Based in Singapore, David Leow is a private investor as well as advisor to public and private companies. His companies have won numerous awards for growth, innovation, corporate governance amongst others. A former equity analyst with HSBC, David is a charter holder with the Chartered Financial Analysts Institute (USA) as well as the Institute of Chartered Accountants (Australia). He is also a graduate of the Owners/President Management program and Harvard Business School.

Based in Singapore, David Leow is a private investor as well as advisor to public and private companies. His companies have won numerous awards for growth, innovation, corporate governance amongst others. A former equity analyst with HSBC, David is a charter holder with the Chartered Financial Analysts Institute (USA) as well as the Institute of Chartered Accountants (Australia). He is also a graduate of the Owners/President Management program and Harvard Business School.Figures cited in article are in USD

|

Summary

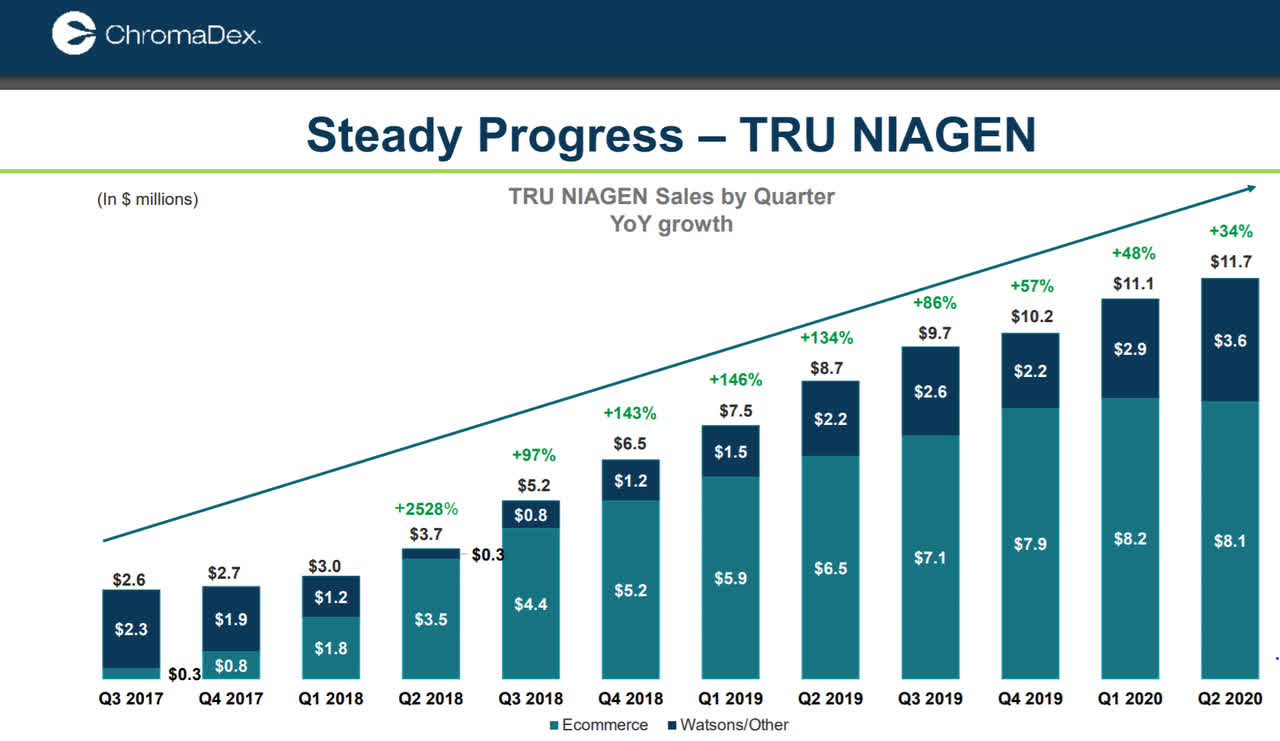

Tru Niagen, CDXC's patented product, showing strong promise in billion-dollar markets. Market underestimates strength of strategy and length of its monopoly. 1 in 1,000 Americans use Tru Niagen. Nestle and Horizon Ventures ($15b profit on Zoom) like Tru Niagen. 2017-2020 CAGR 45%, 60% Gross margins. |

There’s a little company on NASDAQ that makes a product that no-one can pronounce.

That company is Chromadex (CDXC), the maker of a patented small molecule called Nicotinamide Riboside, sold under the brand name Tru Niagen.

Why should you care about this company?

How about this – tech companies make their bones on a “Rule of 40” – revenue growth and gross margin adding up to at least 40.

Chromadex is doing double this, with revenue tripling from 2017-2020 (45% CAGR) and gross margins of 60%.

Source: Chromadex Investor Presentation, August 2020

This is the first comprehensive research report on Chromadex: What it does, why you should care, and how it could be one of the most undervalued companies of our generation.

This is a long report and here are some spoilers:

Chromadex has exclusive patent rights on Tru Niagen, a new form of Vitamin B3 that’s showing remarkable promise in dozens of billion dollar markets.

