorption. There are no indications this will either be safer or better than NR.

CHROMADEX: THE PERILS OF LACKING AN ALIGNED INVESTOR BASE

Chromadex price action is typical of a stock without an aligned investor base.

Stocks with an aligned base have actual and potential shareholders totalling greater than the free float (here ~$200m value) amount that are supportive of management, and pay more attention to what management is doing than daily price movements. Examples of stocks blessed with aligned investor bases are Tesla, Apple, and Berkshire Hathaway.

This anomaly is a minor motivation for writing this report (Also see FAQ: Why is this report so long). I’ve a 13 year old son with a portfolio that’s up 200%+ since March 2020 and making me feels like the Sheriff of Nottingham (puffing to keep up with Robin Hood and his mad lads). This is an opportunity to talk about something that to my knowledge has not been discussed before.

At some level, all stocks are stories. For example, Tesla is the future of mobility (and distributed energy if you think ahead), Amazon the future of retailing and Caesars and cruise lines about the end of COVID-19. And so on.

Investors like a constant stream of activity and information, giving them a way to speculate on and estimate sales growth (e.g. Tesla, Apple, and NVidia).

A stock with an aligned investor base has investors that is looking to buy more stock and buy on dips. A stock without an aligned investor base will rarely sustain price momentum, with gains fading as a lack of news leads jittery investors to bail out.

This situation is especially apparent when a stock lacks continuous analyst coverage to guide and reassure the market. It should also be noted that both listed companies and responsible scientists are often not able to publicly make the same interpretations an independent analyst can.

Lack of analyst coverage leads to investors over-analysing stock price movements, which are often simply due to technical factors, such as a fund that is buying or selling for its own reasons. A few hundred thousand shares - peanuts by fund standards - easily moves Chromadex's share prices.

The reasons Chromadex lacks an aligned investor base are listed below. This is not a litany of sins, but markers of market inefficiency – and an investment opportunity for the patient investor.

1. Complex subject. Chromadex has a challenging mix of almost incomprehensible science, litigation uncertainty and sometimes plain weird stuff in the background (see FAQ: Cast of characters). Uncertainty makes for jittery, rather than brave, investors.

2. Slow and hard-to-understand research results. Chromadex is making its way towards the home plate base by base rather than trying to smash home runs. The company operates in some of the most regulated markets around, and missteps are punished by both regulators and competitors. Study results rarely provide unequivocal guidance, and are often small and hard to interpret.

3. Incredible claims: Many people buy NR for anti-ageing, a field that dates back many thousands of years with zero success. Many fads have come and gone – pycnogenol, resveratrol, royal jelly and so on. Chromadex does not make anti-ageing claims and our investment thesis is based on health benefits rather than lifespan (see also FAQ: Anti-ageing).

Institutional investors have these additional factors to deal with.

1. Closure on the Elysium litigation. Fund managers get to charge fat fees for being smart. Getting stuff like litigation wrong is a bad look.

3. Low market cap and liquidity: Even relatively small purchases send the price up, and then the stock price sags as the buying spike is digested. This makes buying a high risk manoeuvre for most fund managers, as entering is likely to mean immediate under performance. Exiting can also take a long time, and prices can be depressed on the way out.

Traditional funds like to see at free float of at least a $1bn before investing ($500m in a pinch), as it takes this type of size to allow $5-10m investments to be made without market impact. Note that in a modern context, these are very small investments, the type a boutique fund takes for a larger holding, and a large fund takes as a lottery ticket.

2. Green lights on the science: Due to market impact of buying in and selling out as discussed above, fund managers don’t like taking chances with small capitalisation stocks.

This translates to most traditional funds preferring to pay more for certainty than risk getting in too early. This means they want to first see replicated studies and trials in larger populations. Studies involving 300-400 people would probably be the minimum number needed to convince the wider community and regulatory bodies. This is 5-10X the average enrolment to date.

4. No continuous research coverage. Though the analyst coverage is great for a company its size, Chromadex is too small, and doesn’t pay the type of investment banking fees that gets keyboards tapping on a regular basis.

This might change a little if Chromadex activates their standby authority to issue up to $50m in new shares, but even then, at 3%, the $1.5m of fees split amongst two houses is nowhere big enough to drive steady research support. It's also an exceedingly rare and expensive analyst that can understand the science and work sell-side.

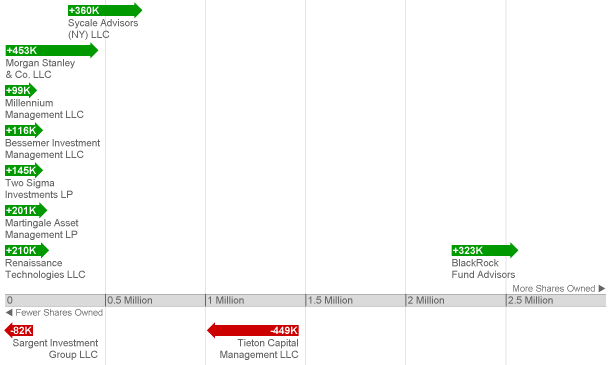

FUND ACTIVITY

Some of this is evident in recent share purchases of stock funds. There is some index buying (there always is) but most of the buying has been from alpha seeking funds, and the amounts being bought are tiny as compared to the fund size.

Source: Here

A DEEPER DIVE: NR AND THE IMPORTANCE OF NAD

At this time, NR is mostly taken as a dietary supplement for general health, energy and anti-ageing.

Is there any basis for believing NR is some form of super drug? The bull case for NAD is more than intriguing.

Let’s start by noting that NAD is an incredibly important molecule, it’s as important as water is to Earth. In plants, NAD performs the same cellular functions as the animals that consume them.

Organisms from bacteria to mammals (including humans) have maintained multiple biosynthesis pathways (being de novo synthesis, NAM/NA salvage, and NR salvage) to produce NAD. Humans have even conserved the extremely inefficient tryptophan method (1/60 of salvage pathways) while happily tossing out ways to make Vitamin B12 and Vitamin C.

This is suggestive of these processes being so fundamental that any attempt to change them reduce species survival and thus has been eliminated from future generations.

Consider this abstract on the importance of NAD:

“In its functional forms as NAD( P)+ and reduced forms NAD( P)H, vitamin B3 participates in more reactions than any other known vitamin-derived molecule, and is intimately implicated in essential cellular signalling, bioenergetics and metabolic pathways, with sub-optimal intracellular NAD+ levels promoting mitochondrial dysfunction and cellular impairment.”

Combine this description of the importance of NAD, with this quote from Charles Brenner from a September 2020 Twitter post. (Lightly edited for brevity)

1. Many conditions of metabolic stress disturb NAD systems. Examples are alcohol, over nutrition, deafening sound, DNA damage, ROS, heart failure, neurodegeneration, inflammation and infection. Ageing [also] reportedly disturbs NAD, though the evidence is weaker.

