| AEM and ISDN are among the top picks of KGI Singapore Research in its report 2H 2020 Outlook: Looking beyond the current pandemic |

Analyst: Kenny Tan

| AEM We continue to observe strong tailwinds for AEM, despite rising competition from Advantest in 2020. Advantest has stepped up efforts in gaining System Level Test (SLT) capabilities, with the acquisition of Essai in January 2020.  Executive Chairman Loke Wai San.We expect the development to have little to no impact with AEM’s main customer, as Intel does not reappear as a key customer on Advantest’s FY19 statements. Executive Chairman Loke Wai San.We expect the development to have little to no impact with AEM’s main customer, as Intel does not reappear as a key customer on Advantest’s FY19 statements. However, given Advantest’s branding, this is likely to have medium to long term impact on AEM’s overall market share of the SLT business. We also note that Intel has reappeared on Cohu’s financial statements as a key customer in FY19, with close to USD 65 mn of sales. Key upside: Further order book wins, onboarding of major customers.

While China’s overall goal is to seek self-sufficiency in the semiconductor industry, we think AEM remains a potential beneficiary, given the company and country’s relatively neutral geopolitical standing between China and US. Key downside: Competitors’ R&D, Huawei sanctions – the uncertainty behind it will not only delay base station and AEM’s tester kit rollouts, but also lead to the loss of potential customers, who may look towards other 5G equipment makers like Ericsson. However, impact is minimal on our target price, which remains at S$3.61. |

||||

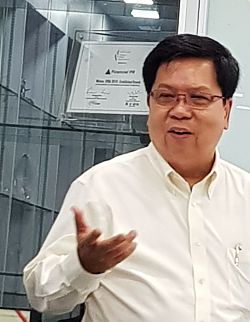

| ISDN Formed in 1986, ISDN is an engineering solutions company specialising in industrial automation (IA), working through the entire engineering stage from conceptualisation to production and after-sales engineering support. ISDN has their bulk of sales from China, supporting over 10,000 clients with both hardware and software solutions.  MD Teo Cher KoonIA has had a substantial downcycle, which was further dragged down by COVID-19 and US-China trade tensions. MD Teo Cher KoonIA has had a substantial downcycle, which was further dragged down by COVID-19 and US-China trade tensions. Orders from Japan Machine Tool Builders’ Association (JMTBA) illustrate the prolonged downcycle, where the latest released May data is likely to be the bottom, with a sharp QoQ % rebound. While global demand for IA is likely to remain sluggish, we think China will be the first to revive the industry, in alignment with its focus on digitalization and transformation away from labour and into tech. We expect upgrades to traditional industrial factories to become smarter, equipped with higher levels of automation and enabled by 5G, AI and IoT. These plans, while an ongoing process, are now further catalysed by the increased safety measures placed on human labour, such as the need for social distancing.

The rebound may have occurred as early as late March, as Schneider Electric and a few other major IA players report improving sales from China towards the end of 1Q20, with a positive China outlook. |