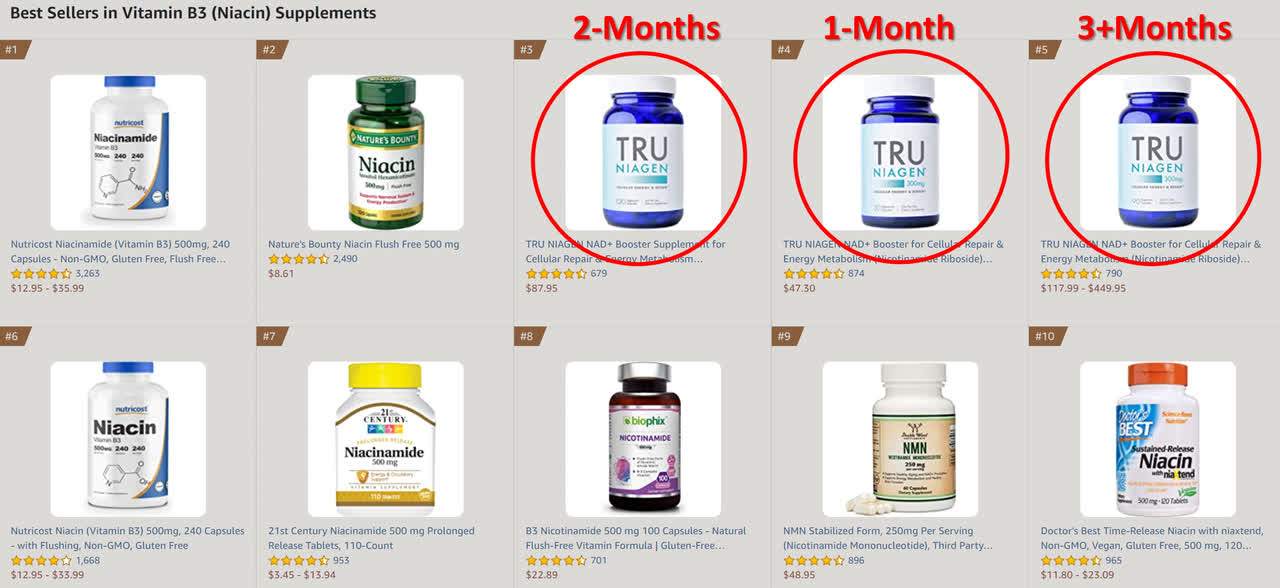

Your doctor hasn’t heard of Tru Niagen, but 1 in 1,000 Americans supplement with it daily and it’s one of Amazon’s best-selling Vitamin B3s. Multi-bottle packs are more popular than individual bottles, a sign of repeat buying.

Amazon Screenshot: Top Selling B3 Vitamins (26th October 2020)

- Tru Niagen is so promising that 200 research collaborations have been inked - many with top names such as Mayo, Cambridge, St Jude’s and NIH

- Human clinicals are more promising than reported – the scientists are signing off on press releases, not the copywriters

- Swiss giant Nestle is ramping its Health Sciences business and endorsing Tru Niagen in two separate product lines

- Horizon Ventures, the VC of Li Ka Shing has taken the unusual step of making multiple investments in Chromadex at the listed stage. Horizon focuses on disruptive technologies at a relatively early stage and its superlative record includes Facebook, Spotify, Siri, and Zoom. They made enough money on Zoom in the past year to buy Chromadex 50x over.

- Bill Belichick (left, picture below) has a passion for getting things right. Dr Charles Brenner, Chromadex’s Chief Scientific Advisor has a day job and probably isn't being scouted for the team. What could they have been talking about?

Lastly, the market misunderstands Chromadex’s strategy *and* the strength of its patent position. Both are far stronger than the market realizes.

INVESTMENT SUMMARY

Despite a passionate community that has grown to 1 of every 1,000 Americans, Tru Niagen is almost unknown to medical practitioners and the general public.

As awareness of this highly promising product grows, a strong re-rating in the share price can be expected over the next few years:

