| Avarga Limited (Avarga) has generated significant interest after my first article. This is a follow-up with a discussion on corporate actions (some confirmed, some speculative) and the impact on shareholders. In late-June 2020, Avarga declared a dividend policy with a payout of not less than 40% of net profit attributable to Shareholders excluding non-controlling interests and non-recurring, one-off and exceptional items, with effect from the second half of 2020. Based on the back-of-envelope calculation in my previous post on Avarga, this translates to a dividend per share of 1.63 Singapore cents. Based on the counter’s closing price of 26 Singapore cents, this represents a whooping 6.38% yield for 2H2020! |

Tong Kooi Ong, Executive Chairman of Avarga and owner of The Edge. Photo: CompanyBut what I think is more important, is the fact that management has delivered on what they had promised.

Tong Kooi Ong, Executive Chairman of Avarga and owner of The Edge. Photo: CompanyBut what I think is more important, is the fact that management has delivered on what they had promised.

Referring to page 5 and 6 of Avarga’s 2019 Annual Report on Chairman and CEO’s Statement:

| “Going forward, barring the occasional major capex needs and opportunistic acquisition deals, we would ideally like to have a dividend payout policy of 40-50% of net profit, to be paid out on a quarterly basis. This will provide shareholders with a constant and regular stream of dividends.” |

Basically, management is exhibiting credibility and following up on what they had earlier preached. This is a rare commodity for a listed company with small capitalization on the backdrop of shenanigans going on with some other small capitalized companies.

| "Avarga had grown from a single paper manufacturing business to include a power plant in Myanmar and Taiga in Canada and USA without stretching the balance sheet. The company have also distributed a staggering $80MM back to shareholders in total dividends in the past eight years." |

A careful read-through on the annual report also details the return on investments.

What can we expect going forward?

Firstly, I think the probability of periodic share buyback is high.

Avarga stopped buying back shares in FY2019 as cash flows from UPP (Power) were used for major overhauls. With the next major overhaul due in mid-2024 to 2025, new capital expenditure requirements will be low.

An exceptional performance that looks likely to roll over into 2021 for Taiga also guarantees ample arsenal for conducting share buybacks.

Secondly, management also shared on 24 August 2020 that it is reviewing opportunities and are implying plans for capital recycling in the short-term.

I think this is a fantastic endeavor. As previously mentioned, Avarga as an investment holding company suffers a holding company discount to the summation of its investments’ value. As good as the constituent investments are, the holding discount is detrimental to shareholders. A track record of realization of value through asset disposals (be it through an outright sale or listing), will compress future holding discounts.

While management had implied that their investment criteria is based on stable businesses producing steady cash flows, the synergy derived from these 3 disparate companies are not immediately noticeable. This could have resulted in a larger holding discount.

A capital recycling exercise can return some cash to shareholders and allow management to further sharpen their investment criteria to facilitate lower investment holding discount.

Which investment is likely to go?

Please refer to the following from Avarga’s reply to a SGX query.

|

“As an investment company focused on creating value through strategic investments, the Company is constantly considering possible corporate actions and exercises to increase shareholder returns. |

Based on the wording of the reply, it is evident that monetisation of UPP (Power) is in a more advanced stage as compared to UPP (Paper).

The merits of the monetisation of UPP (Power) are as follows:

|

1. Reduce Avarga’s exposure to the fluctuations of foreign currency exchange rates of a developing nation. |

Based on the above, I think the motivation to drive monetization of UPP (Power) to completion is present.

The merits of the expansion and/or potential listing of UPP (Paper) are as follows:

|

1. Listing of UPP (Paper) will inject fresh capital into the business with no need to depend on existing retained earnings. Reliance on retained earnings can mean that expansion is slower. UPP (Paper)’s listing will also provide it with an additional avenue for capital whenever it requires expansion; it can do its separate equity or debt issuance with little or no reliance on Avarga to grow. |

| "Avarga has a strong track record of returning cash to investors when they dispose assets, this allows investors in Avarga to share in the fruits of the company’s success. "The plans for UPP (Power) and UPP (Paper) will likely catalyze further upside to shareholder's dividends." |

Listing is a process that needs to run its course and based on Avarga’s reply we know this is still in its preliminary stage but certainly provides more upside than downside for investors.

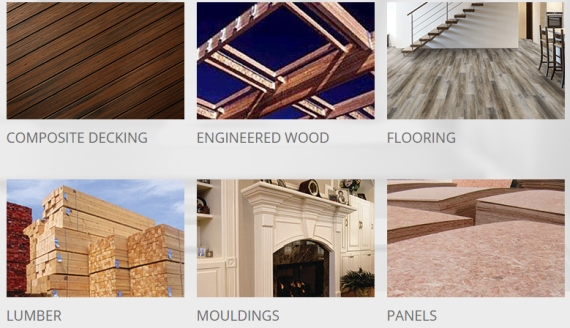

Examples of Taiga's products whose inventory has gone up in value with market prices. Photo: Company Examples of Taiga's products whose inventory has gone up in value with market prices. Photo: CompanyFollowing up on Taiga, I noticed plenty of news flow in USA on lumber prices staying elevated despite a down season for home improvement and building activities. This is beneficial for Taiga as higher lumber prices typically translate to higher selling value for Taiga’s products. |

This article was originally published on Golden Apple's blog.