2. When NAD comes under attack, repair processes are compromised, ATP generation is impaired & anabolic processes are disturbed.

3. Repleting NAD system [Editors comment: Presumably using NR] when NAD is under attack is clearly pleiotropic, meaning that dozens of functions work better.

As well as perhaps being useful for general health, there are also many markets where NR may be promising as a drug:

SELECTED DISORDERS

|

DISORDER |

STUDY STAGE |

AFFECTED POPULATION |

COMMENT |

|

Heart Failure |

Clinical |

6m in the US |

Suppressed inflammatory activation in end-stage heart failure patients. |

|

Non-alcoholic fatty liver disease[1] |

Preclinical |

Approximately 30% of global adult population |

NAD and NAD precursor levels significantly depressed in humans with damaged livers |

|

Type 2 Diabetes |

Preclinical/clinical |

8-10% global population |

Strong evidence in mice, small and short human study (discussed elsewhere in this document) did not replicate effects, but produced significant improvement in lean body mass |

|

Frailty |

Preclinical/clinical |

1/3 older adults, 50m worldwide have sarcopenia |

There’s this study but perhaps as relevant is that a lot (half or more) of users taking NR report better wellbeing |

|

Hearing loss |

Preclinical |

One in three people between the ages of 65 and 74 |

|

|

Coronavirus |

Preclinical |

Global, but if effective, likely to be more important in older population |

NAD is involved in hundreds of bodily processes, and there are many dozens of possible use cases for NR. Let’s look at a few of these below.

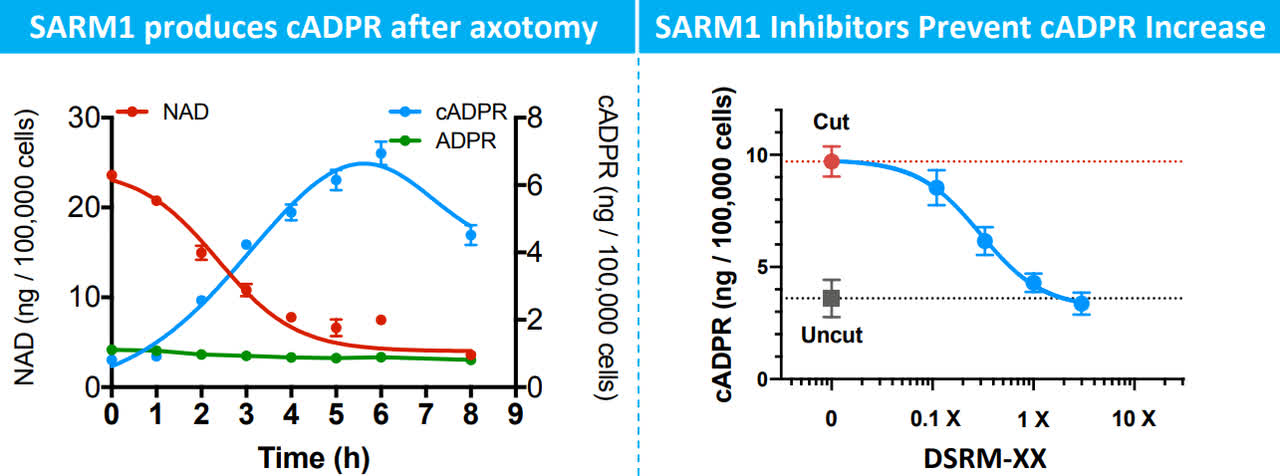

AXON DEGENERATION DISORDERS

These include multiple sclerosis, ALS, Parkinson’s and Alzheimer’s disease and peripheral nerve pain from diabetes or chemotherapy. I’ll just quote Marie-Therese Heemels, Senior Editor of Nature, referring to this recent research paper.

Repleting NAD should be helpful but may be insufficient to prevent Axon degeneration (like filling a leaky radiator, it's good to plug the hole). Drug maker Eli Lilly recently acquired Disarm Therapeutics, a firm working on inhibitors to prevent axon loss. This could be a powerful combination in conjunction with NR.

LIVER

This is my personal favourite. Studies show alcohol drinking reduces liver NAD, and the science to support NR increasing liver NAD seems good. There are also anecdotal stories of NR being a hangover cure.

There are tens of millions of older wine drinkers that probably wouldn’t mind paying a dollar or so a day to keep their livers in good shape. Don’t expect much published about this though, the FDA (like many doctors) seems to find hangover cures morally objectionable.

CORONAVIRUS

It’s too early to buy Chromadex on this alone, but the initial work is highly promising.

1. Chromadex preclinical study

Showed SARS-CoV-2 depleted NAD, leading to disruption of innate immune activity.

Quoting Charles Brenner, a study author and Chromadex Chief Scientific Advisor (lightly edited for readability):

Reasons to think [NR will help]:

1) NAD under attack with COVID-19 infection

2) NMRK genes up [Author’s note: Upregulation is consistent with the NR being converted to NAD]

3) Higher NAD allows better PARP functions, which are antiviral

4) NR shown to depress inflammation markers in small human placebo-controlled trial.

Dr. David Sinclair also published a paper suggest NAD boosters such as NR and NMN for the elderly

Follow-up work is being done with the National Institute of Allergy and Infectious Diseases (NIAID, which the famous Dr Anthony Fauci runs) to assess the effect of NR supplementation on progression, viral replication and inflammatory response.

