Excerpts from CGS-CIMB report

Analyst: Cezzane See

| 4Q19: Systems forge ahead! ■ FY19 core net profit of S$25.0m was ahead at 111%/109% of our/consensus FY19F estimates (S$22.5m/S$22.8m). Final DPS of 1.5Scts was announced.

■ Reiterate our Add call and raise TP to S$0.77 now on FY21F EPS, still based on unchanged 13.5x P/E (+0.5 s.d. of its 5-year mean). |

||||

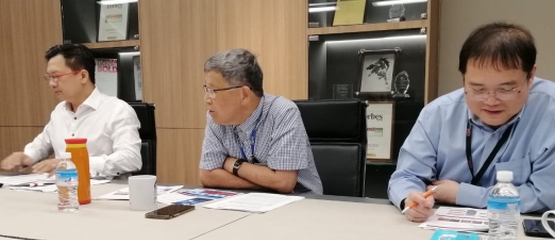

FY19 results conference call (L-R): CFO Eddie Foo | Non-executive Chairman Lim Ming Seong | MD Lim Boon Kheng. Photo by Ngo Yit Sung

FY19 results conference call (L-R): CFO Eddie Foo | Non-executive Chairman Lim Ming Seong | MD Lim Boon Kheng. Photo by Ngo Yit Sung

| • Revenues up on stable flow projects and new acquisitions |

4Q19 revenue of S$156.6m (+57.7% yoy) was ahead on healthier-than-expected oil and gas project execution.

CSE said that flow O&G contracts were significant, while Volta’s additional work provided further boost.

All in, FY19 revenue of S$451.8m (+21% yoy) was driven by O&G revenue which grew 18.7% yoy (S$294.1m); infrastructure revenue rose 4.7% yoy (S$115.3m) and M&M revenue was up by 170% yoy (S$42.4m) (Fig 3).

| • Core net profit up 10.6% yoy on higher GP and lower tax |

FY19 core net profit (based on continuing operations and excluding certain non-recurring severance, M&A costs and forex gains/losses) rose c.10% yoy to S$25.0m with net profit margin at 5.5%.

The uplift came from FY19 gross profit that grew 19.4% yoy and lowerthan-expected tax expense (effective tax rate of 20.4% vs. 25.7% our forecast)

| • Stellar order intake FY19 was a good year for CSE, with order wins rising 52% yoy. |

FY19 flow contracts grew +48% yoy, as activity levels picked up in all segments and on Volta acquisition; CSE also won some oil and gas greenfield projects (S$103m in 4Q19).

All in, this led to an end-19 order backlog of S$307.3m, the highest order backlog in the past five years.

| • Raise FY20-21F forecasts |

We raise our FY20-21F revenue forecasts by 5.0-5.9% given the high order backlog and as we expect flow contracts to grow sustainably.

We also raise our finance costs as we think they were too low previously and lower our tax expense (in lieu of the lower effective tax) assumptions.

Overall, our FY20-21F EPS forecasts increase by 4.3-5.4%. We also introduce FY22F EPS which features net profit growth of 1.3%.

| • Reiterate Add; still our preferred small-cap pick |

Cezzanne See, analystCSE remains our preferred small-cap O&G pick in part due to its Cezzanne See, analystCSE remains our preferred small-cap O&G pick in part due to its i) earnings growth potential; ii) sustained dividend; and iii) padded order backlog. Our TP rises to S$0.77 still based on 13.5x but rolled forward to CY21F P/E (+0.5 s.d. of its 5-year mean due to the company’s strong outlook). Stronger-than-expected order wins and GPMs are potential re-rating catalysts. Lower-than-expected order wins and GPMs are key downside risks to our Add call. |

Full report here