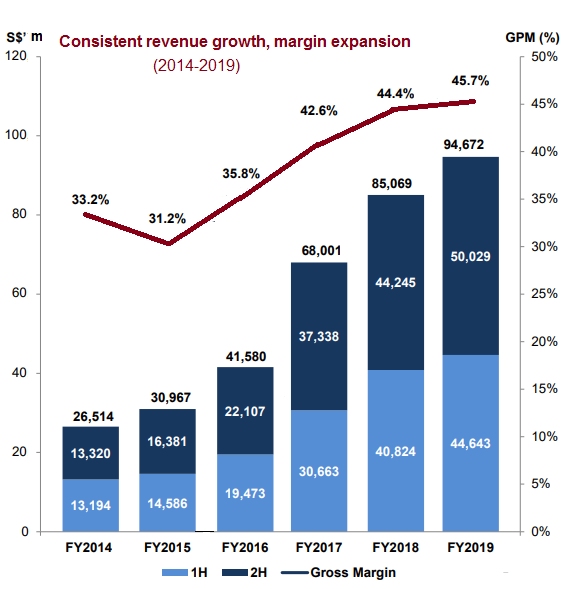

| Over five years (2015-2019), Singapore Medical Group (SMG) has added 22 specialists to its fold -- an 85% increase from 26 to 48. The pool grew consistently every year, mainly through acquisitions of other medical practices and through hiring of specialists from the Singapore government service.  At FY19 results briefing this week: Dr Beng Teck Liang, CEO of Singapore Medical Group. NextInsight photoAs management kept to that playbook, SMG's revenue and gross margin expanded over the past five years that the present management has been at the helm (chart below). At FY19 results briefing this week: Dr Beng Teck Liang, CEO of Singapore Medical Group. NextInsight photoAs management kept to that playbook, SMG's revenue and gross margin expanded over the past five years that the present management has been at the helm (chart below).Its consistency is probably unmatched among Singapore-listed healthcare companies, many of whom have a relatively small base of doctors and are thus vulnerable to departures or other forms of disruption. Yet SMG is arguably under-appreciated, as it trades at the lowest valuation -- on an earnings multiple -- among them (more on that later). For FY2019, it was record sales and record profit:

|

Steady revenue and gross margin growth is not the only hallmark of SMG.

Another one is its overseas expansion which, again, is unmatched by other Singapore-listed healthcare businesses.

• 2014, Jakarta: SMG sets up joint venture eye centre, Ciputra SMG Eye Clinic, offering Lasik and cataract eye surgery.  @ Ciputra SMG Eye Clinic. Photo: FacebookWith profits rolling in, SMG is looking to set up another eye centre in Surabaya. @ Ciputra SMG Eye Clinic. Photo: FacebookWith profits rolling in, SMG is looking to set up another eye centre in Surabaya.• 2017, Vietnam: SMG takes stake CityClinic Asia Investments which currently offers corporate healthcare screening and a wide range of specialist services. Its CarePlus clinics are located near an industry estate and the CBD of Ho Chi Minh City. By the way, the clinics have more specialists (>60, as per 2018 annual report) than SMG has in Singapore. • 2018, Australia: Jointly invests with South Korea's CHA Healthcare Group to take a majority stake in City Fertility Centre, one of Australia’s leading IVF & fertility service groups with 7 clinics and 50 doctors nationwide. SMG holds 40%, 23% and 13% stakes, respectively, in these overseas businesses. |

They collectively contributed S$273,000 as share of results of JVs and associate to SMG in 2019 (2018: S$56,000).

It's still a low base but one from which the numbers can scale after gestation periods and as revenues continue to grow.

And there are more growth initiatives in the pipeline in Vietnam, Indonesia and Australia, said CEO Dr Beng Teck Liang.

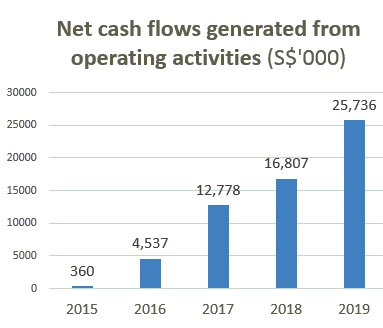

The third hallmark of SMG is its ability to generate lots of cash, something evident over the past 5 years (see chart). The third hallmark of SMG is its ability to generate lots of cash, something evident over the past 5 years (see chart).In 2019, operating activities brought in $25.7 million cash. Such cash inflows position SMG to reinvest in its businesses to compound its growth through acquisitions and hiring of specialists. And not surprisingly, SMG has proposed a maiden dividend of 0.8 cent a share for FY19, and declared a dividend policy of paying not less than 20% of its earnings (excluding contributions from JVs and associates). |

|

(S$‘000) |

2018 |

2019 |

Change |

|

Revenue |

85,069 |

94,672 |

11.3% |

|

Gross profit |

37,795 |

43,241 |

14.4% |

|

Gross profit margin |

44.4% |

45.7 % |

1.3 pts |

|

Net profit attributable to owners |

12,928 |

13,661 |

5.7% |

|

Net profit margin |

14.6% |

14.4% |

(0.2) pts |

|

EPS |

2.74 c |

2.83 c |

3.3% |

At 32 cents, SMG stock trades at around 11.3 X its 2019 earnings per share, which is the lowest among the Singapore-listed healthcare companies, which trade at PEs in the teens and 20s.

For details of peer comparison, and FY19 results highlights, see Powerpoint material here.