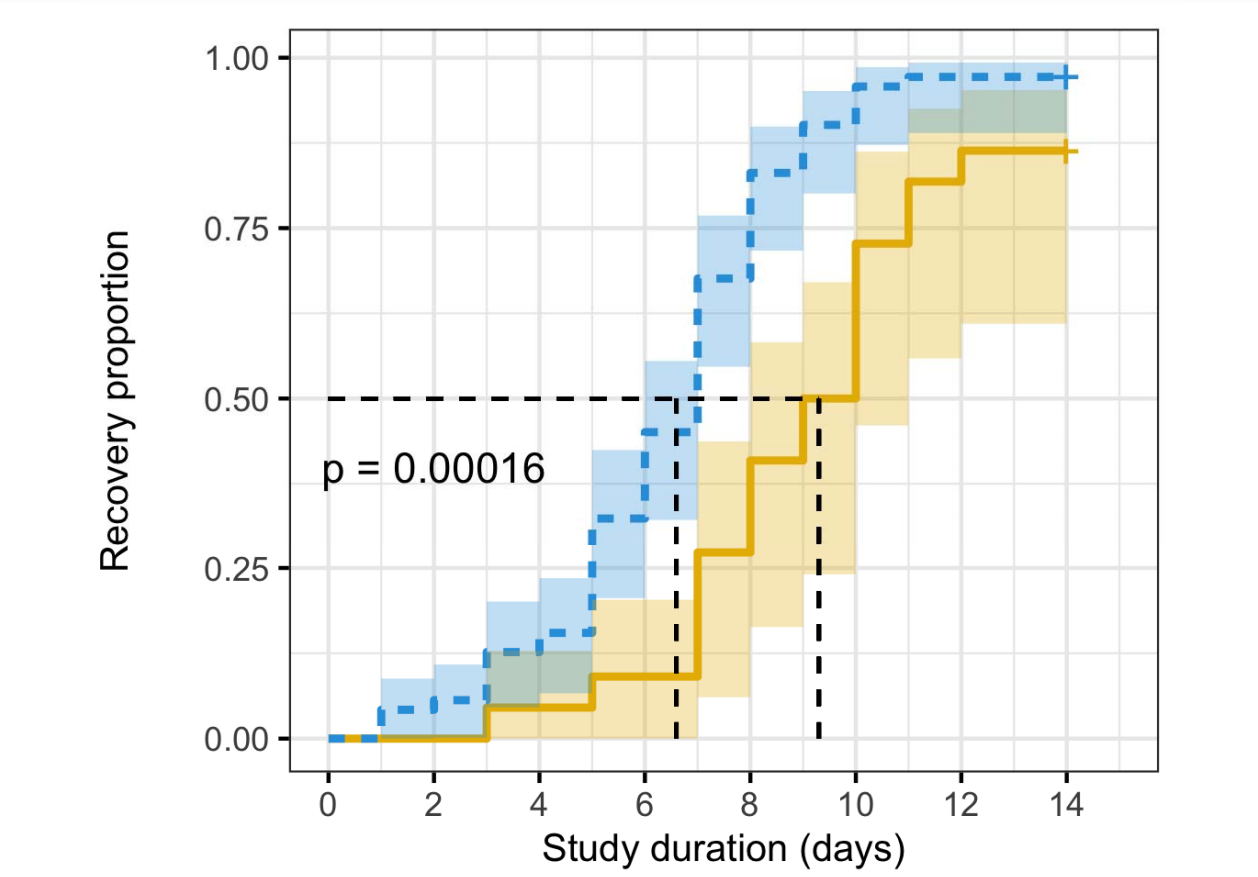

2. COVID-19 Human Trial

Chromadex’s stock spiked 25% on this study sponsored by the Knut and Alice Wallenberg Foundation of Sweden, though it has since settled back.

This study found that 14-day administration of 2 grams of NR, along with high doses of NAC, L-serine, and L-carnitine tartrate along with the standard of care reduced recovery times by 30% as compared to the control group (p=0.0001). These are all OTC supplements you can buy in any pharmacy or on Amazon, and there were no serious side effects in the treatment group. The study was conducted on patients in Turkey, where hydroxychloroquine is the standard of care for COVID-19 (i.e. everyone gets it)

The study internals were good. At day eight, 67% of the treated group had no symptoms compared to just 27% of the untreated group. At the end of the study (i.e. day 14), 98% of the treatment group were symptom free, compared to 87% of the control group.

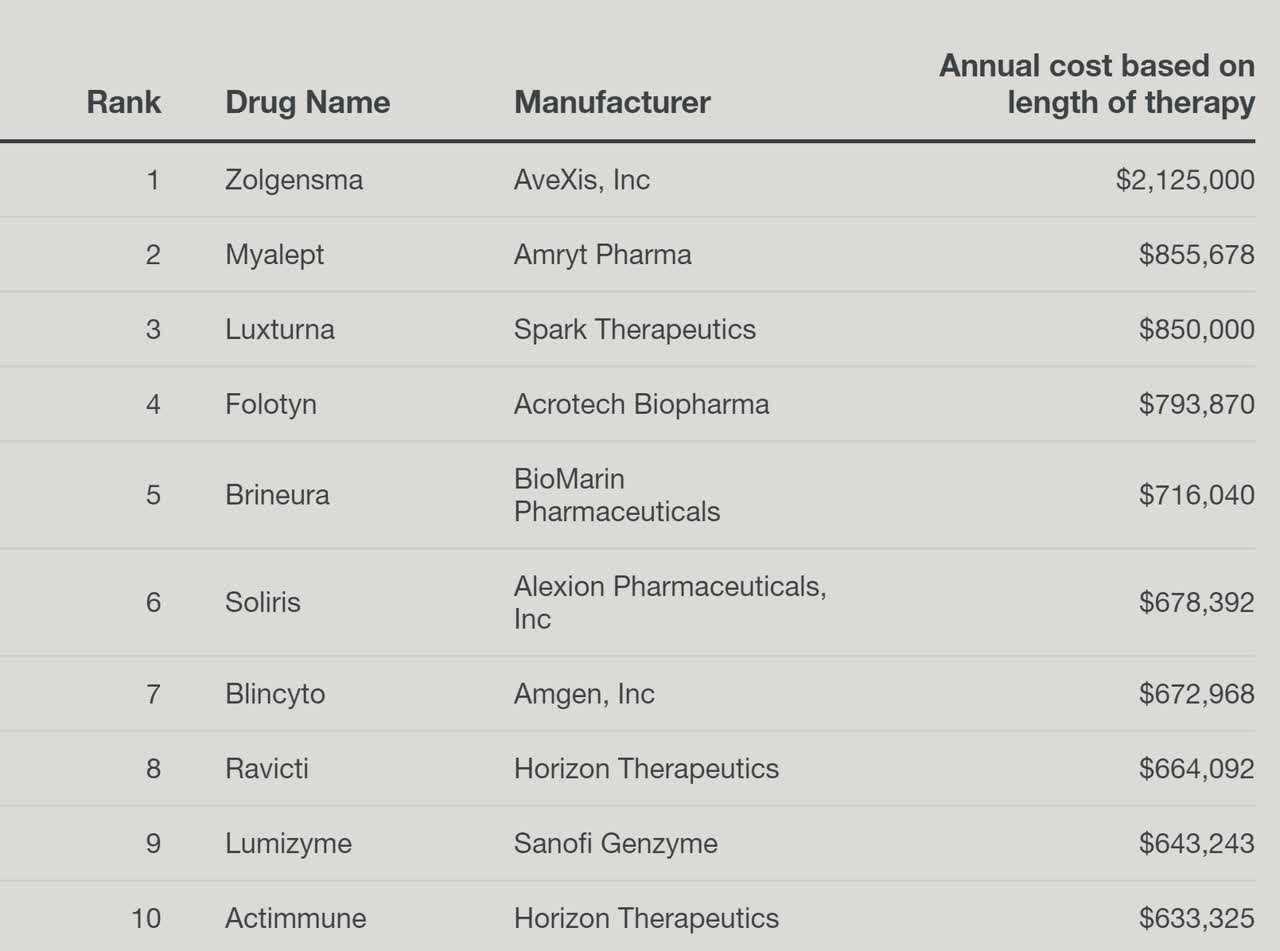

Source: As above

The treatment effect shown in this study is approximately the same as Remdesivir (0-31% depending on which study you look at), which costs $3,120 for a five-day treatment course. This study was on mild cases while Remdesivir is administered for quite serious cases, so the treatment effects cannot be generalised across the studies.