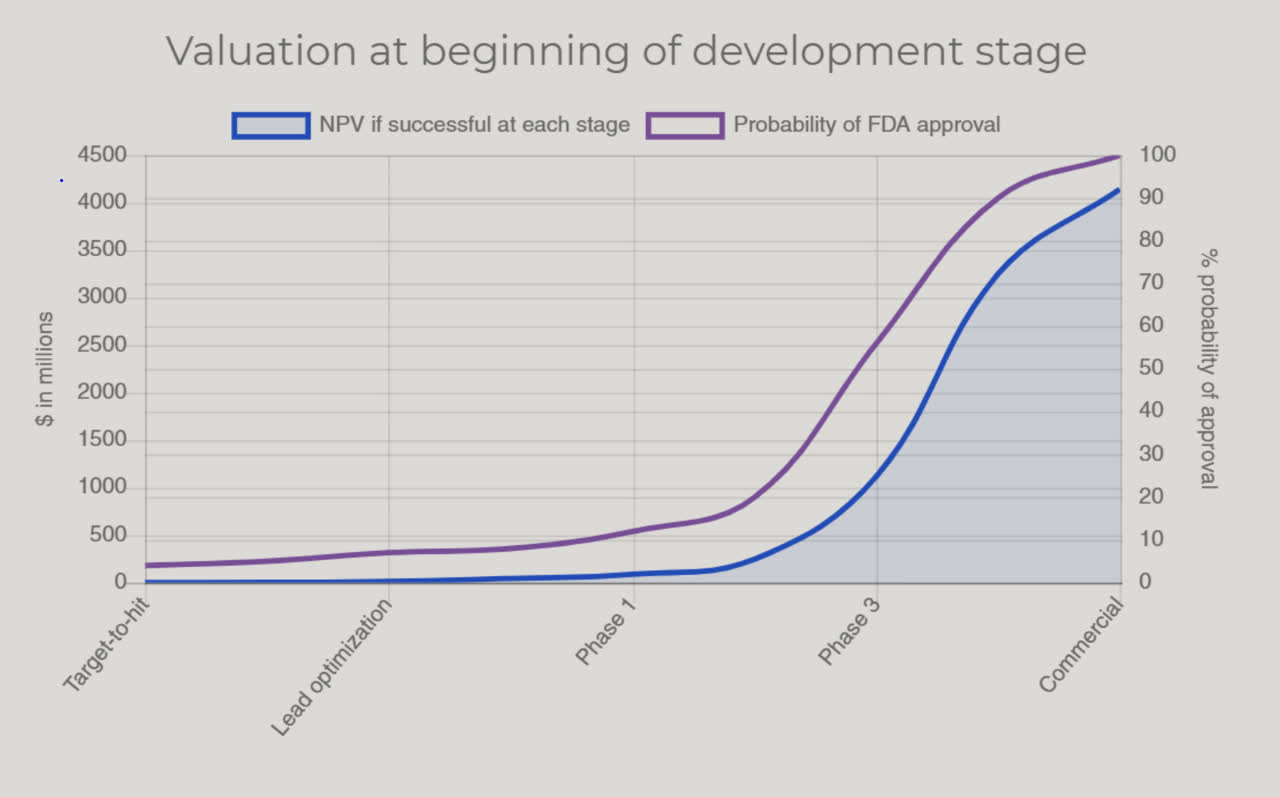

- Stepping into the Spotlight: The science of Tru Niagen is increasingly mature. Around a dozen clinical trials have been conducted, and results have been generally consistent and sometimes remarkable. At the same time, Chromadex is approaching both cashflow breakeven and profitability.

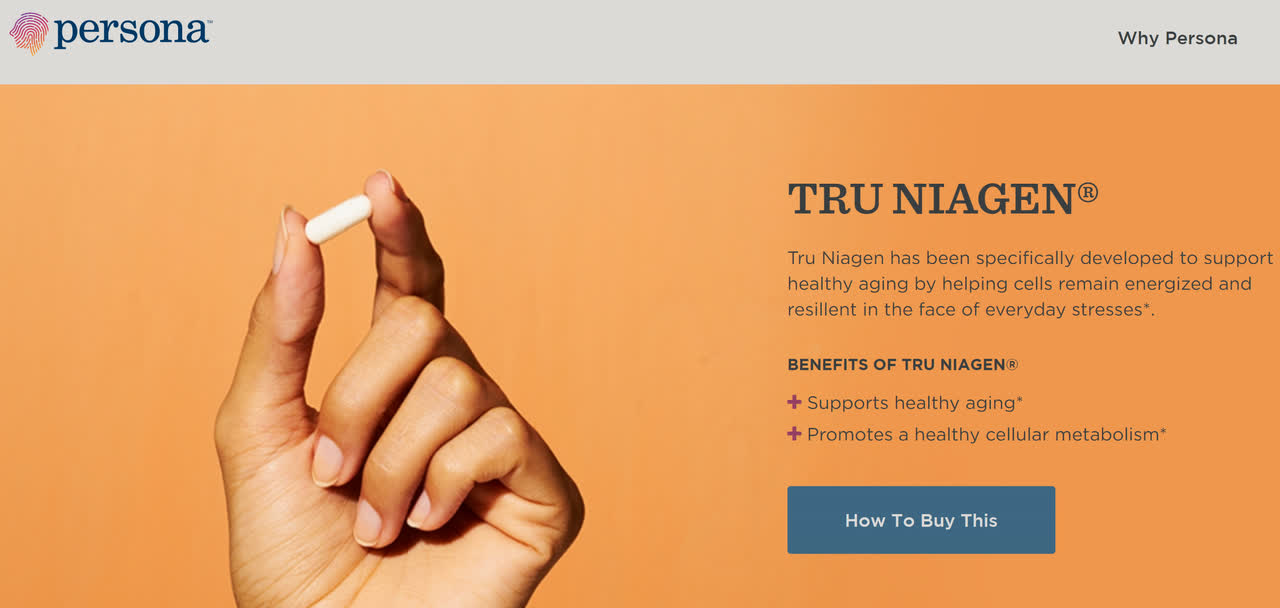

- Enter Nestle: The Swiss giant is making a huge push into health products, and has an exclusive supply agreement for Tru Niagen. There are two sites you can buy Tru Niagen - Celltrient and Persona, both owned by Nestle. Please see the Nestle section below for more.

