|

At end-December 2021 (1HFY22), Southern Alliance Mining (SAM) was stronger financially.

The Singapore-listed iron ore miner's 1HFY22 profit came in at RM19.4 million (approximately S$6.2 million).

|

||||||||||||||||

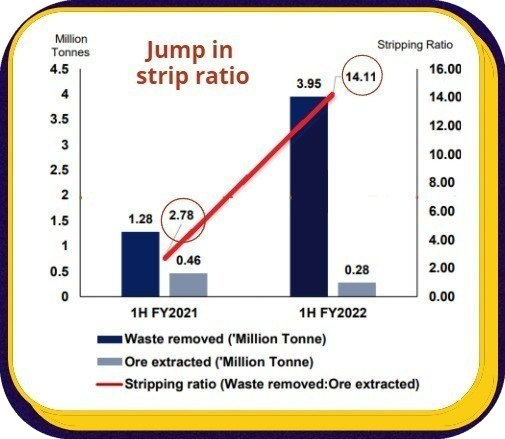

The high stripping ratio in the current year was not unexpected as the 2020 IPO offer document of SAM had indicated the various forecast stripping ratios as the Chaah mine is developed over the years.

For the life of mine, the average ratio is forecast to be 6.78.

Excerpts from the Q&A session involving CFO Lim Wei Hung and analysts/investors last week:

Q: What is the outlook for the next half year? Do you expect overburden removal to continue at the same pace?

A: I would still expect that activity to continue but we are going to get some ore, so it is going to help. It will be a challenging year but with the higher iron ore price and the machines that we have invested so far, we believe that we will see results soon.

Q: What is the expectation of the 150 meter strike extension? When will this yield results?

A: The 150 meter strike extension is in the southeast area of the Chaah mine. While we carry out the stripping work to have access to the existing ore body, or the existing resources, this will serve as the starting point for us to further push the wall right towards the southeast area so that we eventually will have the access to the new ore body.

Whatever works that we are doing now will give us access to the future extension of the ore body.

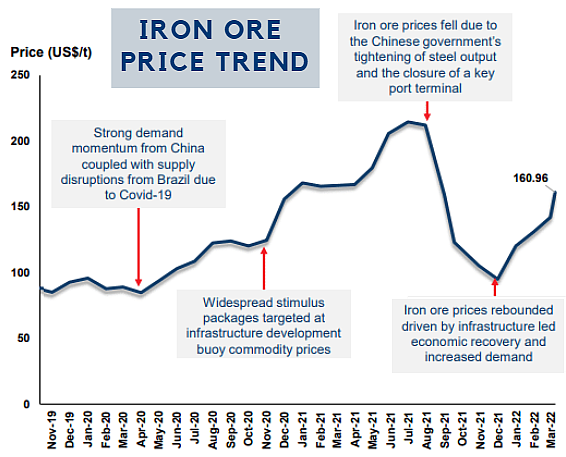

On the iron ore price trend, SAM's 1HFY22 financial statement said:

| • Infrastructure-led economic recovery is supporting elevated prices of iron ore. Iron ore prices broke the US$150/tonne mark in February 2022. • Renewed demand from China, in particular, has been signalled by announcements by the government. It said on 25 January 2022 that there will be a reasonable quota for local government bonds to boost infrastructure investments in 2022. Furthermore, Fitch Solutions expects steel manufacturing activity to pick up strongly after power outages in the second half of 2021 limited production activities. • Compared to the increasing demand, the supply growth has been sluggish. Despite the rise in production from Brazil and Australia, metals major Vale is expected to take a substantially long time to return to pre-Brumadinho dam collapse capacity levels. |

| Another promising mineral: gold |

Photo illustration onlySAM's CFO Lim Wei Hung noted that in Jan 2022, the company received the Johor government approval for gold exploration, and exploration has commenced subsequently.

Photo illustration onlySAM's CFO Lim Wei Hung noted that in Jan 2022, the company received the Johor government approval for gold exploration, and exploration has commenced subsequently.

He drew participants' attention to section 3.5 of the company's circular dated 30 July 2021 in which SAM's proposed joint venture to explore for gold in Johor was spelt out.

He highlighted the following paras from the circular:

|

• In 1987, the Geological Survey Department (GSD), a former body of Minerals and Geoscience Department (JMG), delineated a 45 km2 area with good gold potential in the vicinity of Mersing. • These sectors have been grouped into three zones; Zone 1 covering the coastal regions, Zone 2 covering the central regions and Zone 3 covering the interior regions. |

For more, see SAM's 1HFY2022 presentation deck here.