This study has generated some of the most positive press reports on NR to date, being picked up by MarketBeat (Chromadex's first exposure to a large distribution website) and the highly regarded Brian Nagel tipping a 60% share price surge.

Despite this and the impressive p-value, I’m want to see confirmatory data before declaring this a proof of effectiveness in COVID-19. If the study had been blinded, clearly randomised and used objective endpoints such as viral titre, the results would be very convincing.

However, it's known that self-reported symptoms like headache and cough are susceptible to placebo effects, and while 30% effect is not small it’s also not outside of the range seen in placebo for such symptoms. In addition, the study design was such that randomization problems cannot be ruled out, and the use of 5 therapeutic ingredients leaves us none the wiser which molecules helped, which ones hurt and which ones had no effect.

Together, the results are should be viewed as likely (i.e. significantly better than even chance) to have produced an effect, rather than the virtually incontrovertible proof of effectiveness that p=0.0001 implies.

This all said, the reported effect is mechanistically consistent with Dr Brenner’s hypothesis and the effect in an older population would be well worth studying.

3. China preclinical study

Scientists from several of the most prestigious institutions in China showed boosting NAD significantly rescued inflammatory cell infiltration and embolism in infected lungs, while cell death was suppressed by >65%.

COVID-19 POTENTIAL MARKET

At the time of writing, vaccines are not expected to provide sterilising immunity (i.e full protection) against COVID-19. This means that even with a vaccination, young and old alike are vulnerable to catching this coronavirus, and therapeutics, will be critical to improve health outcomes.

If NR is able to reduce the severity and progression enough, particular for the most vulnerable populations, it could prevent millions of hospitalisations, and many, many deaths.

Patients over 50 years old have 4x the chance of hospitalization and 30x the chance of death as those in their twenties, and the risk grows exponentially with each additional decade of life. For these populations, any improvement in outcomes could be a life-saver.

Source: CDC

Assuming NAD repletion is indeed effective; the greatest effect could well be seen in populations with the lowest levels of NAD.

An analogy would be topping of a gas tank - if it’s already pretty full, more makes no difference. If the tank is low, a top up might be just what the doctor orders.

PETS & LIVESTOCK

Our paw pals get old real fast, and all mammals share the have the same NAD production processes. On the subject of animals, there has also been a study suggestion NR may increase meat yield in livestock.

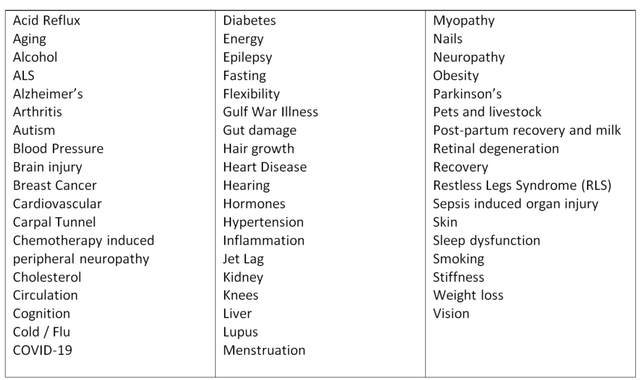

OTHER AILMENTS

The actual list of ailments for which people have claimed Tru Niagen to be effective for is extensive. Many in the list below have been complied, and more information on these of these can be found on RaisingNAD.

Note these are anecdotal, and the effect may be placebo or co-incidental.

https://schema.org/ImageObject">

Source: Compiled from RaisingNAD.com and other sources

BOOSTING NAD: BATTLE OF THE B3s

There are a number of ways to boost NAD, and it will surprise no one that the physician’s trinity of exercise, good diet and sleep also support higher NAD levels.

NAD is fundamental to life and the five precursors (nicotinamide, niacin, NR, NMN and tryptophan) are found in a vast variety of foods, such as meat, eggs, dairy and vegetables. The first three molecules are known as B3 vitamins, and its probably not be coincidental that all three are found in milk, the first food of infants mammals, including human babies.

Achieving the NR intake of supplementation is impossible using whole foods - for example, it takes hundreds of litres of milk to deliver a dose of NR, and kilograms of broccoli for a dose of NMN. However, whole, unprocessed foods contain high levels of NAD and NAD metabolites from which NR, NMN and NAD can be synthesised.

For NAD boosting, tryptophan is much less efficient and rarely recommended as a NAD booster. Following is a quick review of the state of the remaining NAD precursors, and why NR appears to be the best of them.

1. Niacin: Cheap but has Nasty Side Effects

Niacin is inexpensive (about $0.15 a day vs $1.50 a day for NR), shown to improve blood lipids and likely effective as a NAD, but there are concerns over flushing and impaired glucose control at high doses. “No-flush” niacin is available, but is actually inositol hexaniacinate, a niacin precursor and its use has been associated with liver toxicity. The ability of nositol hexaniacinate to boost NAD is unclear.

2. Nicotinamide (NAM): Cheap but Limited

Comparably priced to niacin, has proven effect in preventing skin cancer and no serious long term side effects. Though it is an effective NAD booster, it has limitations particularly feedback inhibition, and a reduction in effectiveness with age and concerns it may depress sirtuin activity. While the jury is out on the exact role of sirtuins, turning them down is generally agreed to be a bad thing.

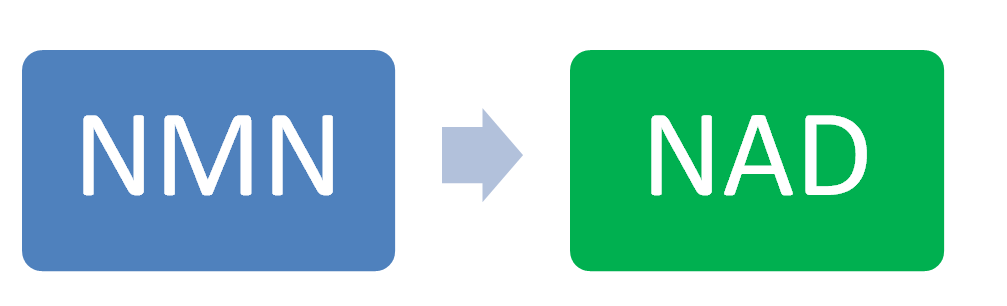

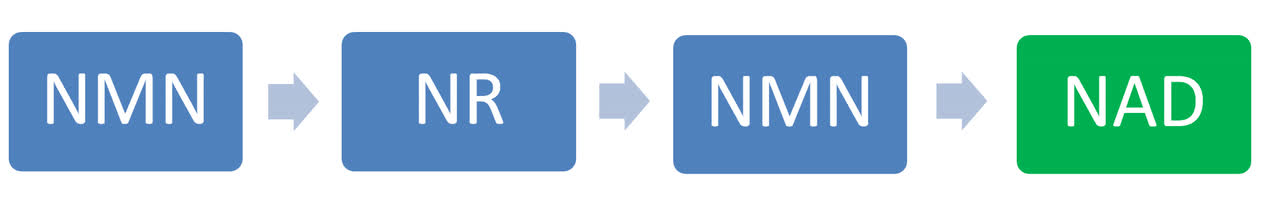

3. NMN: A Precursor's precursor

is the best known of the NAD precursors, but may not be the best. Its fame is due to two factors – Harvard Medical School Professor David Sinclair (See FAQ: Cast) has it in his personal supplement stack and it’s been touted, probably incorrectly, as being a more direct precursor of NAD than NR.

