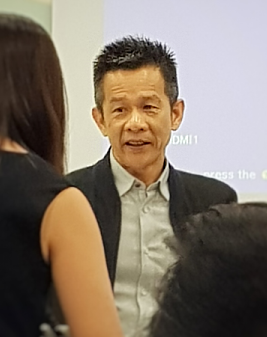

| The Big Picture, first. Riverstone Holdings produces gloves for, mainly, the US, Europe and Japan markets.  Executive Chairman & CEO Wong Teek Son, 57, owns a 50.75% stake in Riverstone. NextInsight photo.It is based in Malaysia and its stock, listed on the Singapore Exchange for 13 years (since 2006), has attracted a stable following of investors who appreciate: Executive Chairman & CEO Wong Teek Son, 57, owns a 50.75% stake in Riverstone. NextInsight photo.It is based in Malaysia and its stock, listed on the Singapore Exchange for 13 years (since 2006), has attracted a stable following of investors who appreciate: 1) its steady business which has, in recent years, clear production expansion plans. 2) nice cashflow, as a result of which dividends are stable. The payout ratio has averaged an equally nice 40% for some 10 years already. 3) Co-founder Wong Teek Son, who is the executive chairman & CEO, has proven to be on top of the game. The figures speak for themselves:

|

Takeaways from Riverstone's 3Q19 results briefing:

| 1. Revenue: Riverstone Holdings' 3Q19 revenue rose 5% y-o-y in 3Q19. It looks lower than expected given the new rise in production volume that kicked in under its Phase 6 expansion. The reason is revenue reflects selling prices, and these have come off for healthcare gloves compared to a year ago because of sharply lower raw material prices. Selling prices of cleanroom gloves have held steady y-o-y. Where it matters is the gross profit and this rose 11.4% in 3Q19 to RM51.4 million.  |

|

Stock price |

99 c |

|

52-week range |

89 c – $1.24 |

|

PE (ttm) |

17 |

|

Market cap |

S$730 m |

|

Net Cash |

RM126 m |

|

Dividend |

2.3% |

|

Year-to-date return |

-9% |

|

Source: Bloomberg/ Company |

|

2. Profit margins: Gross margin expanded 1.2 percentage points to 20.5%, a healthy margin for a manufacturing business

20.5% is a blended figure from Riverstone's two key products.

Gloves produced for the healthcare sector had a gross margin which was only a third that for gloves for use in tech clean rooms.

Volume-wise, the split was 82:18, respectively.

Cleanroom gloves accounted for 30% of revenue, and, most notably, 52% of gross profit in 3Q19.

3. New higher-margin gloves: With healthcare gloves' margins compressed because of competition, Riverstone has been developing speciality gloves for higher margins (on lower volumes).

Examples, which will go into production in 1Q2020, are surgical gloves.

In addition, there will be gloves for use in animal slaughter houses which will have better grip qualities.

And when a glove is nicked, an inner layer of a different colour from the outer layer will be exposed.

|

Year |

Added Capacity |

Final Capacity |

|

2013 |

-- |

3.1 billion |

|

2014 |

+1.1 billion |

4.2 billion |

|

2015 |

+1 billion |

5.2 billion |

|

2016 |

+1 billion |

6.2 billion |

|

2017 |

+1.4 billion |

7.6 billion |

|

2018 |

+1.4 billion |

9.0 billion |

|

2019 |

+1.4 billion |

10.4 billion |

4. Expansion: Given healthy growth in industry demand, Riverstone has no problem with utilising its growing capacity.

Utilisation has consistently hovered at about 90% through the years, and Riverstone has been getting new customers, including tech manufacturers which have relocated from China to Vietnam and the Philippines.

It is currently installing new production lines in a new factory under Phase 6.

It has purchased land in Taiping for Phases 7,8, 9 to be constructed over the next three years. Estimated capex is RM80 million per phase per year.

5. Balance sheet: Riverstone had net cash of RM111.7 million as at end-3Q19, thanks to the positive operating cashflow of RM47 million in 3Q19.

Return on equity stood at 17.0%, while net assets per share was RM1.04.

| • 3Q2019 results presentation is here. • For a background story, see: RIVERSTONE: Stretches Limits with Breakthrough Technologies |