Soo Jin Hou, a full-time investor living in Australia, contributed this article to NextInsight

Four months ago, I put forth an investment thesis for Alliance Mineral Assets (AMA) which was trading at 30 cents. Back then, other than the committed sales numbers to Burwill, the offtaker, and the prospective scenario from the Colts report, there was scant information that could be used to value the Bald Hill Project.

Both cases are presented in the table:

|

|

Burwill agreement |

Colts report |

|

Resources |

Min 12Mt > 1.1% Li2O |

20-30Mt at 0.9-1.4% Li2O by mid-2017 30-50Mt at 0.9-1.4% Li2O by end- 2017 |

|

Throughput |

200kt of 6% Li2O over 2 years Or 100kt per annum of 6% Li2O |

120-160kt per annum of 6% Li2O |

|

Sale price |

USD 880/ton |

|

|

Cost of production |

AUD 400-500/ton |

|

The full article may be viewed here: ALLIANCE MINERAL ASSETS: "Why I'm bullish on it" .

Basically, I argued that based on the minimum commitment to Burwill, AMA does not appear to be expensive. However, due to execution risks, share price will be volatile.

After I put forth my thesis, announcements from both AMA and its 50% joint venture partner Tawana indicate that the project is proceeding as forecasted by the Colt’s report.

In response to this fantastic news, instead of a rally, Mr Market punished AMA’s share price to a low of 0.215 cents. Mr Market is manic depressive.

The carnage may have been triggered by the release of the Pre-Feasibility Study (PFS) by Tawana on the 11/7/2017. At first glance, the report appears to be underwhelming because it accorded a relatively poor valuation of only A$150m to a “starter pit”.

When compared to the current combined market capitalization of AMA and Tawana at A$216m (on 24/9/17, AMA’s and Tawana’s share prices are 0.255 and 0.24 respectively), it appears that neither are attractive investment propositions.

A closer study of the PFS would tell you that this conclusion is incorrect. But first, let’s list down the important parameters used in the valuation of the starter pit as well as some of the results.

|

|

|

|

Life of mine |

3.6 years |

|

Lithium ore |

4.3 Mt |

|

Tantulum ore |

1.4 Mt |

|

Initial capital cost |

A$42.2m |

|

Average operating cost |

A$508/t (after tantalite credits) |

|

Net Present Value |

A$150m |

|

Net cash flow before tax |

A$223m |

|

Internal rate of return |

185.03% |

|

Payback |

12 Months |

The starter pit is only a small section of the total reserve

AMA disclosed the JORC report on the 8/8/17. The report states that the total reserves, both indicated and inferred, stands at 12.8 Mt. Therefore, the starter pit only accounts for a third of the total known reserve, and that reserve is growing as exploration proceeds. A resource update is expected in October.

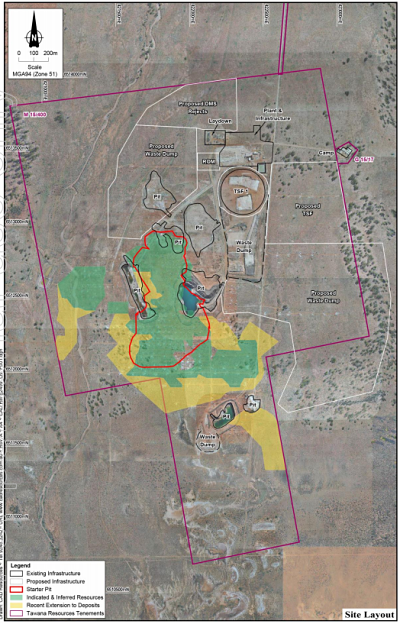

Perhaps the scale of the starter pit is best summed up in the layout from the PFS:

The red enclosure represents the starter pit, the green represents the reserves disclosed in the JORC report, and the yellow reserves found that have not yet been quantified.

The red enclosure represents the starter pit, the green represents the reserves disclosed in the JORC report, and the yellow reserves found that have not yet been quantified.

Management has guided that “the company has only drilled 20% of the known pegmatite footprint and there are significant other portions of our tenements that are unexplored…”

How much more of the tenement remain unexplored? Well, Tawana’s AGM presentation disclosed that the main target area is only 3km by 2km or 6 km2, whereas the entire tenement spans 59,000 ha or 590 km2.

Tawana, in addition to the 50% rights in the Bald Hill Project, also owns 100% rights to the adjacent Cowan Lithium Project. Exploration is progressing slowly due to the higher priority given to the Bald Hill Project. The Cowan Project NPV has been accorded zero value for the time being.

The NPV is skewed by the initial capital cost

The initial capital cost of A$42.2m is a one-off expenditure. Including this cost in the computation of NPV is akin to amortising the entire cost of the asset to the life of the starter pit, estimated to last only 3.6 years.

If the initial capital cost is excluded from the NPV, the NPV is A$192.2m, which is much closer to the combined valuation of both companies. The initial capital cost shaved off 22% of the NPV, and represents a large distortion considering the mine is expected to last for more than a decade, not just 3.6 years. If the initial capital cost is excluded from the NPV, the NPV is A$192.2m, which is much closer to the combined valuation of both companies. The initial capital cost shaved off 22% of the NPV, and represents a large distortion considering the mine is expected to last for more than a decade, not just 3.6 years. |

After the capex is expended and the processing facilities are in place, subsequent processing of lithium ore incurs only operating expenses. Tawana estimated that each ton of lithium concentrate will incur A$508 after tantalite credits. This corroborates well with Galaxy Resources’ H1 cash cost at US$391/ton (A$491/ton). At the sale price of US$880/ton to Burwill, the cash margin is a magnificent 54%.

The NPV does not include the future extraction of lithium from middlings and fines

For the current process, about 28% of the feed containing 29.6% of the contained lithium are rejected and stockpiled as “fines” and “middlings”.

"Over the past four months, there has not been a shortage of automotive majors and countries vowing to phase out internal combustion vehicles. The one with biggest impact is China. Not only is China the largest car market, it is also a command economy. If there is a country that can reshape the automotive industry, it is China. "Over the past four months, there has not been a shortage of automotive majors and countries vowing to phase out internal combustion vehicles. The one with biggest impact is China. Not only is China the largest car market, it is also a command economy. If there is a country that can reshape the automotive industry, it is China. "If China automotive goes fully electric, what was thought to be a possible glut in future lithium supply will turn into a deficit. I believe with so many players onboard the electric vehicle initiative, lithium prices should remain elevated for the medium term at least." -- Soo JinHou (photo) |

A recent metallurgical study has indicated that concentrates up to 5.30% and 6.55% can be produced from the “fines” and “middlings” if a second Dense Media Separation (DMS) facility is build, thereby boosting production by another 25% above the current 150,000 tpa design rate.

The first DMS plant cost A$27m. And a second plant, I presume, would cost about the same. Back-of-the-envelope calculations show that a 25% increase in production can potentially boost the cash profit by another US$17.9m a year, or A$22.4m a year, equivalent to 1 year 3 months payback on investment.

Furthermore, the processing of “fines” and “middlings” carries very little incremental cost, because most costs are carried by Phase 1 such as mining, crushing etc.

As a matter of fact, the PFS divulged that A$117/t has been incurred to produce them, which again goes to show that the NPV understated the value of the project by attributing zero value to these “rejects”.

Having examined the PFS in detail, I stick by my assertion that AMA at 30 cents is still inexpensive.