Despite what NMN users think, it appears to be a precursor to NR, rather than a precursor to NAD.

NMN supporters (Likely Wrong)

Source: Analyst

NR supporters (Likely Right)

Source: Analyst

NMN vs NR

If NMN entered cells as NMN, then it would not need NR kinase to elevate NAD+. We knocked out NR kinase. As expected, NR could not be used by cells from these mice to make NAD+. We and others showed that NMN loses its phosphate outside cells

-- Dr Charles Brenner

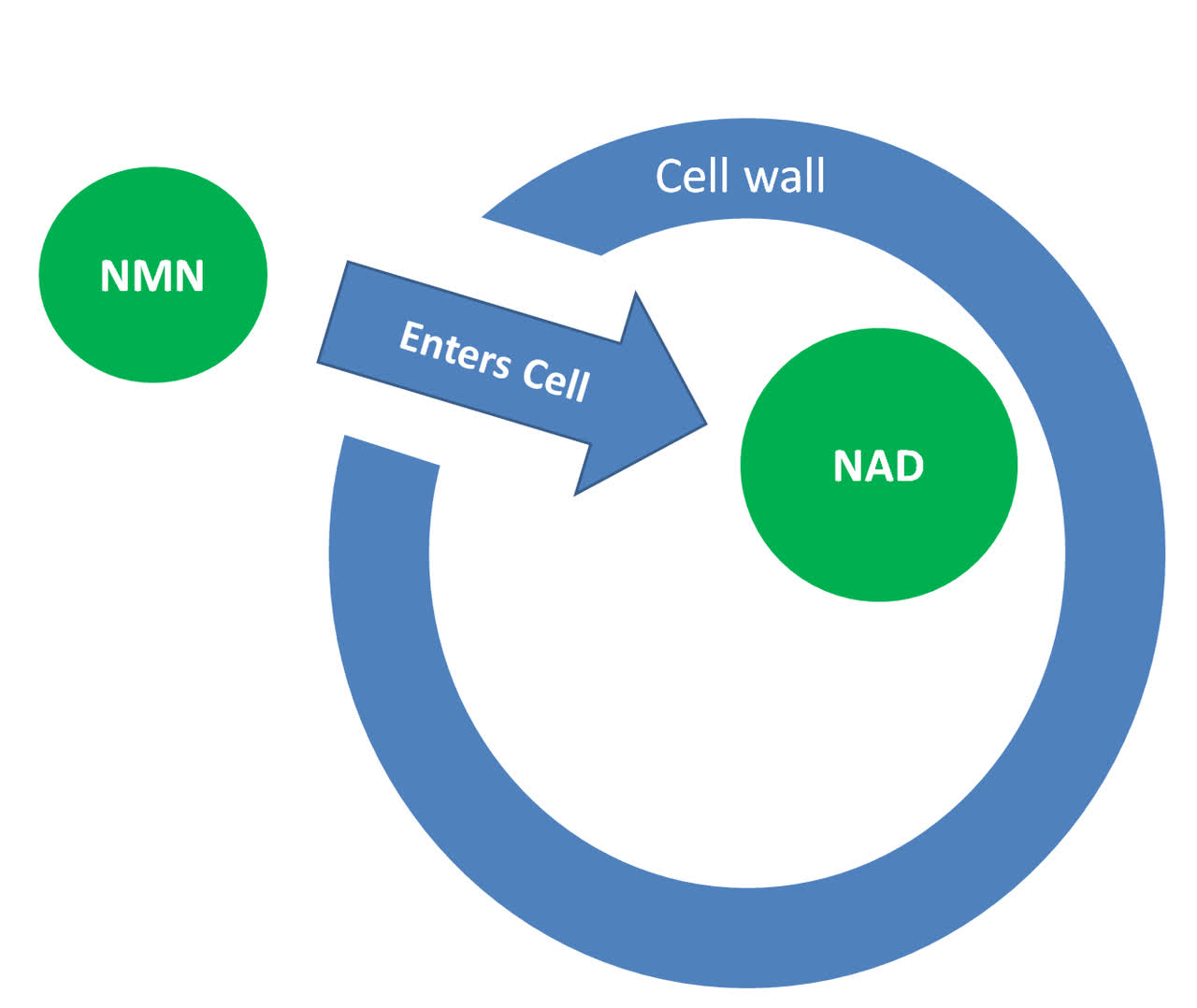

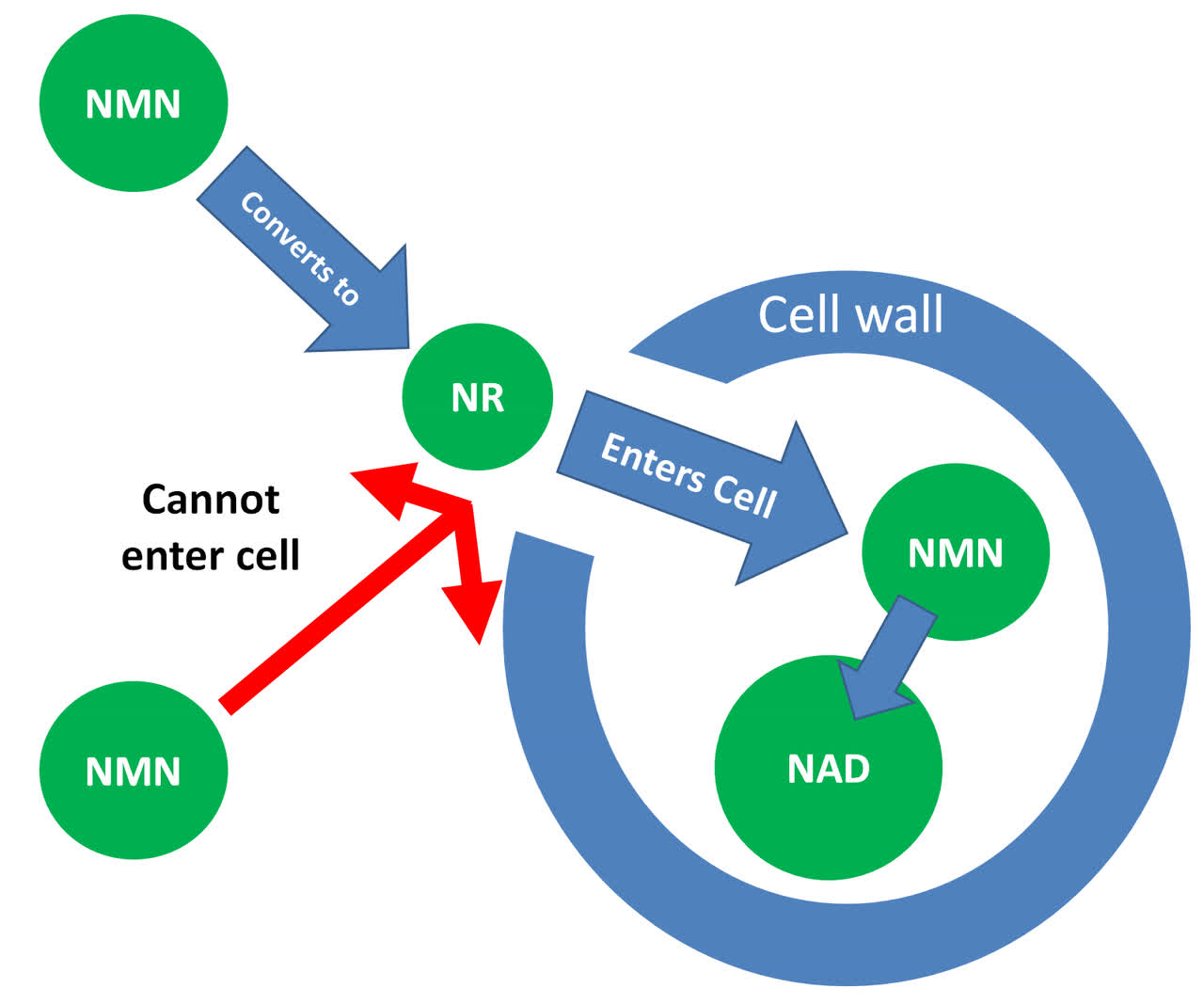

A number of research papers cite NMN as being the direct precursor, and hence superior as NAD booster. While it’s true the NMN is the molecule that is a step before NAD, there is significant evidence that NMN does not enter cells whole, and instead is first broken down to NR before entering cells.

This would mean that rather than being 1-step from NAD as some claim, NMN needs 3-steps (one backward then two forward). This would rank NR as the more efficient 2-step process. An analogy would be move a big bookshelf to your house. If you can’t fit it into your car, it’s better to get it as slabs ( NR) than pre-assembled, and having to pull it apart to move it (NMN).

In other words NMN is the precursor to the NR.

A review of the literature suggests the weight of evidence supports the view than NMN doesn’t enter cells directly:

1. NMN is a nucleotide, meaning it has an attached phosphate group. Nucleotides don’t enter cells unless the phosphate group is stripped off (pro tip: NR is NMN without the phosphate group). This phosphate group is why NMN is not considered a B3 vitamin – it is not the type of molecule that would be considered a vitamin.

2. The only purported NMN transporter identified in mammals is in the small intestine of mice, its existence and function is disputed and even then the amount of NMN involved is small.

3. Some well cited works on NAD agree with this view, for example a paper by Nestle scientists and others including Dr Brenner stats “Irrespective of the circulating NMN concentration, our work indicates that NMN dephosphorisation to NR constitutes a critical step in order to act as an exogenous NAD+ precursor”

True Niagen: Chromadex’s patented NR

NR appears to be the best NAD booster available, and Chromadex the best source of it. The cost is higher, but not extortionately so. A three pack works out to $4.80/gram on Amazon.

This puts the bottle recommendation of 300mg dose at $1.40/day. NR is well tolerated, and many people take dose such as 500mg or even 1000mg a day ($2.40-$4.80/day). Prices can be about 25% lower through long term subscription on Chromadex's own website.

Proven: NR is clinically proven as a NAD booster, and the pathway used for conversion to NAD does not appear to cause feedback inhibition. NR also has proven bio-availability and known pharmacokinetics in the form it is taken. In other words, taking Chromadex’s Tru Niagen capsules means taking the same product in the same way as study participants. As a contrast, many NMN studies have used intravenous injection.