Source: Nestle owned website

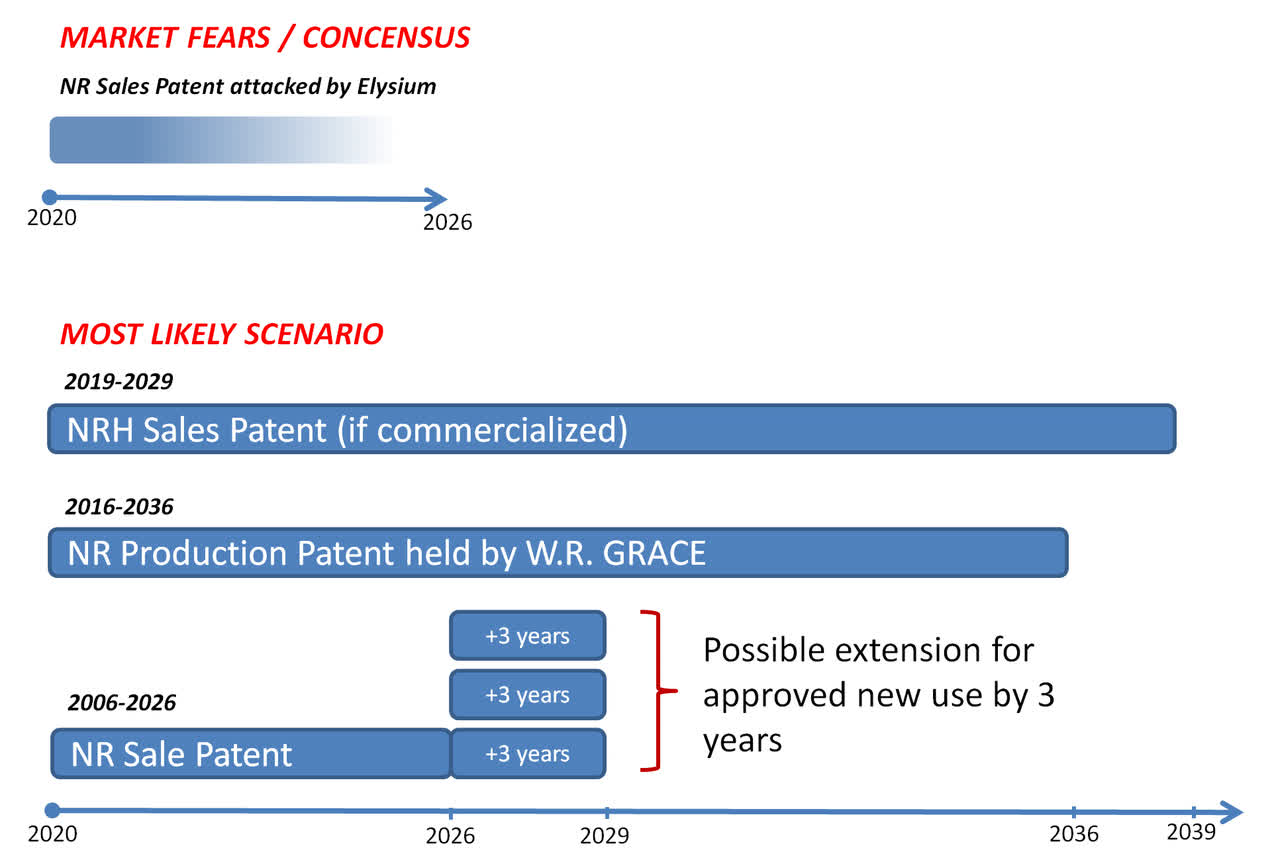

- Tru Niagen patents are ~3x what the market thinks: Comments and research reports on the subject indicate the market thinks the Tru Niagen patents expire in six years (November 2026). This is wrong – Chromadex’s monopoly on NR could run as far as 2036. This is discussed in detail (see Section “ Patents”)

- Buzz growing: The underground buzz from passionate users of Tru Niagen is similar to the excitement in the early years of keto, CBD and creatine, which developed fervent support a decade or so before being proven by science and are now largely mainstream. Awareness of Tru Niagen has been driving 45% revenue CAGR (2017-2020) and is rising to a tipping point.

- Market expansion: Tru Niagen sales are primarily from US and HK. In the years ahead, markets such as China, Europe and Japan could grow to be bigger still, even if existing markets grow to a multiple of their current size.

TRU NIAGEN: CHROMADEX’S PATENTED PRODUCT

SNAPSHOT: WHAT IS TRUE NIAGEN?

SNAPSHOT: WHAT IS TRUE NIAGEN?

