Excerpts from Maybank Kim Eng report

Analyst: John Cheong, CFA

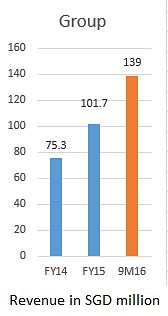

We expect the growth momentum to continue, as BEST enters into the seasonally strongest quarter in 4Q, where its anniversary promotions take place. We raise FY16-18E EPS by 2-4% after increasing our China sales assumptions.  Maintain BUY and raise TP 2% to SGD2.16 from SGD2.11 (the previous TP of SGD2.63 adjusted for 1-for-4 bonus shares issued). Our TP is still pegged to 16x FY17E EPS, on par with peers’ average. BEST is trading at a 26%/31% discount to the average of peers’ FY16E/17E P/E despite having the second highest growth profile. |

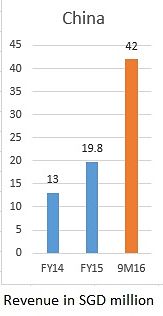

The strong growth in China was due to higher demand for DR’s Secret line of skincare products, especially after the initial approval of the direct selling licence announced on 1 Jul 2016.  The direct selling licence has been officially obtained after fulfilling the final requirements in verification of nine service centres in Hangzhou. This will allow BEST to scale up quicker by increasing its recruitment activities moving forward. The direct selling licence has been officially obtained after fulfilling the final requirements in verification of nine service centres in Hangzhou. This will allow BEST to scale up quicker by increasing its recruitment activities moving forward. |

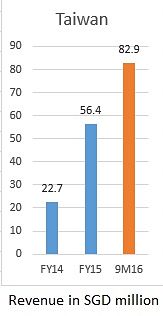

Taiwan revenue grew 95% YoY, but fell 21% QoQ due to seasonality effect, where distributors prepare for the anniversary promotions during OctNov. Our channel check from the Facebook page of its Taiwan distributors suggests the sales in Oct are reflecting the typical seasonal strength.  Also, BEST’s inventory days have increased to 195 days from 111 days in 2Q16, as it stocked up in anticipation of higher orders and to prevent stock-shortage issues it faced in 4Q15 Also, BEST’s inventory days have increased to 195 days from 111 days in 2Q16, as it stocked up in anticipation of higher orders and to prevent stock-shortage issues it faced in 4Q15 |

Maybank Kim Eng analyst John CheongUpside Maybank Kim Eng analyst John CheongUpside◊ Increasing market discovery could re-rate the stock. A longer-term 3-yr scenario incorporating a 16x peer P/E in FY18 suggests 75% upside to a TP of SGD2.62. ◊ Robust growth in China after the approval of direct selling licence. ◊ Successful expansion in Taiwan, Indonesia and Philippines. ◊ Expansion into new markets such as the Middle East. |

Full report here.

What company says .... --->>

"....while local authorities and the Department of Commerce for Zhejiang Province has completed the verification of the setup of 9 service centres in Hangzhou, the Ministry of Commerce (MOFCOM) has not announced the completion of the verification in its website. As a result, we have not commenced direct selling through these 9 service centres. Therefore, the current revenue in China has no relation to the setup of the service centres in Hangzhou." "....while local authorities and the Department of Commerce for Zhejiang Province has completed the verification of the setup of 9 service centres in Hangzhou, the Ministry of Commerce (MOFCOM) has not announced the completion of the verification in its website. As a result, we have not commenced direct selling through these 9 service centres. Therefore, the current revenue in China has no relation to the setup of the service centres in Hangzhou."-- Huang Ban Chin, executive director, Best World International |

We constantly build the DR’s Secret brand to stand for a simple and safe solution for anyone who wishes to be able to effectively resolve their skin problems and achieve healthy, glowing complexion, without the need for makeup." We constantly build the DR’s Secret brand to stand for a simple and safe solution for anyone who wishes to be able to effectively resolve their skin problems and achieve healthy, glowing complexion, without the need for makeup."-- Huang Ban Chin, executive director, Best World International (Source: Company announcement posted on SGX) |