Quality: Chromadex prides itself on quality, and even the name reflects this, with“chroma” being a word describing the purity of color. This Colorado Company started out life as a supplier of reference and research grade materials, and you can find their name as a supplier of materials on independent research reports. In this, it fills a role like “Le Grand K” the cylinder of platinum-iridium kept triple-locked in a Parisian vault and used for a century to define weight of a kilogram.

u Niagen is manufactured in the US, with the raw material made by W.R.Grace (NYSE:GRA), and packaged by companies such as Best Formulations and 4Execlsior of California.

u Niagen is manufactured in the US, with the raw material made by W.R.Grace (NYSE:GRA), and packaged by companies such as Best Formulations and 4Execlsior of California.

Each of these companies has rigorous quality control processes and in-house testing you can read about here, here and here. Chromadex itself used to own a quality consulting arm and was recently accredited under ISO/IEC 17025:2017, the world’s most respected quality management standard to test Tru Niagen.

All this put together means that Tru Niagen is thoroughly quality checked, which helps it to meet rigorous requirements of companies like Nestle, which has stringent standards on quality, traceability, sustainability, labour use and so on.

Safety: Three FDA Safety notifications - twice successfully reviewed under FDA's new dietary ingredient (“NDI”) notification program, and also notified to the FDA as generally recognized as safe (“GRAS”). NR also has received regulatory acceptance by European, Canadian and Australian bodies and has been used by hundreds of thousands of people for years.

NMN's only safety trial was with 10 people being given a single dose at no more than 500mg, half the typical dose. Even if the molecule was safe, most of the NMN raw material is produced in China. NMN also is said to be susceptible to degradation in heat and humidity which mean storage and transport can be issues.

Well Researched: NR has been studied in many preclinical trials and a dozen clinical trials. Notably, the amount of research interest continues to grow rapidly, and many studies involve prestigious institutions with first rate labs.

Even without patents, Chromadex will be able to sell well with some combination of being a trusted brand name (like Tylenol, Advil, Bayer Aspirin, Centrum etc.), patent extensions (3 years for new use cases) and orphan drugs, which can enjoy 7 years of patent protection.

Patent extension is a science and art, and it's also fairly common to patent new formulations, such as the fairly common "extended release" formulas. Though the grant of such patents is not assured, it is widely accepted that encouraging innovation with improved products is desirable.

Ultimately, it's the courts rather than the Patent Office that decides whether a product meets the twin test of "Novelty" and "Non-Obviousness", but the very existence of a patent means that anyone making a generic needs to be ready to challenge a patent in court. This is a classic free rider problem, as a successful challenge invites competition from all and sundry. Your dime, everyone's free phone calls.