Tru Niagen is Chromadex’s patented form of Nicotinamide Riboside (NR), a newly discovered form of vitamin B3, available online and proven to boost NAD levels in the human body. NAD is critical for hundreds of bodily processes and declines with age. Many people buy NR for anti-ageing, though this is not a label claim (See FAQ: Is it Anti-ageing). Tru Niagen shows great potential in preclinical and clinical trials for many serious human diseases (fatty liver, cardiovascular function, hearing loss, even serious nerve and brain diseases). Persona, owned by Nestle, has a page on Tru Niagen and you can read more about the benefits and science here

NICOTINAMIDE RIBOSIDE (NR): A NEW FORM OF VITAMIN B3

Tru Niagen holds so much promise that over 200 research collaborations have been inked.

Source: Chromadex

USAGE

Tru Niagen is sold in capsules, and a typical dose is 300mg a day. Many people, especially older people with ailments, take higher doses such as 600-1,000mg a day. At around US$5/gram, people spend US$500-1,000 p.a. on Tru Niagen.

SAFETY

Numerous studies indicate Tru Niagen is extremely safe. It’s naturally found in trace amounts in milk (and beer too!). NR is registered as Generally Recognised as Safe (GRAS) with the FDA, and authorised for sale and has approval for impressive health claims with the strictest regulatory authorities in the world – FDA, Health Canada, the European Commission and Therapeutic Goods Administration (TGA) of Australia.

Tru Niagen is not a drug (See: FAQ: Drug or Supplement) and is as easy to buy as any other vitamin. Its GRAS certification allows it to be sold in foods such as protein bars, shakes and chewing gum.

As a water soluble B vitamin, NR is not the type of compound that typically raises safety concerns. The bottle dose for Tru Niagen is 300mg, and safety studies have been performed for 12 weeks at 2g a day with no side effects. In the body, NR is metabolised into nicotinamide (another form of B3), which is generally considered safe for long term use even at multi-gram doses.

The 300mg dose was published in the 2016 GRAS application, which used highly conservative assumptions.

SALES

Tru Niagen is tightly controlling its sales channels, and sales are primarily through its own website and Amazon. It also sells in HK and Singapore through Watsons, a chain with retail stores as well as online shopping.

THE INVESTMENT CASE

The sections below cover the science and more in extreme detail. For now, let’s look at why Chromadex may be a compelling investment.

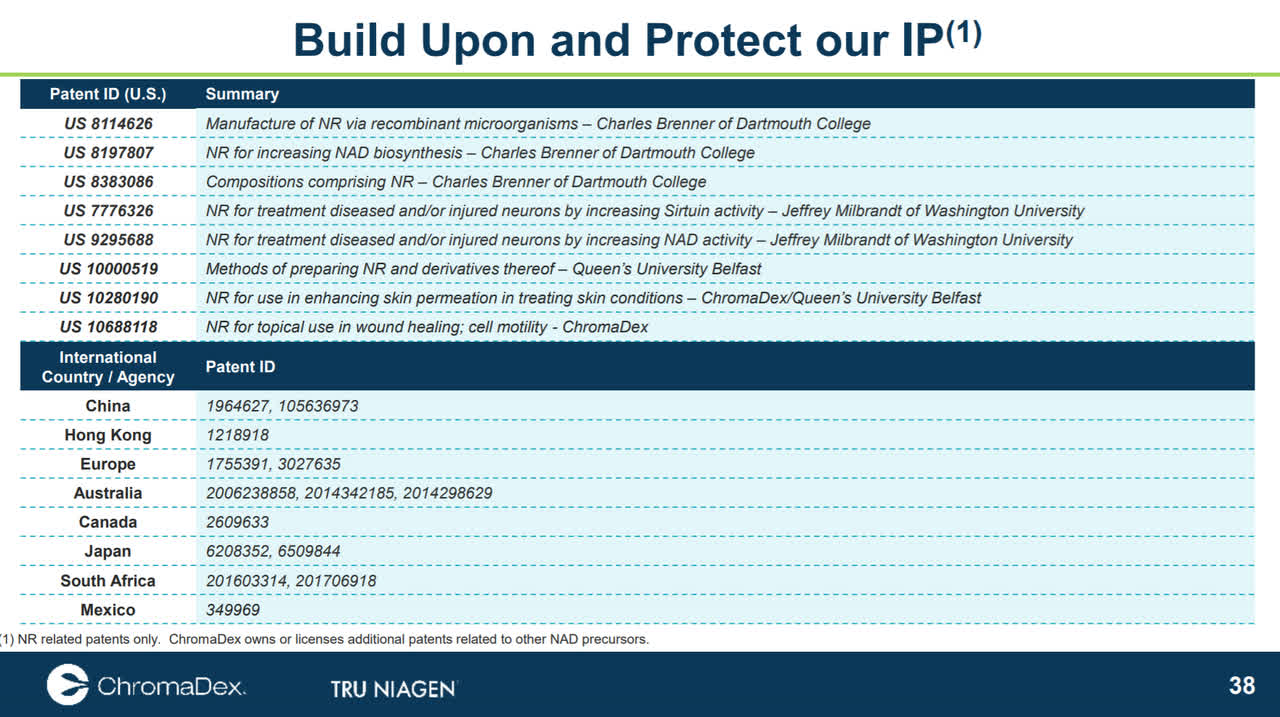

The company's market capitalization is tiny at around $300 million, considering it holds 20 patents around NR. Even if only a fraction of the use cases in the areas of study prove fruitful, the company is massively undervalued.