It is interesting to note that patented forms of insulin are sold today, despite being invented almost 98 years ago.

Chromadex also has patents over a reduced form of NR, called NRH (dihydronicotinamide riboside). There are few published studies on NRH. One of the studies shows it’s orally available, effective at increasing NAD levels and works on a synthesis pathway different from NR. There is evidence it may be even more effective than NR at producing NAD and may be more stable in blood plasma.

There is an undercurrent of excitement around NRH, but little is known by the public about this molecule. Its likely Chromadex has proprietary research on NRH but sensibly chooses not to back two horses in the same race, which would split its resources, restart the research and brand building clock at zero and perhaps bring little or no net sales increase. Instead it is devoting resources to validating (i.e. strengthening and proving health claims) and marketing Tru Niagen for at least the next few years.

This is also a sound strategy to avoid cannibalization of Tru Niagen sales. It is also more than possible that Chromadex intends to keep NRH as a drug version, and backing two horses in two separate races makes a lot more sense than backing two horses in the same race.

This would also allow it to charge for value, as Tru Niagen is too cheap for a drug treatment. (See FAQ: Supplement or Drug?)

Source: Here

The NRH patents were granted in 2017 and patents last 20 years, with minor variations based on circumstances.

VALUATION

At its current market value, Chromadex trades at ~5x FY2020 sales, which is undemanding given it has tripled sales from 2017-2020 (CAGR has ~45%), has 60% gross margin and is close to cashflow breakeven. Based on current sales growth, Chromadex will achieve its first profitable quarter in the first half of 2022.

Furthermore, sales have potentially tremendous upside, and any number of events could result in a stepwise boom in sales:

Higher dosages: The standard bottle recommends 300mg of Tru Niagen, and there is also a 500mg “Pro” version available through physician channels. The 300mg dose for regular use is based on 2016 GRAS application, which was extremely conservative. Having read the safety trials in detail, there's little reason the number cannot be 1g a day.

It may be that Chromadex didn’t want to be too aggressive in its GRAS application or wanted to keep the daily dose and cost more affordable. Tru Niagen is also a fine powder and the volume of a gram is many times that of a gram of sugar or table salt, so perhaps there there was also a consumer acceptance aspect to the dosing.

It’s also clear from various interviews that the people closest to the science – Rob Fried, Frank Jaksch, and quite probably Charles Brenner -- take more than 300mg a day. (CEO Fried takes 1g or more as a COVID-19 strategy)

A study that shows the optimum dose to be higher than 300mg could boost sales greatly. Not everyone will take the higher dose, but plenty will (i.e. 300mg = good. 500mg = better. XX00mg = best). Assuming this happens, and 30% of customers go to the 500mg prodose, sales would rise 20%. This is enough to take cashflow and profit deep into the black.

Strong clinical trial results: It’s often forgotten that Tru Niagen hasn't been around all that long – it obtained GRAS (Generally Regarded as Safe) status in 2016, sold less than $200K of Tru Niagen in 1Q2017, and the first clinical trial was in 2018. There are a number of ongoing clinical trials and a successful trial could drive sales up powerfully.

Building a solid base of clinical research is also critical to driving awareness, media coverage and finally tapping doctors as a sales channel.

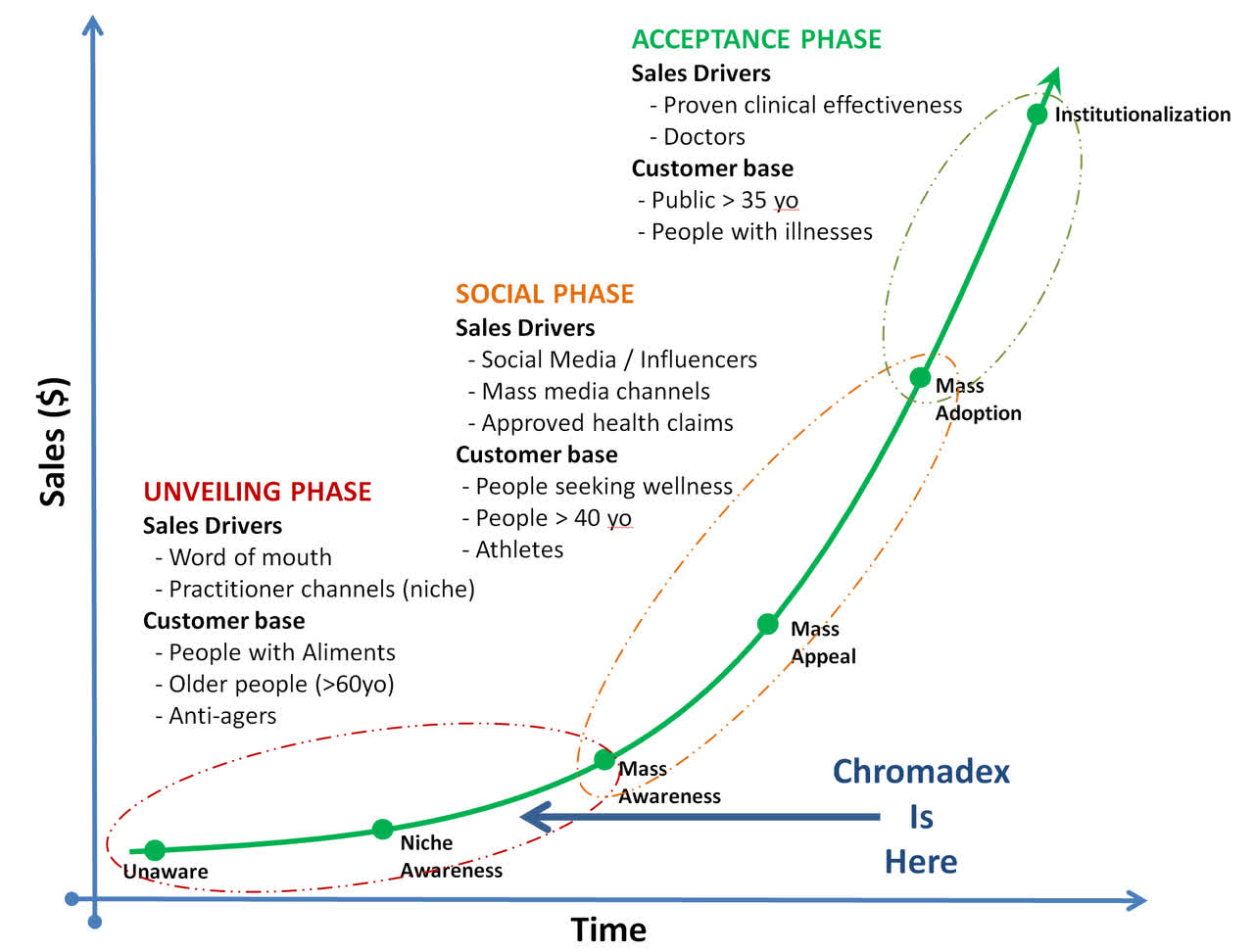

TRU NIAGEN ACCEPTANCE CYCLE: THE BULL CASE

Source: Analyst

Launch into new markets: Tru Niagen is currently selling directly to consumers in a small number of markets, and most sales come from just two countries – US and HK.