Patents

Source: Chromadex

Chromadex patents are extensive, covering an extensive variety of uses of NR until 2026.

What seems to be unknown by the market is that through exclusive supply arrangements with W.R. Grace, Chromadex may be able to keep a monopoly on the supply of Tru Niagen until 2036.

There's much more on the patents below, but the summary is that W.R Grace, Chromadex's exclusive supplier for Tru Niagen, has process improvement patents that run to 2036, and under the exclusive supply agreement they cannot supply to any other party.

These patents aren't listed on Chromadex websites because they don't own them, but they allow for effective retention of their monopoly to 2036. Please see Section: Investment Risks - Patents for more detail.

The first diagram is what the market fears, which also seems to correspond to the consensus market position. The second diagram is what the most likely Base Case will be.

Source: Analyst

THE SCIENCE OF NR

Independent sources are the most credible, and here are a few you can look at for more about NR.

Healthline put up a page a few months ago, and a blog that appears to be independent is here. There's a research paper of May 2020 summarising studies on NR. Finally you can find a listing of the research on a Chromadex-run website here.

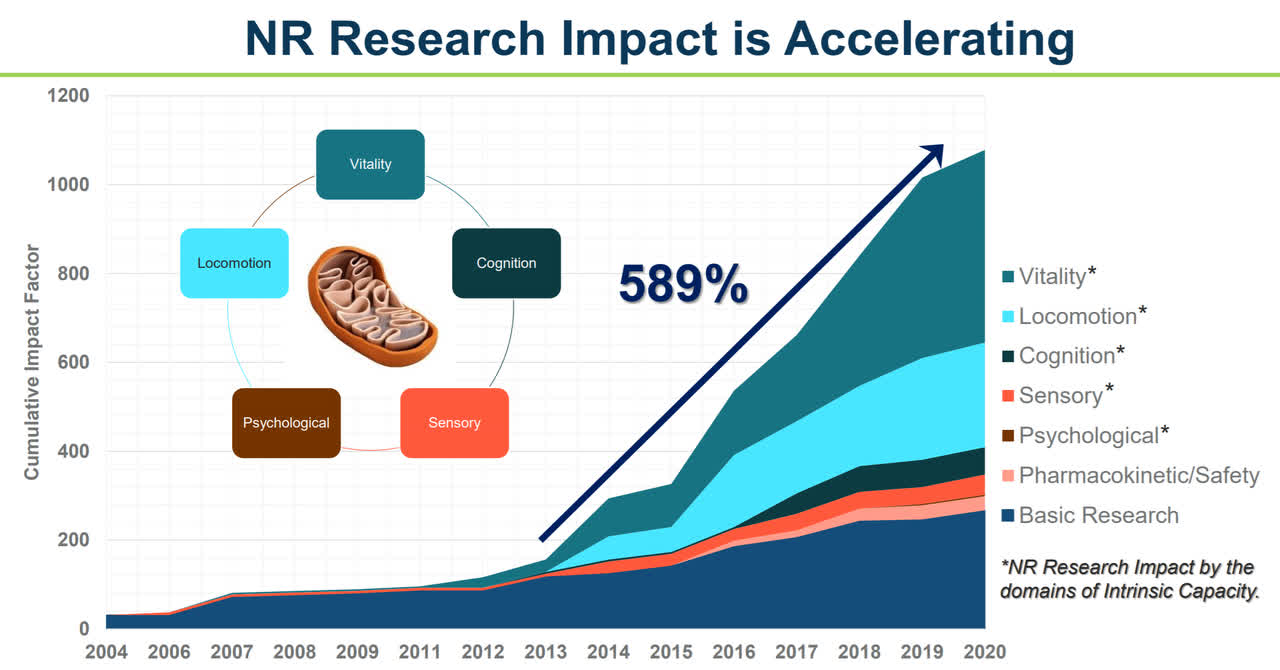

As with all compounds that undergo trials, there are more preclinical studies clinical studies on NR. They show many positive outcomes for health issues ranging from neurodegeneration to cardiovascular disorders, diabetes and even viral infections. There have also been promising results from clinical trials.

Source: Chromadex Investor Presentation

CLINICAL TRIALS

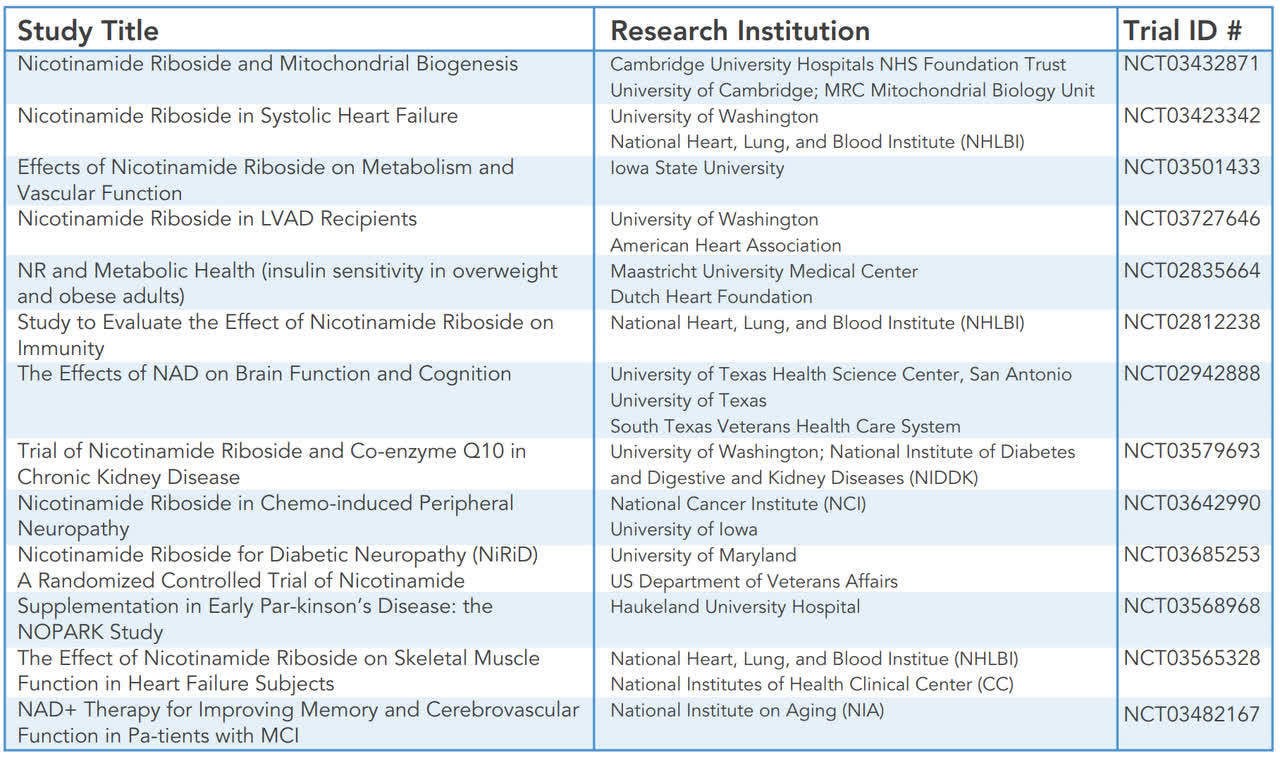

The following are studies by highly reputable institutions into the effects of NR in humans. If any single one (let alone more than one) of them is proven successful, Chromadex could be worth many times its value today.

Source: Bay Bridge Bio

There are 11 published studies and 56 listed on Clinicaltrials.gov. Results from four of the more interesting human trials are below.

|

Publication |

Dose/ |

Probability effect happened by chance |

Notable results |

|

1. Nicotinamide riboside supplementation alters body composition |

1g/day |

2% 2% 4% 2 % |

Decreased fat mass, particularly in women (37.35% ± 2.49% compared with 38.68% ± 2.58% in NR and placebo) Increased lean mass (62.65% ± 2.49% compared with 61.32% ± 2.58% in NR and placebo) Increased muscle acetyl carnitine, (4558 ± 749 vs. 3025 ± 316 pmol/mg dry weights in NR and placebo. See here for why some people think this a good thing Increased sleeping metabolic rate |

|

2. Chronic nicotinamide riboside supplementation is well-tolerated |

1g/day |

5% 3% |

Systolic blood pressure ( SBP) was 9 mmHg lower after NR vs. placebo in individuals with stage I hypertension. No change was observed in subjects with initial SBP in the normal range Reduction in aortic stiffness using the gold standard PVV measure |