Hong Kong has been a stunning success, easily outselling the US on a per capita basis. Indeed, Tru Niagen is reportedly the top supplement out of the thousands sold by Watsons in Hong Kong, with sales so brisk that they offer a recycling program for empty bottles.

In HK and Singapore where Chromadex offered limited country retail exclusivity, Tru Niagen has been heavily promoted by Watsons, with large banners and prime in-store product positioning. Watsons has over 15,000 stores globally, though like most large retailers, has localised decision making so that Chromadex needs to negotiate specific arrangement in each country.

There’s currently a soft launch of Tru Niagen into a small number of Superdrug stores in the UK, which is part of the same group as Watsons. There are no indications how well sales are doing, but it would not be surprising if the promotion and roll-out were affected by COVID-19.

In addition to retail distribution, each country around the word (and even for countries in the EU) may have specific regulatory requirements for registration and marketing approval. As such, Chromadex also needs to work with country regulators to sell in such countries.

Markets such as China, Japan and Germany represent huge untapped opportunities for Chromadex to grow sales. Indeed, in China, rival NAD precursor NMN is referred to in the press as the ” Elixir of Life”, and NMN related stocks have seen their prices surge. This sector has attracted recent regulatory attention due to the untrue claims it is FDA approved, labelling and import irregularities, and some questions about the claimed bio of a prominent player.

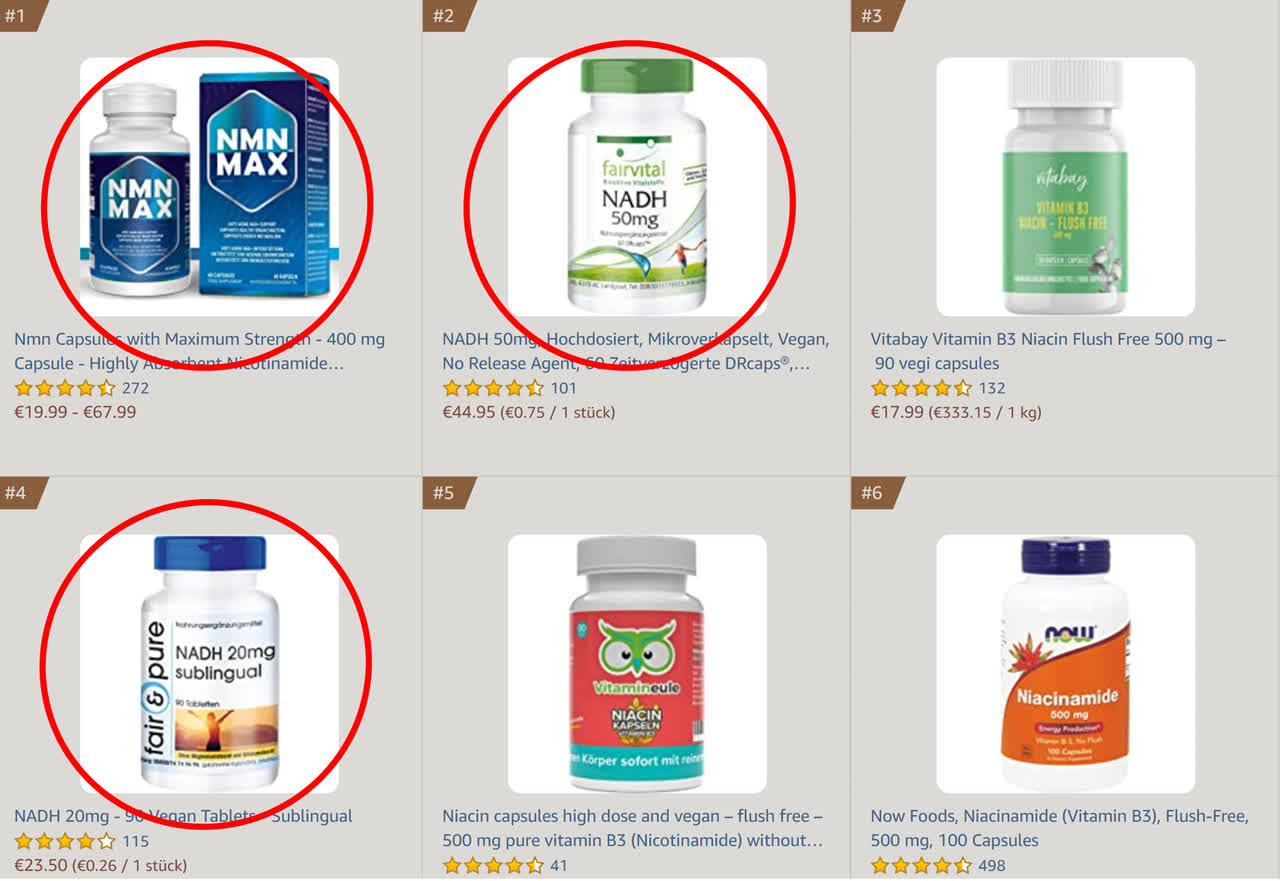

Takes market share from NMN: This is somewhat related to new market entry. Many people interested in NAD take NMN or NAD directly, and are unaware that NR is likely better than both. As True Niagen enters markets, it is likely to convert such users to NR. Based on market awareness, the sale of these products is easily larger than NR, and while no hard data is publicly available, 2-3x larger seems plausible.

TOP B3 VITAMINS AMAZON GERMANY: 3 NAD BOOSTERS AND NO TRU NIAGEN IN SIGHT

Screenshot October 28, 2020

|

SUMMARY Earnings results have been deliberately omitted from this report because it’s a mistake to invest in Chromadex based on the next quarter’s results. This report was written to help build awareness of Chromadex, its business plans, and provide a basis to evaluate its long term value. The actual investment thesis is actually pretty simple: 1. Tru Niagen is a product with enough promise that 200+ studies have been inked 2. Chromadex’s patent position is stronger than the market fears 3. $300m market capitalization is way too low for a company with this much promise The science and marketing isn't just my opinion, it’s a view shared by Swiss giant Nestle, which launched a new line featuring Tru Niagen and Horizon Ventures, which recommitted money in Chromadex this year. Assuming the science and patents hold up, Chromadex offers an incredible risk adjusted return, with upside of 5-20x the current price. This may take a few years, but in the words of Philip L Carret " Patience can produce uncommon profits." |

Part 4, the final part, will be published tomorrow.