|

3. A randomized placebo-controlled clinical trial of nicotinamide riboside |

2g/day |

13% |

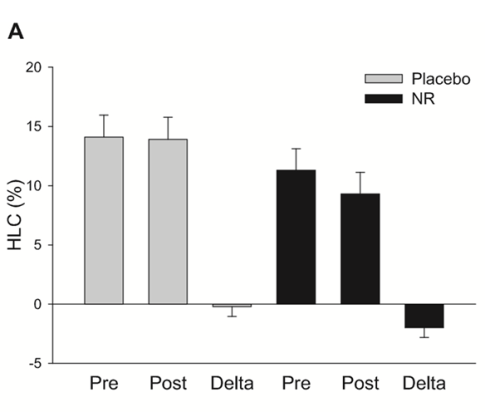

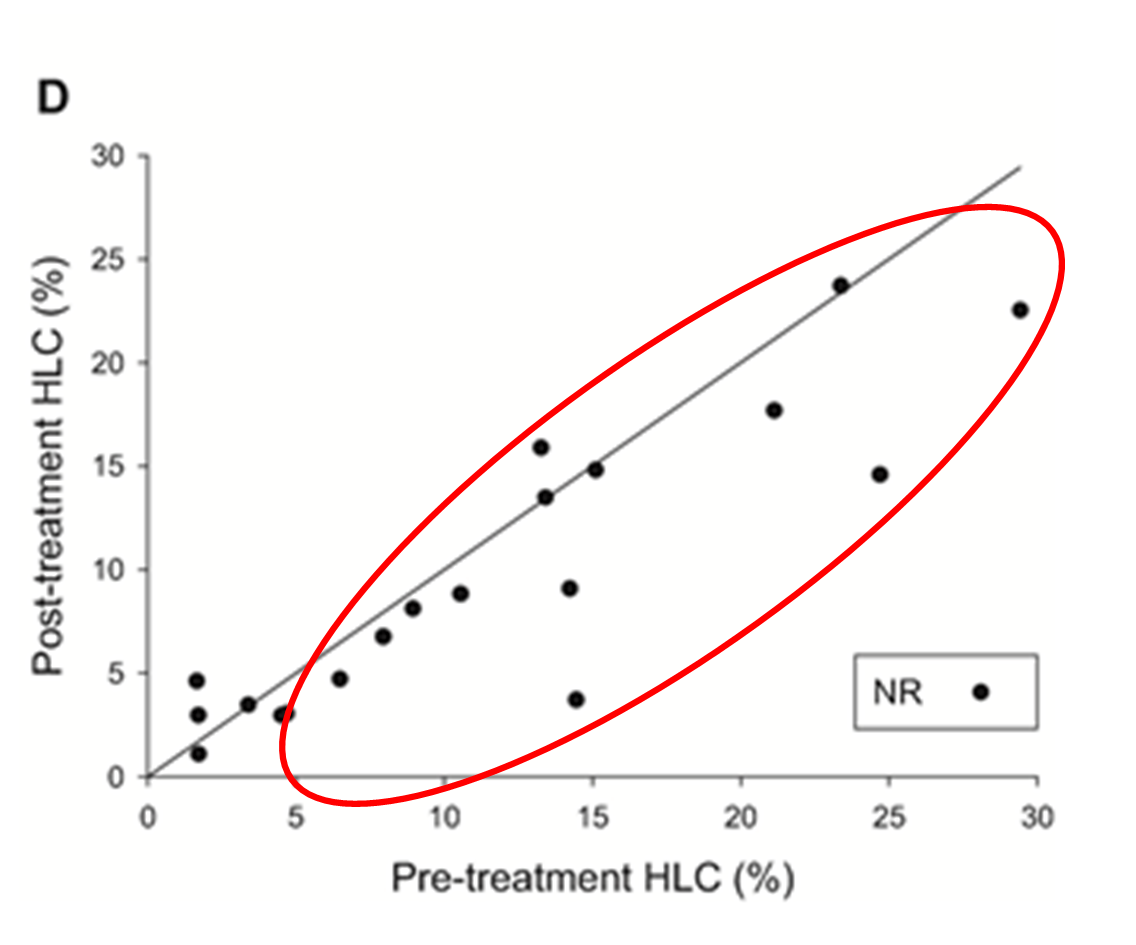

18% reduction in liver fat (i.e. hepatic liver content) |

|

4. Combined metabolic cofactor supplementation accelerates recovery in mild-to-moderate COVID-19 |

2g/day |

0.01% |

2 grams of NR, along with NAC, L-serine, and L-carnitine tartrate to the standard of care reduce COVID-19 recovery times by 30% as compared to the placebo group. At day eight, 67% of the treated group has no symptoms compared to just 27% of the untreated group. |

Source: Compiled by Analyst

Of the studies above, only the last was published as being successful.

In the first three studies, the results shown in the table above weren’t the primary endpoints for the study. To avoid False Positives from p-hacking (i.e. trawling through data until something is found), it's considered good practice to use a more stringent significance than 5% in such cases. (often using a Bonferroni correction). This higher significance level was not met and these studies therefore did not deliver results deemed to be significant.

Bonferroni corrections are known to be conservative, meaning they are biased towards rejecting true positives. Conservatism is absolutely correct in matters of medical science and nobody wants something false stated as true when life or health is at stake.

However, money is fungible and investors don't need such high standards.

Stated another way, for a life-or-death treatment that risks financial ruin, emotional devastation to patient and family and debilitating side effects, we want to be absolutely sure the treatment does something. As investors that run portfolios, return adjusted probability is plenty dandy.

In a section towards the end of this report, we take the second approach to re-look at the trial results (FAQ: A Deep Dive into the Clinical Trials).

As a taster, let's examine just the third study here. This was not published as successful, but look at the data below – fatty liver isn’t renown for spontaneous remission, and the charts surely make it look like something could be going on.

Indeed, the p=13% means there's 87% chance of the indicated fatty liver reduction. This is not enough to convince the medical community, nor should it. Science is rightly conservative and no one wants seniors and their families getting bled of dollars and hope with supplements like Prevagen.

However, studies to date on NR have too low power (i.e. too small) to detect anything other than fairly large effect sizes. The study results meed to be confirmed in large trials, but I will make the observation that the statistics tell us there is a good chance the studies will be replicated, and if they are, the implications are astonishing.

Change in Human Liver Fat

Part 2 tomorrow: here

You’re providing such valuable content for your readers.